Author: Aylo, author of alpha please; flow, encryption researcher; translation: bitchain hozou

We are ushering in an important moment in Crypto history.

Over the past few weeks, we have witnessed a 180-degree turn in the U.S. stance on cryptocurrency.Although it is difficult, all eight Ethereum ETFs have been approved by the U.S. Securities and Exchange Commission.In addition, the U.S. House of Representatives not only approved the crypto bill FIT21, but also passed legislation to prevent the formation of central bank digital currencies.But even more surprisingly, crypto has even begun to become an important topic in the upcoming U.S. presidential election.

So, if you are a large financial institution, the information is clear: crypto will not leave, so if you don’t want to fall behind, you’d better be familiar with the world of crypto and start exploring its various use cases.

From this perspective,It seems obvious that the real-world asset tokenization field will have huge growth potential in the future.

But what exactly is this trend, why has it attracted so much attention and hype, and how can you make the most of it?This is the main content we will discuss in this article.And, you will find many alpha opportunities in the article.

1. RWA case

If software is devouring the world, then real-world asset tokenization is devouring the capital market.

In recent years, the RWA (real-world asset) field has become one of the most promising use cases of blockchain technology, that is, moving real-world assets to the chain.The RWA case is simple: connecting the stability and value proposition of real-world assets with the innovative features and potential efficiency of blockchain technology and DeFi (decentralized finance).

In fact, many people see this field as a very important part of the financial world.Recently, we have even seen big names in the financial world – such as BlackRock and Franklin Templeton – show keen interest in this field and launch their respective tokenized funds..

In fact, many people see this field as a very important part of the financial world.Recently, we have even seen big names in the financial world – such as BlackRock and Franklin Templeton – show keen interest in this field and launch their respective tokenized funds..

In theory, any real-world asset that can be easily traded can be tokenized and brought to the chain, including tangible and intangible assets, as well as replaceable or irreplaceable assets, the following figure is a partial list.

(1) Why is tokenization so important?

If there is no obvious advantage in bringing assets to the chain, RWA would not have received so much attention.The following diagram lists the main benefits of tokenization.

The core theory that supports DeFi is that blockchain can create better standards for seamless exchange of different assets.In this sense, RWA just recognizes DeFi’s value proposition and expands it to all tradable assets to create the next generation market – a more transparent, secure, fair and open market.

(2) Understand RWA meta

We are entering the era of tokenization in the market.Although slow, it is certain that all assets will be transferred to the chain, challenging the current status of the global capital market for 30 years.This view is especially true, given that RWA meta is at the intersection of two trends shaping the world today: Everything will be financialized and digitalized.

-

Financialization:In today’s world, finance has no boundaries, and the economy has become increasingly borderless. Individuals can transfer ownership of assets around the world.Everything has a market, everything has a price, everything becomes tradable.Therefore, it becomes increasingly meaningful to establish a more efficient, transparent, fairer and more open market mechanism.

-

Digitalization:Our world is increasingly digital.We have internet-connected mobile phones and watches, and soon there will be internet-connected brains.In this sense, the next step that seems reasonable is to migrate the proof of ownership of assets to the blockchain network.

In this sense, RWA can completely seize the opportunities brought by these two trends.

(3) Main Challenges

There is no doubt that real-world assets on the chain have very interesting features, but also bring many challenges.These challenges mainly revolve around:

-

Supervision:At present, there is no clear answer to where to establish a tokenized asset market in an environment without complex regulation.However, this may change as the world’s perception of crypto continues to evolve over the years.

-

Liquidity:Providing the right market structure for the liquidity and market making of real-world assets can be challenging, especially for highly illiquid markets that are traded around the clock.

-

Propaganda and Education:It takes a long time for everyone to understand the true value proposition of bringing real-world assets to the chain, as it can be difficult to understand at the beginning to master blockchain technology and its pros and cons tradeoffs.

2. The development and evolution of RWA

(1) US dollar pegged stablecoin

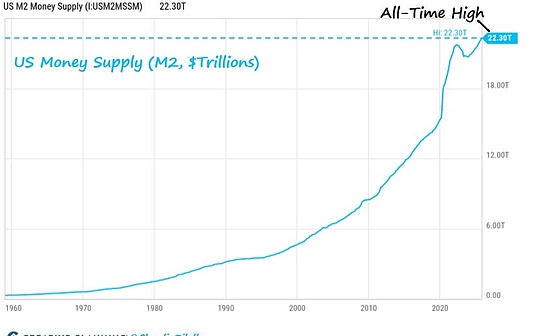

The fiat-backed stablecoins are the first killer use case for real-world asset tokenization, and this market has grown significantly in recent years.Today, the two largest fiat currencies supported by the stablecoins are Circle’s USDC and Tether’s USDT. The total market value of the two exceeds US$130 billion, and the total market value of the two at the beginning of 2020 was about US$5 billion.

(2) Product support token

Tokenization of precious metals has also become another popular application of RWA.For example, Tether Gold (XAUT) or PAX Gold (PAXG), they are tokens backed by physical gold.Although this is a relatively new market, it is developing very quickly, with the market capitalization of XAUT and PAXG totaling approximately $840 million.

(3) Tokenized Treasury bonds are growing rapidly

The last big trend of RWA is the tokenization of US Treasury bonds.According to 21co data, we noticed that the market capitalization of the sector has grown very fast, reaching more than $1.3 billion.But it is more noteworthy that large TradFi institutions are entering the market.For example, Franklin Templeton’s BENJI token has accumulated approximately $370 million in deposits, while BlackRock’s BUIDL token has received more than $380 million in deposits.

(4) The beginning of the next chapter

This tokenization trend has just begun and is expected to maintain rapid growth.According to Boston Consulting Group, the tokenized market size of global financial assets will reach $16 trillion by 2030, which may eventually become our long-awaited bridge between TradFi and DeFi, creating a new developmentA generation market.

We can envision a future where not only pure financial assets, but almost all assets that are easily tokenized—from luxury watches to artworks to real estate—will be tokenized on the blockchain.This is the financial world in the future.

3. Seize the opportunity

Seeing this, I’m sure you’ll ask yourself now: “Okay, I get it, but how can my portfolio take advantage of this new trend?” Don’t worry, I’ve prepared an RWA list for you and shouldHelps you.

But I want to remind you that the crypto world is highly speculative and must be cautious.So, as always, what’s next is not prediction, it’s just my thoughts.As data becomes easier to obtain and the noise is isolated over time, the idea changes a lot.

Please note that this is not an exhaustive list, just some items that I think are worth paying attention to.There are many projects of this type, and obviously, I should have missed a lot of projects.

Ready?Now let’s look at a few items you might want to add to your attention list:

(1) Chainlink (LINK)

Chainlink recently updated their description of the network, calling it “a common platform for developing the future of global chain markets.”As a bridge between real-world data and blockchain, Chainlink is the key to real-world asset tokenization.

I wrote this tweet below not long ago, but today it seems more correct than ever.Currently, Chainlink is actively working with Swift, The DTCC and some of the world’s largest banks, and none of them are hype partnerships.Very real pilots and case studies prove that the technology has been implemented and you will eventually see a full on-chain RWA coming day, it’s only a matter of time.

In the long run, I am still very optimistic about Chainlink.

(2) Ondo Finance (ONDO)

Ondo is building the next generation of financial infrastructure to improve market efficiency, transparency and accessibility.It allows retail investors and qualified investors on the chain to enter the bond market through products such as USDY, a tokenized notes secured by US Treasury bonds, and OUSG (short-term US Treasury bonds).

ONDO is the best performing emerging token in 2024.I think this project is very interesting and has been in a strong momentum lately.But now it may be a bit over-hyped.Still, it’s definitely worth adding to your RWA watch list.

(3) Pendle Finance (PENDLE)

Pendle is a decentralized financial protocol that supports user tokenization and future earnings for sale.It is an innovative tokenized model solution that provides users with flexible dynamic revenue management options.

This is also a very good agreement to earn points.

(4) TrueFi (TRU)

TrueFi is a modular infrastructure for on-chain credit that connects lenders, borrowers, and portfolio managers through smart contracts governed by TRU.

(5) Mantra Network (OM)

Mantra is a security-first RWA L1 chain designed to comply with real-world regulatory requirements.

(6) Polymesh Network (POLYX)

Similar to Manta, Polymesh is an institutional-level licensed blockchain built specifically for regulatory assets.

(7) Centrifuge (CFG)

Centrifuge provides infrastructure and ecosystem for tokenization, management and investment in a complete, diverse real-world asset portfolio.The asset pool is completely guaranteed, investors have legal recourse rights, and the agreement is irrelevant to the asset class. The asset pool covers structured credit, real estate, US Treasury bonds, carbon credit, consumer finance, etc.

(8) Dusk Network (DUSK)

Dusk is a license-free ZK-friendly L1 blockchain protocol focused on tokenization of real-world assets.

(9) Clearpool (CPOOL)

Clearpool is a decentralized financial ecosystem designed to bring the first license-free market ever to unsecured institutional liquidity.

(10) Polytrade (TRADE)

This is a real-world asset market.It brings tokenized Treasury bills, credit, stocks, real estate, merchandise and collectibles, art, intellectual property, creator royalties, and luxury goods to one platform.

The easiest way to participate in this trend:

If you don’t want to spend too much time researching monitoring different projects, you have another option: SwissBorg’s RWA Thematic.

You can think of it as a basket of RWA tokens, and the selection of tokens and token allocation will automatically rebalance you based on the market conditions.It’s like an ETF, but it’s aimed at the RWA realm.

This is a way to get exposure to the entire RWA field, easy and fast, with just one click.

These are your alpha opportunities.