Author: YASH AGARWAL Source: X,@Yashhsm Translation: Shan Ouba, Bitchain Vision

STRIPE acquired Bridge for $ 1.1 billion, letting me explain to you why the company you might never have heard of is so important.

Stripe enters the stabilization currency

The co -founder of Stripe demonstrated the acceptance of Phantom to accept the stable currency, earlier this year.- -have been launched with cryptocurrency payment/payment, that is, any American merchant can accept stable coins such as USDC and settle in US dollars.

>

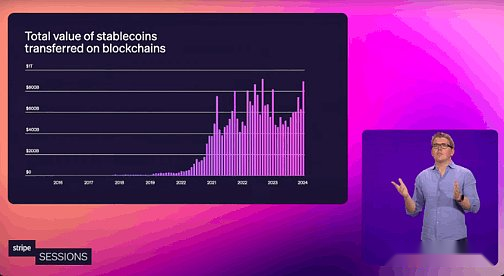

Although in the bear market, the volume of stable currency continues to rise, and the support of high -performance blockchain such as Solana and Base makes them very optimistic about the market fit (PMF) of the stablecoin.

These will become the most iconic lines in financial history:”Stable currency is a normal temperature super conductor in the field of financial services.”

>

Why does Stripe need stablecoin?

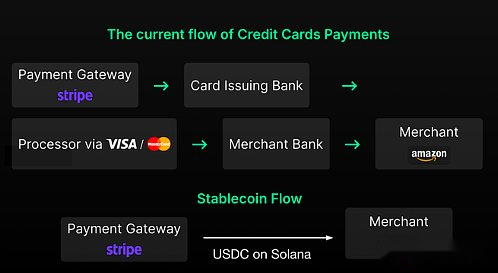

Stripe is currently just a payment gateway, and must rely on Visa/MasterCard and other networks:-—— additional approximately 1-3%-dependence on banks/local partners-low authorization rate stablecoin can save all middlemen, thereby having stacks.

>

However, if Stripe wants to have a stable currency stack, they must build: – -entry/export (legal currency & lt; & gt; cryptocurrency conversion) – — stable currency issuance (for example, Tether’s annual profit of US $ 10 billion) – complexStable currency infrastructure (handling more than 20 blockchain, more than 10 stablecoins, etc.).They can spend years to build or buy it directly.

Bridge came into being

Bridge was established by the founder of the second entrepreneurial in 2022 (the previous company was acquired by Square).The members of the founding team include the former Brex chief product officer (@zcabrams) and former Airbnb engineer Sean.

Their vision is to create a variety of “APIs” for stable currency.They first started by supporting stable currency payment and infrastructure (similar to Stripe’s way of serving traditional financial services).

In 2023, they completed a round of unintentional seed financing (speculated that about $ 18 million was led by Sequoia Capital).In the past 2.5 years, they have built APIs for the following areas:- -the scheduling system (entrance/export channel, the upcoming form of the US dollar into another form. For example, the USDC on Solana is converted to the US dollar)- Issuing (cast stable coins and manages reserve asset investment)

Their API has supported more than $ 5 billion in transactions. Customers include:

-

Stable currency fintech application, such as @Getdolarapp (virtual account provided by Leeds Bank)

-

Global fiscal operations, such as @Spacex and the US government

-

Pay, such as @Scale_ai (for payment of its contractor)

-

@Zerohashx (larger scale, but insufficient credibility)

-

@Brale_xyz and @paxos (stable currency issuance; PAXOS helped release PYUSD of PayPal)

-

@Coinflowlabs

-

This is the largest acquisition in the encrypted field (it is expected to have more mergers and acquisitions activities)

-

It is also the biggest acquisition of Stripe in history (showing their vision for the field of encryption)

Bridge supports many up/off channels and cryptocurrency cards.What are their competitors?a lot of!

And basically any out/entry channel and stable currency infrastructure provider.

Why only consider Bridge?

– API Preferred: Integration with Stripe Technology Stack──The future competitors (for example, integrated Bridge’s stable currency fintech company may disturb the Stripe market)- – complementary products (for example, financial management service+stable currency issuance, bank service as service+baaS+cryptocurrency payment)- -Common Investor: Sequoia Capital+Founder of San Francisco TechnologyEssence

Why pay $ 1.1 billion?

The main reason is the powerful team -the founder has led or cooperated with the top startups (Airbnb/Brex/Coinbase/Square) -ly they are the most suitable candidates for leading the “Stripe encryption infrastructure”.

In addition, there are permits, products, market affairs, and customer groups.I guess the payment method of this transaction will be more equity, not cash.

From a strategic point of view, acquiring Bridge helps:

– -speed up the progress and compete with encrypted giants such as BlackRock, Revolut, PayPal- -24/7 global operation; get rid of the limitation of the localized payment system (Stripe faces huge problems when expanding to Asia and Latin America, etc.)

>

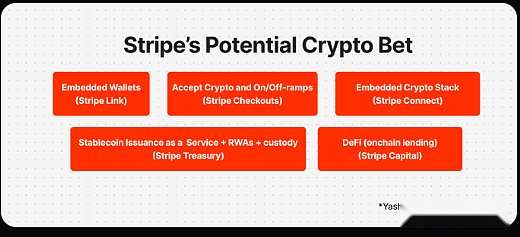

Stripe’s next step?My guess

→ Continue to promote the acceptance of/entry channels and encrypted payment, and control the API of Bridge→ Deeply cultivate stable currency infrastructure (allowing global fintech companies to issue stablecoins, and may even launch its own stablecoin -StusD to integrate the entire ecosystem vertically?)→ Become the advocate of stable currency payment, so that every street shop can accept stable currency payment

As an enthusiastic enthusiast with a stable currency, I think this is a positive signal in the encryption field:

Will this become a historic acquisition like Instagram and really improve the GDP of the Internet?