Author: Matthew Sigel, VANECK Digital Asset Research Source: X,@Matthew_sigel Compilation: Shan Ouba, Bitchain Vision Realm

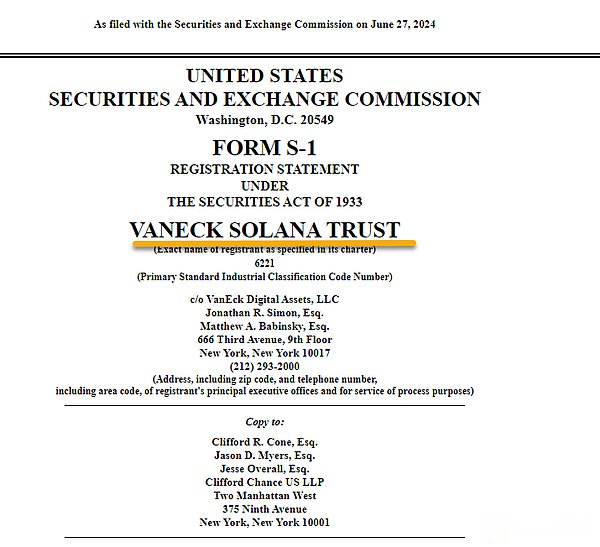

Editor’s note: On June 27, 2024, according to SEC documents, asset management institutions VANECK has submitted to the United States SEC to apply for files.Matthew Sigel, director of VANECK Digital Assets Research, explained why Solana ETF was applied for in X.

The following is the original content:

I am glad to announce that VANECK has just applied for the first Solana Exchange Trading Fund (ETF) in the United States.The following is why we think SOL is some of the thoughts of a product.

Why do we apply for Solana ETF?

As a competitor of Ethereum, Solana is an open source blockchain software, which aims to handle various applications, including payment, transactions, games and social interaction.Solana blockchain runs as a single global state machine, and does not require sharding or two -layer solutions.Its unique combination of scalability, speed and low cost may provide a better user experience for many cases.

By supporting thousands of transactions per second and a very low handling fee, and adopting a high -level security mechanism combined with historical proof and equity proof, we believe that Solana stands out among many blockchains, which has the characteristics of strong and easy access.We believe,The combination of high throughput, low cost, strong security and strong community atmosphere makes Solana a attractive ETF choice,Show investors a multifunctional and innovative open source ecosystem.

Why do we think SOL is a product?

We believe that the functions of Solana native currency SOL are similar to other digital products, such as Bitcoin and Ethereum.It is used to pay trading costs and computing services on the blockchain.Just like ETH on the Ethereum network, SOL can be traded on the digital asset platform or used for point -to -point transactions.

The widespread application and services supported by Solana ecosystem, from decentralized finance (DEFI) to non -homogeneous tokens (NFT), highlighting SOL’s practicality and value as digital commodities.Without a single intermediary or physical operation or control Solana network, this principle is called decentralization.Transaction verification and record preservation infrastructure is jointly maintained by a diverse user group, including many independent verifications in the world.These verifiedrs are responsible for dealing with transactions and protecting the network to ensure that no single entity can monopolize the system.

SOL’s decentralization characteristics, high practicality and economic feasibility are consistent with the characteristics of other established digital productsIt has strengthened our belief in SOL as a valuable product, and provides multiple use cases for investors, builders, and entrepreneurs seeking double -headed monopoly alternatives for applied stores.

>