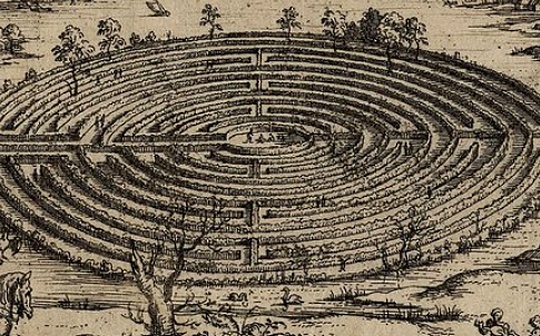

original:>Phantom tokenomics, inside the obscure daedalus labyrinth

Author: 0xlouist, L1D investment partner; compile: 0xxz@作 作 作 作 作

This article is the second part of the author tokenomics series articles

In Greek mythology, the maze was built to imprison the bull head monster. The bull head monster is a bloodthirsty monster, with a human body and bull head.King Minos was afraid of the bull’s head, so he asked Genius Daedalus to build a intricate maze, so that no one could escape.However, when the Prince Theseus killed the Bull head with the help of Dalodos, Minos was very angry and retaliated against him in his prosecutor and his son Icarus.In the maze built.

Although Icaros’ arrogance led to his drop, Daedaros was the real creator of their destiny -without him, Icaros would not be imprisoned.This myth reflects the hidden backdoor token transactions that have become universal in this cryptocurrency cycle.In this article, I will reveal these transactions -a maze -like structure carefully designed by insiders (Daljaros), and the project (Icaros) will fail.

What is backdoor tokens trading?

High FDV tokens have become a hot topic, causing endless debate on its sustainability and influence.However, a dark corner of this discussion is often ignored: back -door tokens trading.These transactions are guaranteed by a small number of market participants through chain contracts and attachments. These contracts and attachments are usually blurred and are almost impossible to identify on the chain.If you are not insiders, you may not know these transactions.

In the latest article of Cobie, he introduced the concept of Phantom Price (Phantom Pricing) to emphasize how real prices have discovered how it happened in the private market.On this basis, I want to introduce the concept of Phantom tokenomics to illustrate how the tokens on the chain show the distortion and inaccurate view of the tokens under the actual chain.The content you see on the chain may seem to represent the real “capital distribution form” of the tokens, but it is misleading; the version under the ghost chain is accurate.

Although there are various types of tokens, I have determined several common categories:

1. Consultation allocation:Investors obtain additional tokens because they provide consultant services and are usually classified as teams or consultants.This is usually a means to reduce the cost foundation of investors, and it almost does not provide any additional suggestions.I have seen the consultant allocated 5 times that of the initial investment of Gundam investors. Compared with the official valuation, it effectively reduces its actual cost basis by 80%.

2. Make market allocation:Part of the supply is retained in the market on CEX, which is very beneficial because it can improve liquidity.However, when a city merchant is also an investor in the project, there will be conflicts of interest.This enables them to use tokens assigned to the city merchants to hedge their lock -up tokens.

3. CEX listing:Paying marketing and listing costs are listed on top CEX (such as Binance or Bybit).If investors assist these listings, they sometimes get additional performance fees (up to 3%of the total supply).Hayes recently published a detailed article about this theme (see Golden Report earlier:>How should the new Smilklip project be on the currency), Show that these costs can be as high as 16%of the total supply of tokens.

4. TVL leasing:Large whales or agencies that provide liquidity can usually get exclusive and higher benefits.Although ordinary users may be satisfied with the annualized income of 20%, some whales have quietly earned 30% of their benefits with the same contribution through private transactions with the foundation.This approach may be positive and necessary to ensure early liquidity.However, disclosure of these transactions in the community is crucial.

5. OTC round:Although OTC is very common and it is not bad itself, it will cause opaque, because the terms are usually unknown.The biggest culprit is the so -called KOL rotation, which accelerates the acceleration of token prices.Some first -level L1 (the name has not been disclosed) has recently adopted this approach.Many Twitter Kols have obtained seductive token transactions, with a large discount (about 50%), and the attribution period is short (linear within six months), which inspires them to promote the tokens into the next [L1] killer.If you have any questions, there is a convenient KOL translation guide here to help you eliminate noise.

6. Selling unlocked pledge rewards: Since 2017, many POS networks have allowed investors to pledge to tokens, and at the same time collect unwilling rewards.If these rewards are unlocked, this will become a way for early investors to make a faster profit.@GTX360TI and@0xsisyphus have recently cited examples like Celestia and Eigen.

All these backdoor tokens have created the ghost token economics.As a member of the community, you may browse the token economics chart below and be assured of its obvious balance and transparency (charts and numbers are only explained).

butIf we peel off layers and expose hidden false transactions, the real token economics looks like this cake picture.It does not leave too much for the community.

Just like Da Daloss (he built a prison himself), these arrangements determine the fate of many tokens.Internal personnel trap their projects in the maze of opaque trading, causing the value of tokens to lose from all directions.

How can we go to such a situation?

Like most market efficiency, this problem stems from serious supply and demand imbalances.

Excess project supply on the marketThis is mainly a by -product of VC prosperity in 2021/2022.Many of these projects have waited for more than 3 years to launch tokens, but now they have entered a crowded field, competing for TVL and attention in a deserted market.It is no longer 2021.

The demand does not match the supply.There are not enough buyers to absorb the influx of new listing.Similarly, not all agreements can attract funds to park TVL.This makes TVL a scarce and highly sought -after resource.Many projects have not found organic PMFs, but are trapped in the trap of tokens to increase KPI to make up for the lack of sustainable attractiveness.

The private equity market is currently the most active market.With the departure of retail investors, most VC companies and funds are difficult to get meaningful returns.Their profit shrinks, forcing them to create Alpha’s income through tokens rather than asset selection.

One of the biggest problems is token distribution.Regulatory obstacles make it almost impossible to distribute tokens to retail investors, and the team’s choice is limited -mainly airdrop or liquidity motivation.

Summarize

It is not a problem to use token to inspire stakeholders and accelerate the development of the project itself; it can become a powerful tool.The real problem is that token economics is completely lacking in chain transparency.

The following are several key points for the founders of cryptocurrencies to increase transparency:

1. Do not provide inquiries and allocation to VC:Investors should provide full value for your company without additional consultation and distribution.If investors need additional tokens to invest, they may lack real confidence in your project.Do you really want such people to appear in your equity structure table?

2. The market service has been commercialized:The market service has become commercialized, and the price should be competitive.There is no need to pay more.In order to help the founder to control this field, I created one>guideEssence

3. Do not talk about financing with irrelevant operations:During the financing period, the focus is to find funds and investors that can appreciate your company.At this stage, avoid discussing as a city merchant or airdrop -later sign any documents related to these themes.

4. To maximize the transparency of the chain:The tokens on the chain should accurately reflect the actual situation of token distribution.When the creation is created, the token is transparent to different wallets to reflect your token economics chart.For example, use the following cake maps to ensure that you have six major wallets, teams, consultants, investors, etc.Actively contact the following team:

-

EtherScan, Arkhami, and NANSEN label all related wallets.

-

Tokenomist to obtain the belonging schedule.

-

Coingecko and CoinMarketCap ensure accurate recycling and FDV.

-

-If you are L1/L2/AppChain, make sure your native block browser is intuitive and easy to navigate for all users.

5. Use the chain to belong to contract:For teams, investors, off -site transactions or any types of ownership, ensure that it is transparent on the chain through smart contracts and is realized by programming.

6. Lock the pledge reward of internal personnel:If you want to allow lock -up tokens to pledge, at least ensure that pledge rewards are also locked.You can>Check here my views on this approachEssence

7. Focus on your products and forget the CEX listing:Don’t be obsessed with obtaining the listing of Binance; it will not solve your problems or improve your fundamentals.

8. Unless necessary, do not use tokens to motivate:If you issue tokens too easily, then your strategy or business model must have problems.Tokens are valuable and should be used with caution to achieve specific goals.They can become growth hacking tools, but not long -term solutions.When planning tokens, ask yourself:

-

What are the quantifiable goals to use these tokens?

-

Once the incentives stop, what will happen to this indicator?

If you think that the result will drop by 50 % or more after the inspiration is stopped, then your tokens are likely to have defects.

If there is only one key point in this article, that is: priority is given to transparency.

I don’t have to blame anyone.My goal is to trigger a real debate to promote transparency and reduce false token transactions.I sincerely believe that over time, this will strengthen the field.

Please continue to pay attention to the next part of my token economics series, and I will explore the comprehensive guidelines and rating framework of tokens in it.

Let us make the token economics transparent again and get rid of the Daloda maze.