Note: The WLD tokens assigned by Worldcoin to the contributor Tools for Humanity were originally scheduled to be unlocked in a linear manner every day starting July 24, 2024.But on July 16, Worldcoin announced that the unlocking schedule for 80% of WLDs held by Tools for Humanity team members and investors will be extended from 3 to 5 years.Affected by this “good” news, the price of WLD tokens soared by more than 50%.

WLD, which was originally known for its low circulation and high FDV, has long been criticized by the crypto community, and this incident has once again attracted community attention.Crypto trader DeFi Squared once again issued a statement to refute Worldcoin, saying that the internal team of Worldcoin controls prices through tokens, using extremely low circulation rates, high FDV, and releasing good news, so as to maintain extremely high FDV when unlocking internally.It’s a money grab plan.

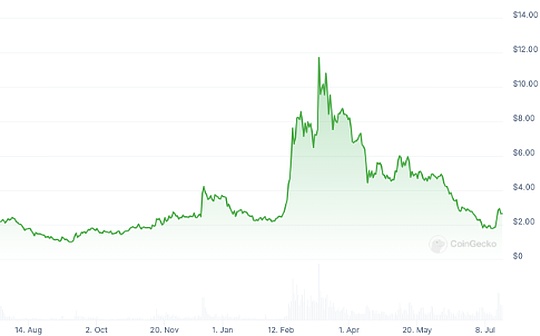

Bitchain Vision 0xxz compiled. Before reading, let’s take a look at the historical trend of WLD prices:

The following is the original text of DeFi Squared:

Worldcoin is expected to start internal unlocking in 7 days, one of the lowest ever circulation in the industry, with circulation of just 2.7%.With this in mind, it makes sense to dig deep into how the project has achieved this state.

This research article reveals how the Worldcoin team controls prices so that it still maintains $30 billion in FDV when internal unlocking begins, while liaring that it is not involved.Everything is in sync with the latest attribution schedule changes.

First, let me introduce the background.When Worldcoin was first launched, the Foundation’s circulation supply was 1.4% or 140 million WLD.Despite concerns that this circulation rate would lead to its launch with extremely high FDV, the team has allocated 100 million of the tokens to market makers and provided them with call options that allow them to slightly at the end of the contractPrices above $2 are repurchased to a large number of tokens, with the aim of preventing the price from soaring too high.It is not uncommon in the industry to allocate supply to market makers to create favorable price conditions.

Old Worldcoin white paper for 2023 describes price suppression formulas offered to market makers

As one would expect, WLDs cannot significantly outpace the bullish price during this contract term, as market makers will only “suppress” the price.Worldcoin CEO Alex Blania discusses here how this contract is particularly needed to prevent prices from squeezing their low float:

Worldcoin CEO introduced their tips on price suppression to prevent WLD from soaring to $10, and later that year they refused to renew the contract, and WLD price surged to $10 (Source: Scoop Podcast)

Note that he pointed out that the purpose was to avoid the price “splashing to $10” and continued to say that the situation would be “very terrible”.

Nevertheless, on December 16, with the circulation of only 1.2%, Worldcoin decided not to renew the existing market maker contract, canceled the price-suppressing call options, and even further removed another 25 million from circulation.WLD.Now, with extremely low market makers participating, its market cap is only $98 million, and its price has soared by 100% in a few hours, as expected – exactly what Blania claims they are trying to avoid.Within a month, Worldcoin prices have risen to nearly $12 and FDV is $120 billion.

Apparently, the team later realized that it was unwise for the U.S. team to publicly describe how they control prices, so when asked on Token2049 Dubai whether they were paying attention to prices, the CEO of Worldcoin claimed that they could not control prices, which was only by the marketDriven by:

Worldcoin CEO claims they have nothing to do with price, although their policy changes and token economics have a significant impact on price

This is not the case.The fact is that 11-digit valuations are only possible under the design of the team’s token economics, and the daily price changes of tokens are affected by the team in many occasions because they actively change the issuance volume and do it.The municipal contract is held and an announcement will be issued in a timely manner before unlocking.This raises the question: Why they don’t want the public to believe that this is true.

So let’s go back to the original starting point – we go back to when insiders unlocked, when the supply of circulating was only 2.7%, which is probably the lowest ever seen in cryptocurrency history projects powered by major VCs when unlockedratio.As a reminder, this may be the only thing that will keep WLD on with an amazing $30 billion FDV, and insiders will be able to sell it for that price soon.But why is the circulation rate so low?According to Blania in 2023, they must keep circulation low because in order to achieve universal basic income UBI, it is completely unfair to release 10% of the supply at one time:

The Worldcoin CEO defended low circulation, saying it was necessary to achieve universal basic income (UBI).However, it is confusing that the token economics arrangement designed by the team will result in most of the token issuances flowing to insiders next year, rather than UBI subsidies.(Source: The Scoop Podcast)

But that’s exactly what the team plans to do with unlocking tokens, except that these tokens fall into the pockets of insiders, not the pockets of UBI recipients.Even with a new unlocking plan, the team/VC will issue nearly 1 billion tokens in a little over a year, and according to the current UBI grant rate, there are only 600 million tokens at the same time.Will be distributed to UBI recipients.This means that within one year, WLDs issued by internal personnel are expected to account for more than 60% of Worldcoin’s overall circulation supply.60% is a large proportion – it basically means that most of the ecosystem is purely for VCs to sell out.This seems to directly refute the reason for keeping circulation at a low level for the benefit of UBI recipients at this time.

There are several other sources that increase circulation supply, but these supply does not flow directly to UBI recipients.My previous research article discusses the large supply of “community funds” to be sold at discounted prices to trading counters; in addition, it is worth a look at Orb operators like this (verified from public orb operator emission wallets)They sometimes earn puzzling 20,000+ WLDs per week by collecting biometric data from vulnerable groups and sending them directly to Binance:

When WLD prices soared to $12 in March, the Orb operator sent close to $150,000 to Binance every 3 days

But the question remains – even if circulation is so low, who is the unfortunate victim of WLD currently holding nearly $30 billion of FDV and maintaining high valuations when unlocked?It turns out that a large part of them are actually Korean retail investors, many of whom may not even understand English and cannot understand the situation.At the time of writing, nearly 25% of the circulation WLD is held on Bithumb and continues to rise despite an upcoming release:

As insider unlocking approaches, Korean retail investors’ WLD positions on Bithumb continue to grow.

In recent months, the value of these positions has been lost 70-80% as the Worldcoin Foundation actively sells tokens to trading platforms

(Balance historical data comes from Arkham Intelligence)

With that in mind, it may not be a coincidence that Worldcoin waited until the week before unlocking it.While this is just a small change that releases selling pressure, the news has proven to be very effective so far, forcing retail investors to offer higher prices and more liquidity without their knowledge, allowing insiders to exit within a week.Worse, it seems possible (but unproven) that someone in a team or venture capital can take advantage of insider information to get the message first, even before it is announced publicly:

Chart shows a coincidental surge in prices within 24 hours before the release of the unlocked extension news.

Unfortunately, while such project behavior is not new to cryptocurrencies, it is surprising that many market participants still don’t understand the disadvantages of the investments they make.This article aims to reveal an item that seems intentionally to support the price of the token that should be lower, and many of the reasons listed are why I intend to short WLD within a few months after the unlocking begins.