Author: Stephen Katte, CoinTelegraph; Compilation: Wuzhu, Bitchain Vision

Compared to 2024, the cryptocurrency rug pull cases fell 66% year-on-year, but recent data shows that the size of each rug pull has been increasing.

According to a report by blockchain analytics platform DappRadar on April 16, the frequency of rug pull events has been declining year by year, with 21 independent events recorded in early 2024, compared with only 7 so far in 2025.

However, according to a DappRadar report, the Web3 ecosystem has lost nearly $6 billion since the beginning of 2025.However, the report blamed Mantra’s OM token crash for 92% of the decline, and the founders strongly denied it was a conspiracy.

By comparison, during the same period in early 2024, the total losses caused by rug pull reached $90 million.

“This shift shows that the phenomenon of rug pulling black hands is decreasing, but once it happens, it is much more destructive.”

“These scams are becoming more and more complex, often carefully planned by teams with sophisticated brands and well-curated narratives.”

Memecoin is the culprit of the rug pull incident

Gherghelas said the nature of rug pull is constantly evolving.In the first quarter of 2024, most of them originated from DeFi protocols, NFT projects and memecoin.During the same time period in 2025, most rug pulls occur in memecoin.

Libra (LIBRA), the native Solana token for the Libertad project, is one of the most highly anticipated cases of rug pull recently; on February 14, the company’s market value rose to US$4.56 billion after Argentina President Javier Milei posted on X.

The token price fell more than 94% after he deleted the post, sparking allegations of his price gouging.

“Fraud and exit scams remain an ongoing threat, especially in ecosystems where projects can quickly gain attention through hype, but can disappear overnight by sweeping away user funds,” Gherghelas said.

“While people are constantly aware and more tools to detect suspicious behavior, rug pull remains a recurring problem, especially in DeFi and the newly launched token ecosystem.”

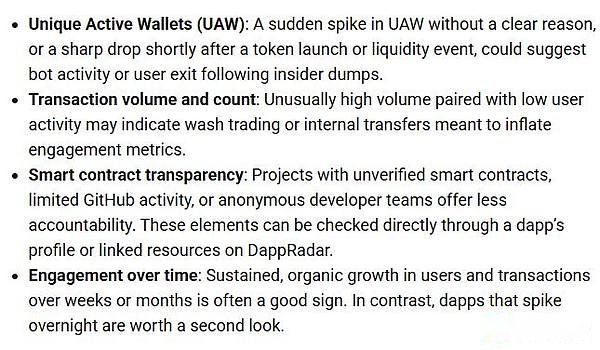

Gherghelas saidThe red flags of rug pull include a sudden surge in the number of active wallets without obvious reasons, or an abnormally high transaction volume but low user activity.

DappRadar analyst Sara Gherghelas said there are several red flags that could indicate a project is a scam.Source: DappRadar

Meanwhile, unproven smart contracts, limited GitHub activity, or projects that proliferate overnight with anonymous development teams or DApps can also be a red flag.

“As the industry matures, the means used by criminals are becoming increasingly sophisticated. But the tools available to users are becoming more and more powerful,” said Gherghelas.

“While rug pull behavior may never be completely eliminated, the impact can be greatly reduced when the user has the right information.”