Author: Alex O’Donnell, CoinTelegraph; Compiled by: Tao Zhu, Bitchain Vision

A report from Blocknative on August 20 shows thatPrivate transactions now dominate the order flow of Ethereum as users seek to protect transactions from preemptives.

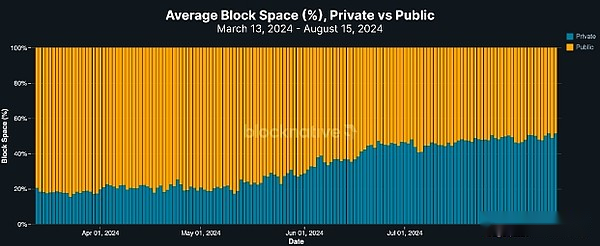

Blocknative saysAlthough private order flow still accounts for only about 30% of Ethereum transactions, it consumes more than half of the gas on the network.The report said the shift created “a new centralized carrier because the flow of private transaction orders is accessible only to licensed network participants.”

Private orders involve sending transactions directly to validators, an arrangement called “dark pools” rather than entering a public queue.Public transactions may be preceded by automated trading “robots” that make money at the expense of users—a practice known as Maximum Extractable Value (MEV).

Private orders consume more than 50% of gas on Ethereum.Source: Blocknative

“To protect MEVs, users often choose to transfer transactions privately, especially when performing more complex (and therefore require a lot of gas) on-chain operations (such as exchanges),” Blocknative said. “In turn, the gas consumed by each transaction of these transactions,”More than non-MEV transactions.”

According to Blocknative, private order flow is dominated by a handful of block builders, namely Beaver, Titan, Rsync and Flashbots, all of which “have shown a significant increase in private order flow since March.”The report said gas consumption of these block builders increased by 130% to 150% during this period.

According to Blocknative,The growth of dark pools has negatively impacted users participating in public transaction queues, including more unstable and unpredictable gas prices.

“When most of the block space is occupied by privately sent transactions, the observability of the on-link gas fees is reduced,” the report said.

“This means that either you will be priced too low and eventually causing the transaction to get stuck, or you will be priced too high to ensure the transaction will be on the chain, and that possibility will increase.”