Author: blofin options desk & amp; research department head Griffin Ardern; Cycle Capital Yilan

Foreword

On May 23, 2024, the US House of Representatives passed 136 votes to 136 votes and passed the “21st Century Financial Innovation and Technical Act” (FIT21). The legislation was mainly driven by the Republicans of the House of Representatives.Consumer protection measures, designated the commodity futures trading committee (CFTC) as the main regulatory agencies of digital assets and regulators of non -securities spot markets.Democrats of the House of Representatives performed strongly.The encrypted market structure bill marks the most important legislative achievements of the industry in Congress.

After voting by the House of Representatives, the bill will continue to be transferred to the Senate, and finally decide whether to be a law through presidential actions.

This bill is particularly significant to those non -Bitcoin crypto currencies that are affected by uncertain regulatory environment.It is expected to reduce the current legal uncertainty and regulatory risks facing many cryptocurrencies.Whether this remarkable bill can eventually become law and whether ETH ETF can pass the approval as soon as possible is also an important decisive factor in the cottage season.From the perspective of CME positioning data, option market period structure, and important MM hedging points, it has studied and summarized the market sentiment and direction given by ETH in the derivative market.

Main point of view

-

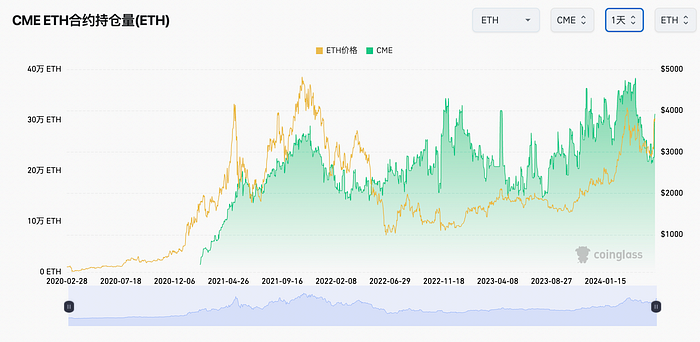

From the perspective of CME’s positioning, compared to the growth of the BTC ETF through the position of the previous CME’s position, from 71,600 pieces in October 2023 to 138,200 at the high point after approval (January 12, 2024), nearly doubled.Subsequently, the BTC was favorable to land and adjusted a 20 -day adjustment at a profit of 13,000 BTCs to 125,200 positions. After February 4th, the main rise was opened, and the CME holding volume at the end of March 22 reached the current volume of CME positions., 1761,000.

-

From the perspective of CME’s positioning, from 225,900 pieces on May 20 to 312,100 on May 23, the time span of significant positions occurred.Positive, there are no many bulls bet in advance.ETH CME currently is still on the rise.

-

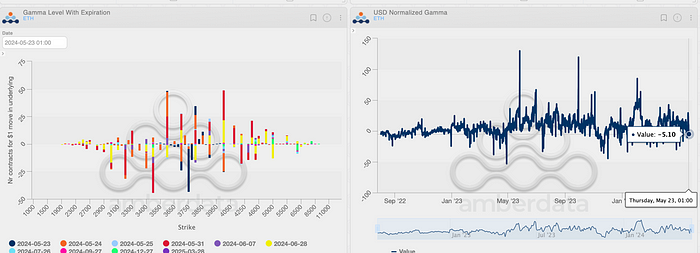

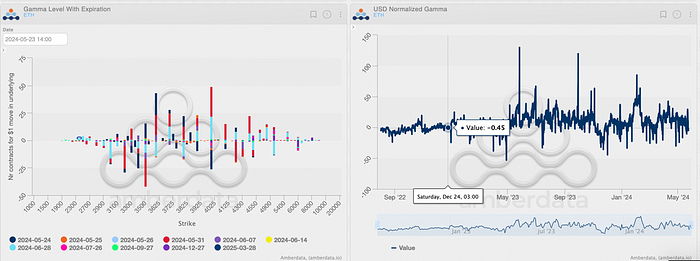

ETH has the selling pressure caused by options near $ 4,000, and the pressure on the hedging of a large number of ending date rights near $ 3750 has been touched. At present, it is mainly moved by the main hedge support to near 3500.From the perspective of hedging, the range of ETH fluctuations is near 3500–4000, but if there are more external demand or supply, it will break through this hedging interval.

-

The term structure of the option market and the long -term exchange rate of ETH/BTC still indicate that BTC is even stronger in the longer period of time.

From the perspective of the option market, in terms of the term structure, the BTC overall shows a rising structure, and the implicit volatility increases with the increase of the expiration time, which means that the market expects that the remote volatility will increase.ETH is the opposite. The market is expected to be full of recent market fluctuations, and IV gradually falls in the long run.This means that BTC is still the target of long -term selection of transactions in the market, but ETH’s recent fluctuation performance is expected.

From the perspective of options Gamma Level each period of time, ETH has at least 5,000 ETH hedge selling pressure near 4000, and a large number of ending date right hedging purchase pressures near 3750 US dollars have been touched. At present, it is mainly moved by the main hedge support to near 3500.Therefore, from the perspective of hedging, the range of ETH fluctuations is near 3500–4000, but if there are more external demand or supply, it will break through this hedging interval.

Gamma is an indicator of the change rate of Delta (sensitivity of the option price relative to the change of the target asset price).

For sellers, when the price of the target asset rises, the Delta of the bullish options sells will become closer-1 (for example, if Delta is -0.3 at the beginning, it may become -0.6).Gamma is intentional. With the rise of the target asset price, Delta’s change will slow down.This increases risks for sellers because they need to make more buying hedges under rising market conditions.

However, when the overall market is in the net buyer, that is, Gamma is a normal position, and the hedge is mainly based on high sales and low buying, that is, ETH has a lot of selling spot in 4000 positions for hedging.