Author: Eric SJ, independent researcher Source: X,@SJ95E

This year’s DEPIN narrative allows the storage sector to be attracted by the market again. I actually suspected that this was the new cycle of Fil Dogzhuang.

Outline of this thread:

1. CESS’s business model and multi -chain framework

2. Analysis of ther²s consensus mechanism

3. Passing economic analysis

4.Depin & amp; decentralization storage track scale and view extension

One picture read the full text:

>

CESS business model and multi -chain framework

The business model of decentralized storage is actually very simple to understand:That is, one party provides storage space and one party uses storage space, which is a model that is done by the leading heads including Fil.

Instead of entering the CESS, the storage node uses CESS to provide storage space for the demand side, and CESS will be reduced to nodes; the demand side is to request storage space by paying CESS, which is the basic economic closed loop.

On this track, the implementation differences on different paths at these two ends constitute their own characteristics of each project.Means to allow users’ data to have higher privacy.

Of course, these methods are also available.In addition, it is necessary to mention: thanks to the Substrate framework, CESS also supports multi -chain scenes, which is the relay model shown in the figure below.The multi -chain architecture design provides sufficient rich scenarios to the ecology on the chain and bring more native needs for data storage. I think this is a point that is more distinctive and competitive than other infrastructure.

>

R²s consensus mechanism solution

因为本身除了提供存储方面的功能之外,CESS还是一条Layer1,所以网络中的节点也有着不同的角色,我在此就简单基于架构分一下:提供存储空间的和维持链共识的(不是就只有Two meanings)

Here, we will focus on the consensus node and consensus mechanism: To become a consensus node, you must first pledge, but the optical pledge is not enough. CESS has designed a mechanism called reputation rotation consensus.

Simply put, in a verification phase, the composition of the credit system can be completed through 11 nodes to complete the consensus system through the built -in credit system. 80%of the factors can be simply understood as the work in the CESS network.The quantity proves, and then add a 20%random number to make the credit ranking system rotibility.

Fortune Economic Analysis

The blue part is the part that the project can control, the red part is the community to control parts, and the orange system is the proportion of investors.

It can be seen from the composition of the token in the chart that more than half of the parts are divided into nodes, and it has a production reduction effect of 4 years.In addition to these, the project party or the early contributor itself is not reserved, and the large amount is designed with locking.

The proportion of institutions is only 10%, which is a project with a heavy node scale effect. Based on this, two links are attached. This is also the same place I think it has the same attributes as Fil.

-On node/miner hardware configuration and construction tutorial:https://docs.cess.cloud/core/storage-miner/running

-CESS cloud computing power purchase participation method:https://cess.cloud/daocm/

>

Perspective

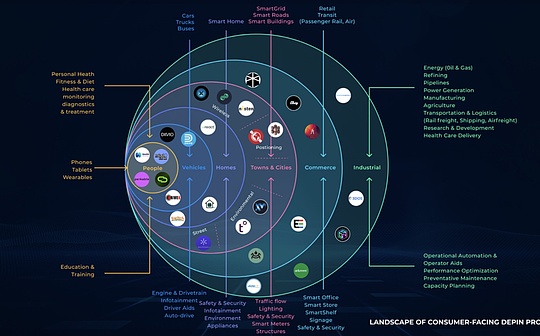

The composition of the current DEPIN track is still relatively chaotic. There is no enough phenomenon -level and certainty thing in the new project to run out. Continuing the old logic.In the storage sector, the faucet Fil also occupies a 25%share.

At present, in addition to several more popular or more popular projects launched by Solana, DEPIN is the highest degree of decentralized storage tracks between the odds/certainty., But the choice of high odds in the certainty track is a more comprehensive direction of funds. This is why I think that CESS is likely to lead in the new cycle.

PS: This year’s Pokka series, Manta uses modular+L2 RPLLUP to kill the siege, and CESS ride the DEPIN boom is expected to set off the plate narrative again.