Author:Bull Theory, crypto analyst; compiled by: Bitchain Vision

Today, Bitcoin wiped out 16 hours of gains in just 20 minutes after U.S. stocks opened.

Since early November, Bitcoin has fallen almost every time U.S. stocks open.The same thing happened in the second and third quarters.

zerohedge has pointed this out many times and believes that Jane Street is the most likely person behind the scenes.

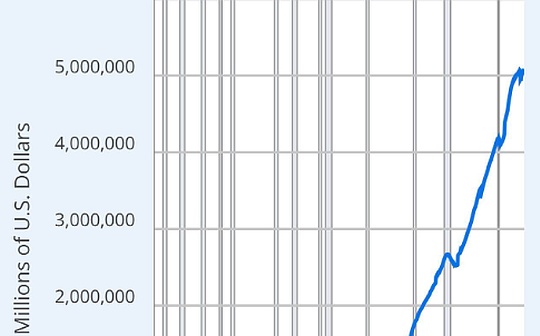

Looking at the chart, you’ll see a pattern that’s too consistent to ignore: Prices plummet within an hour of opening, followed by a slow recovery.This is a typical high-frequency trading technique.

Also consistent with their characteristics:

-

Jane Street is one of the world’s largest high-frequency trading firms.

-

They have the speed and liquidity to move the market in minutes.

Their operation seems simple:

1. Sell Bitcoin at the opening.

2. Push the price to an area of abundant liquidity.

3. Buy again at a lower price.

4. Repeat daily.

In this way, they accumulated billions of dollars in Bitcoin.

Currently, Jane Street holds the BlackRock IBIT ETF worth $2.5 billion, making it the top five holdings of IBIT.

This means that Bitcoin’s plunge was not caused by macroeconomic weakness, but was the result of manipulation by a large institution.

Once these big players stop selling and start buying, Bitcoin will continue to rise.