Author: @brianq; Compilation: Baishui, bitchain vision

While Ethereum’s fees are likely to be out of your focus for the time being, it has been quietly rising over the past few weeks.The recent modest rise has hardly caught the attention of traders because historically people are more willing to ignore the additional costs when their portfolios are moving in the right direction (ETH has risen by 15.6 since September 15%).Overall sentiment in Ethereum remains relatively unaffected as many traders are still trying to recover after buying 3.7K to $3.9K highs in May.

But Ethereum expenses have been rising in recent weeks, rebounding to levels never seen in the ecosystem since the end of May.Understandably, network activity has increased in this encouraging price rebound, but discussions surrounding these cost increases remain relatively dull.

There has been no significant surge in discussions about Ethereum fees, suggesting that traders are not too sensitive to these changes, according to Santiment’s social volume data.This is probably because the average fee of $3.23 is still relatively low compared to the much higher fees earlier this year, especially in March, when the fee reached over $15 during market highs.

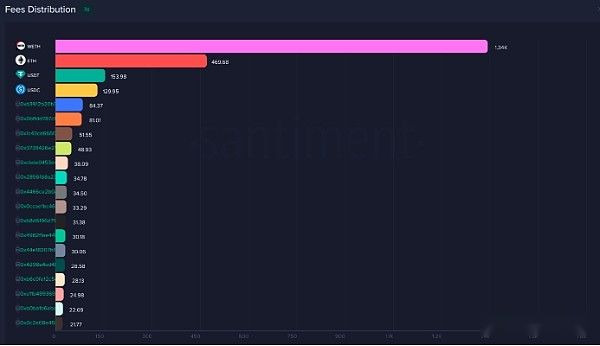

One of the main contributors to these fees is Wrapped Ethereum (WETH), which continues to dominate Ethereum’s fee rankings.WETH plays a key role in Ethereum’s decentralized finance (DeFi) ecosystem, as it is a “packaged” version of Ethereum that makes it easier to interact with decentralized applications.WETH’s dominance in expense contributions suggests that traders are heavily using the DeFi platform and may participate in liquidity pools, trading and other financial activities that require WETH as the underlying asset.This suggests that the current increase in expenses may be driven by increased DeFi activity, which is often a positive signal for ecosystem health.

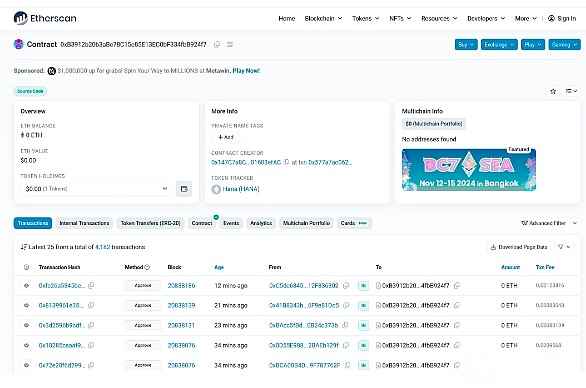

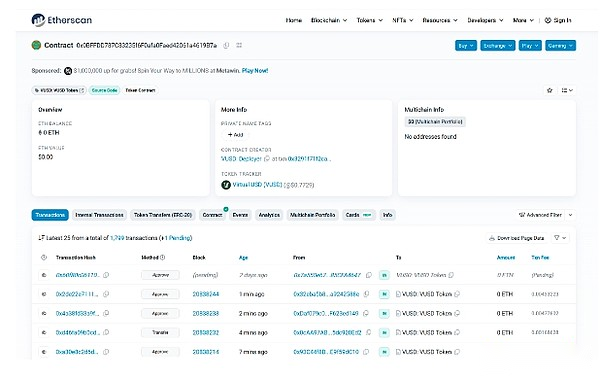

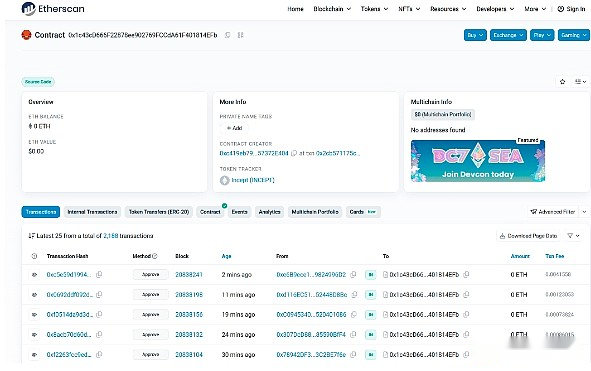

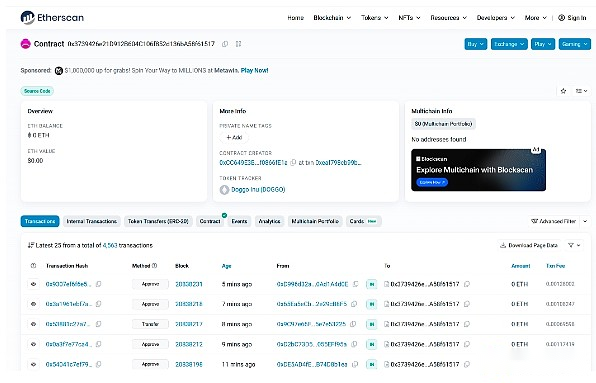

Interestingly, after WETH, the next four contract addresses that contribute to Ethereum network fees are Hana (HANA), Virtual USD (VUSD), Incept (INCEPT), and Doggo (DOGGO).Each of these tokens tells a unique story of the activity that took place on the Ethereum blockchain:

1) Hana (HANA): The token is becoming more and more popular in decentralized finance, which may indicate its growing role in staking or lending platforms.Its increasing network usage may be a hallmark of deeper integration in the Ethereum DeFi protocol.

2) Virtual Dollar (VUSD): As a stablecoin, VUSD’s fee contribution may reflect the user’s search for a safe haven for stable assets during market volatility.Stablecoins such as VUSD are popular for trading, liquidity provision and risk mitigation, all incurring fees on the network.

3) Incept (INCEPT): INCEPT is an emerging token that seems to be gaining momentum.While it is relatively new, the increase in cost contribution may indicate that it is involved in niche projects such as games or NFTs that are becoming increasingly popular on Ethereum.

4) Doggo (DOGGO): Similar to other currencies such as Dogecoin, speculative trading volume of this memecoin has surged.The increasing network activity around DOGGO shows that traders are betting on their short-term potential, which could increase the overall fee structure of the Ethereum network.

Although the fees for the Ethereum protocol have increased, these levels are still moderate by historical standards.The average fee of $3.23 is well below the shocking high we saw earlier this year, meaning traders will not hesitate to continue using the network.This low-key sensitivity in social discussion further supports the idea that unless fees rise significantly, they are unlikely to be a major obstacle to Ethereum availability in the near term.

It is worth noting that rising expenses may sometimes indicate that the market is approaching the peak of speculation, as higher expenses tend to coincide with the surge in online activity driven by market speculation.However, the small increase in costs is unlikely to cause concern.Instead, it reflects healthy, growing activity in the Ethereum ecosystem, especially in DeFi and speculative trading around smaller tokens.As long as fees remain controllable, Ethereum is likely to continue to flourish without much disruption.