Author: Sunny Shi, Corporate Research Analyst at Messari

Last weekend, Bitcoin briefly fell below $50,000 for the first time since February amid concerns about a massive withdrawal of $1 trillion arbitrage transactions.On Thursday, less than a week after the crisis, Bitcoin returned to above $60,000.

Although BTC is a cornerstone asset for cryptocurrencies, it is still much more volatile than the stock index.We can attribute Bitcoin’s high beta reflexivity to:

-

Due to futures trading,Cryptocurrencies have too high leverage penetration.During the break below $50,000, cryptocurrency traders cleared more than $1 billion.Nearly $100 million of BTC shorts were liquidated Thursday as they rose to $62,000.

-

Bitcoin lacks cash flow.Long-term stock managers usually trade at a price-to-earnings ratio or free cash flow, which gives them confidence to “buy on dips.”If macro-driven capital flows do not affect the profit potential of their company, fundamental investors have no reason to sell.By contrast, Bitcoin’s valuation has no basis.

-

The institutional foundation of cryptocurrencies is weak.On August 5, retail investors were mainly net sellers of stocks, while institutions bought them.Normally, institutional holders holding existing capital are unlikely to sell out for risk and panic.In more mature markets, diversification of investor investment periods contributes to stability.

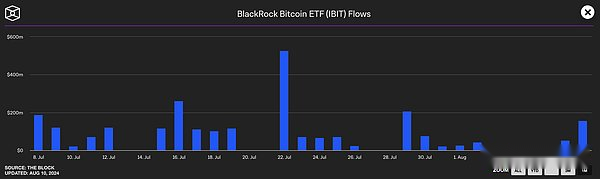

The situation in Bitcoin may start to change.It is worth noting that BlackRock’s Bitcoin ETF IBIT has only experienced a day of capital outflows.

BlackRock contributed more than $200 million in net inflows of Bitcoin ETFs last week.This doesn’t mean BlackRock will never start selling, but now, the asset manager chooses to accumulate bitcoin.

-

This trend may indicate that unlike retail investors, BlackRock has a longer-term business vision.

These developments support the crypto asset class to a large extent, and the continued growth of Bitcoin held by ETFs may be exactly what we need to get rid of the never-ending violent boom and bust cycles.”Baby Boomers” may eventually save us.