Author: PEDRO M. Negron, Medium; Compilation: Deng Tong, Bit Chain Vision Realm

Decentralization Finance (DEFI) introduces a financial agreement that allows direct borrowing on its platform, and users can borrow assets without relying on traditional intermediary agencies.

These protocols mainly use smart contracts. They are automatic execution protocols. The contract terms are directly encoded into it, thereby improving transparency and security.The lender provides his assets to the liquidity pool and obtains interest as compensation, and borrowers can obtain loans by providing mortgages.The interest rate is usually determined by the algorithm, and the algorithm shows the supply and demand dynamics of assets in the pool.

This article studies the economic risks related to the DEFI lending agreement, determines its most vulnerable point, and discusses effective methods for monitoring the risk of DEFI.In this article, we will study indicators in the AAVE protocol (the largest loan agreement in Defi).

Loan and borrower

The main financial risk of depositing loan agreements is the possibility of unable to recover assets, and it usually occurs when the borrower fails to repay the loan.

The DEFI protocol is currently running on the basis of excess mortgages, which means that the borrower must provide a certain percentage of mortgage in advance for the borrowing amount.If the value of borrowing funds is lower than this threshold, the mechanism will be activated to seize the borrower’s mortgage to protect the assets of the loan party.

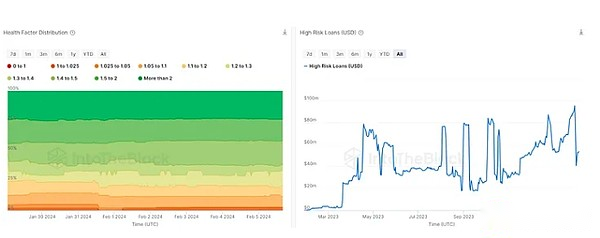

Source: intoTheblock ’s Risk Radar

These two indicators are designed to monitor loan categories facing liquidation risks.The indicator “Health Factor Distribution” on the left shows the health factor of the loan position as an indicator. By calculating the ratio of the holder of holding the mortgage and the amount of borrowing, it reflects the security level of the borrower’s position.The user’s mortgage is classified according to their own health factors.Indexes that are higher than 1.50 indicate that the risk level of the agreement is low.Monitor the number of mortgages in each health factors is useful for tracking purpose.If the price suddenly falls, understanding the exposure level of the scheme within each health factor can help reduce the risk.

The indicator on the right shows the loan value guaranteed by volatility assets, and its liquidation threshold is within 5%.This information can help users understand the high -risk loans of protocols and specific pools, and enable the liquidator to predict future liquidation.If the value of mortgage declines or the price of assets rises, the chance of liquidation will increase, so loans within 5% of the liquidation threshold will be considered a high risk.By identifying loans with a cleaning rate of less than 5%, investors and users can better understand the level of relevant risks and help them make wise decisions on deposit or use an agreement.

Liquidator

In the AAVE agreement and most of the borrowing agreements in DEFI, the individual responsible for monitoring and ensuring that the loan repay the loan is called a liquidator.If the mortgage value provided by the borrower for the loan is lower than the scheduled threshold, the liquidator is responsible for liquidation.Maintaining a strong and active clearing people in the agreement is critical to ensure the vitality of the agreement.

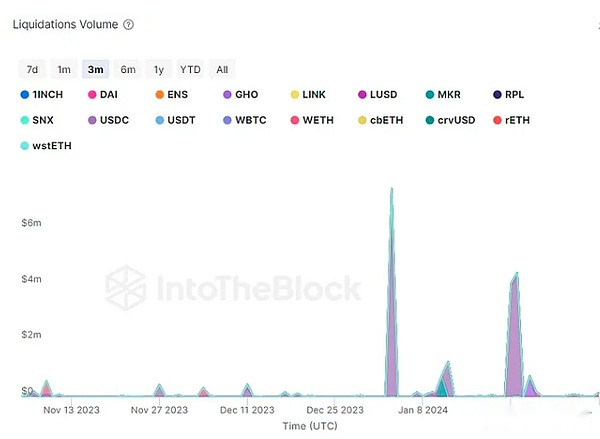

Source: intoTheblock ’s Risk Radar

The amount of liquidation refers to the total amount of funds confiscated and sold when the borrower fails to repay the loan.This indicator can insight into the level of risk in the system. The higher liquidation volume indicates that more and more borrowers arrears loans, so that the agreement is facing greater risks.In addition, it also shows the value obtained by the liquidation of an artificial protection agreement from the influence of bad debts.

Whale activity

The actions and movements of the big holder (whale) are also crucial for the economic security of the agreement.Their activities in the market can quickly affect various markets and significantly change interest rates.

If the liquidator’s incentives are not enough to motivate them to handle orders, the large -scale liquidation of the whale may cause bad debt in the agreement.Therefore, it is recommended to continue to monitor their activities and their markets involved when participating in the agreement.

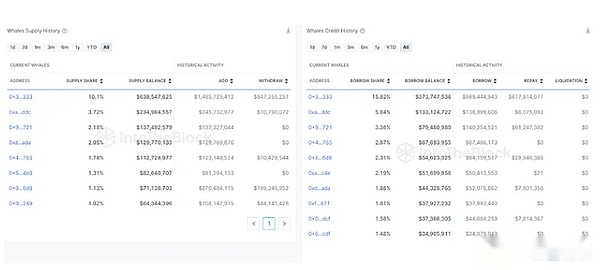

Source: intoTheblock ’s Risk Radar

These two indicators provide a comprehensive overview of the current behavior of whales in the agreement.From the perspective of borrowers, analyzing the history of liquidation can allow you to evaluate the risks related to borrowing from agreement.In addition, by checking repayment and total debt, users can evaluate the interaction between whale’s past and agreements, and try to predict their typical behaviors.In addition, the current loan share enables the liquidator and lender to predict the situation where the whale may be liquidated.

From the perspective of the supply side, the borrower can monitor the loan’s supply share and estimate the situation of liquidity withdrawal and its potential impact on the loan interest rate.Users can also observe the largest storage households to analyze their loan capacity relative to deposits, which can provide useful information when investigating the lenders’ leverage for protocol deposits.

Power of insights on monitoring indicators

In short, the DEFI ecosystem, especially the borrowing agreement such as AAVE, runs on a complex mechanism, involving the key role of borrowers, lenders, and liquidants in maintaining the health and safety of the system.

Monitoring indicators such as health factor distribution and liquidation volume can provide valuable insights for the risk level of the agreement and the efficiency of the clearing process.The behavior of large storage households or “whales” will have a significant impact on market dynamics and economic well -being.It is necessary to continuously monitor to reduce risks related to large -scale liquidation and interest rate fluctuations.Understand the interaction between the borrower and the lender, and analyze the activities of the maximum storeders, which helps users evaluate the potential impact of the borrowing risk and liquidity changes on the ecosystem.