Author: David C, Bankless; Compilation: Deng Tong, Bit Chain Vision

Investing in a stablecoin or Solana’s native liquidity pledged token may be as exciting as finding the next breakthrough tokens, but it can provide reliable ways to make money.

Stablecoin provides price stability, and LST allows you to obtain basic pledge rewards while maintaining liquidity.Through the DEFI platforms such as Kamino, Drift, and Save (previously referred to as Solend), you can put stablecoins and LST in use to increase your income through revenue farming strategies.

Whether you like passive low -risk returns or are willing to take higher risks to get greater returns, this article will subdivide the leading stable currency (such as USDC and Pyusd) and Solana’s best income opportunity to help, help helpYou find a match that is best for you.

US dollar stabilization currency

The stable coins on Solana showed explosive growth in the market cycle in this round.Although USDC occupies a dominant position on the chain, compared with Tether’s USDT, this is a unique phenomenon, and PayPal’s Pyusd has experienced explosive growth after recently, which is due to the DEFI protocol.

These stablecoins provide relatively low risk choices for income farming in the DEFI protocols such as Kamino, Drift and Save (formerly known as Solend).Whether you are looking for a stable income or a higher risk return plan, these assets are indispensable for those who aim to hedge market fluctuations and obtain stable returns.

USDC

Kamino

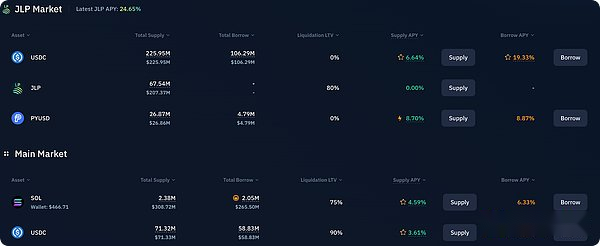

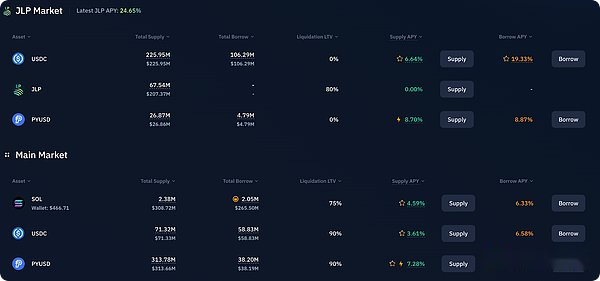

Kamino Finance provides multiple income options for USDC holders. The main pool vault currently offers about 3.5% of its annual interest rate, which is lower than its history of 6-9%, but it is still reliable and can get passive and low-risk returns.EssenceTo get higher returns, the Kamino’s Congzhong Pool offers about 7.5% of the USDC annual interest rate, and the JLP (Jupiter Liquidity Provider) pool provides about 6.6% of the annual interest rate.The ideal choice of higher reward users.

Drift

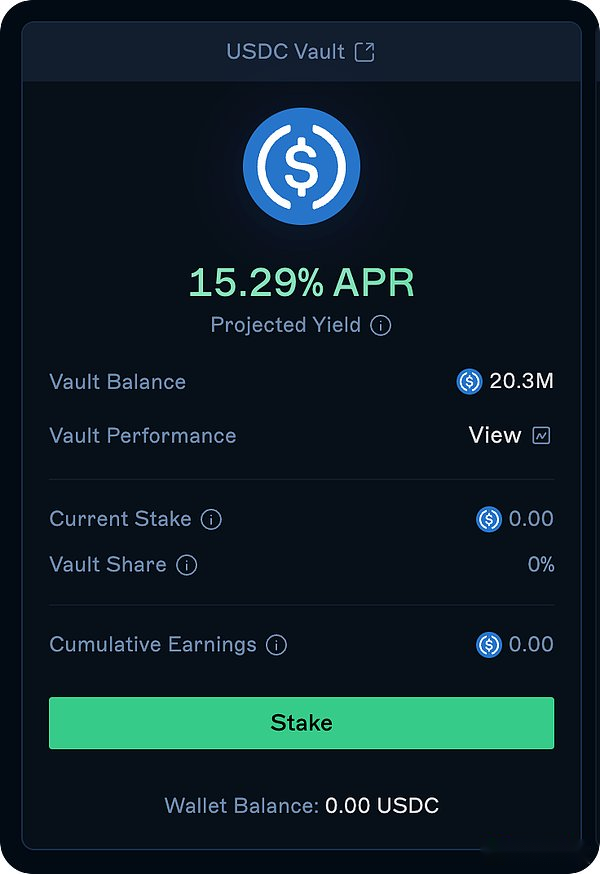

The transaction protocol Drift also allows users to earn income by borrowing USDC.Although the yield here is moderate, it is about 3-4%, which is far lower than the previous high, but for those who do not seek radical risks, they provide a stable and low-risk opportunity.In addition, DRIFT’s insurance funds provide a much higher rate of return, which is currently about 15%. The cost income from transactions, borrowings and liquidation, but the risk is greater because it acts as a backing ability to maintain the solvency.

Save

The algorithm lending platform Save provides 4-5% of the USDC borrowing annual interest rate in its main pool.The platform also has other pools that do not need to be deployed by the agreement, such as its JLP/SOL/USDC pool. At present, for those who are willing to participate in a high risk strategy, the pool’s annual interest rate is 8.5%.

Pyusd

Kamino

Pyusd is the new entry of the Solana ecosystem, but due to Kamino’s positive revenue strategy, it quickly gains development momentum.Although the initial yield is as high as 30%, the yield has been stabilized at about 7%since then, which is the highest among the Kamino’s main pool stabilization vault.Kamino also just incorporated PYUSD into the JLP (Jupiter Liquidity provider) pool, which is higher than its main vault, about 8.5%.

Drift

The yield of Drift borrowing vault is slightly higher, about 10%, which makes the platform a attractive choice for Pyusd.In addition, in its insurance funds, Drift provides about 18.5% of the annual interest rate, but please remember that this will bring higher risks.

Save

Save’s PYUSD main pool yield is currently about 12%, and it seems to have increased recently, while Drift and Kamino’s yields have declined.If this trend continues, SAVE may be the best platform for users who want to use Pyusd without taking additional risks.

LST

Liquid token (LST) is an important part of the Solana pledge economy, allowing users to pledge SOL while retaining liquidity to use in a wider DEFI ecosystem.Three LST on the largest market value of Solana -MEV enhanced liquid pledged JitoSol, well -known Marinade Finance MSOL, and Jupsol provided by Jupiter exchanges with Sanctum — the basic yields of pledge rewards, respectively, and the basic yields of pledge rewards, respectively, and 7.5%, respectively.~ 8.12% and ~ 8%, and there are additional opportunities to enlarge these returns through DEFI (especially on Kamino).

For each of these LST, additional benefits can be obtained through Kamino’s main vault or leverage strategy.The main vault provides passive returns on the basic pledge reward, and leverage income strategy provides higher returns for those who are willing to take more risks.

Jitosol

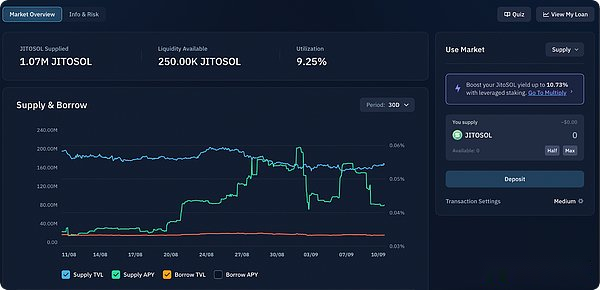

Main Hydra

Kamino provides a moderate return of 0.04% for the main insurance libraries provided by Jitosol, adding passive income to the basic pledged reward.This option is suitable for those who seek stable and low maintenance returns.

Leverage

For users who want to maximize their income, Kamino provides a higher income for leverage income options for Jitosol, which can currently reach up to 10.5%.This strategy uses leverage to amplify the income, but if these derivative assets are decoupled, the risk will increase compared to holding only LST.

msol

Main Hydra

Kamino’s MSOL main vault offers 0.11% of the income, which slightly enhanced the basic pledge reward through passive DEFI returns.This vault is very suitable for long -term holding MSOL while earning additional benefits.

Leverage

For those who are not afraid of risks and want to increase their return, Kamino’s leveraged pledge strategy for MSOL can push the yield to about 14.5%.

Jupsol

Main Hydra

Jupsol’s main vault yield on Kamino is 0.02%, and a small amount of additional returns are provided on the basis of matrix pledge rewards.Although the yield is low, this provides a stable source of passive income for Jupsol holders who want to have no worries at night.

Leverage

Kamino’s leverage Jupsol pool has the highest yield, about 14.7%.By using the pledged Jupsol in DEFI, users can get considerable returns. This strategy is very suitable for those who want to maximize pledge income while bear higher risk.

Summarize

All in all, the stable currency and LST on Solana provide various income farming opportunities, and users can increase the most mature or stable assets according to their own risk tolerance.

Pyusd currently provides the highest income opportunities in stable coins, especially on Drift and other platforms. APY is about 18%.In terms of liquidity, Jupsol and MSOL currently have the highest leverage yields, about 15%, providing considerable returns for those who are willing to take the risk of leverage.However, these vaults must be monitored because their yields fluctuate regularly.

Whether you choose a low -risk coin vault or a high -risk LST farming strategy, there are many opportunities to invest your assets into the DEFI ecosystem of Solana.