Author: Haotian; Source: X, @tmel0211

The UNification community proposal that has been anticipated for many years has finally changed its protagonist.This time it was jointly launched by Uniswap Labs + Uniswap Foundation, and it is finally no longer a vague game of “Wolf Crying”:

1) In the past, a large number of $UNI Holders and the community have made fee switch or buyback proposals at least a dozen times, but in the end they all came to nothing.Because the “officials” do not take a stand, Labs is busy promoting products for fear of affecting growth, and Foundation is busy maintaining the ecology, fearing that sharing LP’s cake will cause governance differences.

This time is different. Hayden Adams personally stepped forward to initiate the proposal.It is equivalent to recognizing $UNI’s goal of capturing value and no longer making vague promises..

2) 100 million pieces, 10% of the supply will be directly repurchased and destroyed. The sensational effect this brings is extraordinary.

If you do the math, it includes various fees such as protocol fees, Unichain sequencer fees, MEV auction slots, etc.Is it a conservative estimate that there will be hundreds of millions of dollars in continued repurchase orders a year?It gives enough room for imagination for sustainable growth in the future;

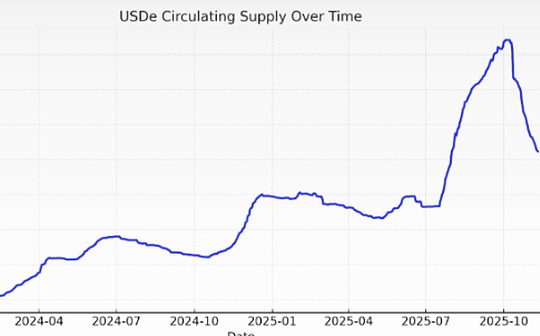

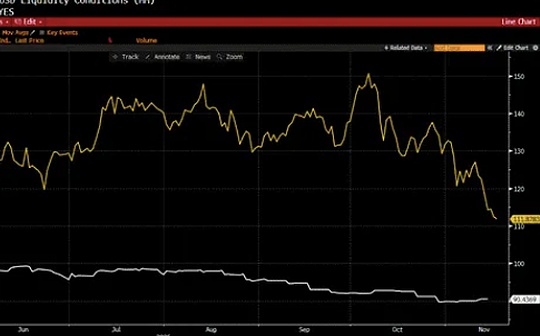

3) To be honest, Uniswap has been slow to respond. Hyperliquid has used protocol revenue to repurchase a total of US$644 million, Aave has launched a US$50 million annual plan, Raydium repurchase scale has exceeded hundreds of millions of US dollars, Curve Finance is also activating fee switch, and Ethena Labs…The entire blue-chip DeFi project is using real income to promote token buyback to prove that it is not empty..

As the leader of DEX, Uniswap has only made its official announcement now, which is thought-provoking.

4) However, if Uniswap does this, its scope of influence will be wide.Is this equivalent to setting a benchmark for the entire on-chain protocol that “protocol income must repay tokens”?

Are the dark days of the priceless governance tokens that have been criticized finally coming to an end?This also forces those projects that are still relying on so-called governance rights and community beliefs to support themselves. It is time to stand up and prove themselves.

Finally, congratulations to $UNI Holder, and also to us:

Because altcoins have finally embarked on the road of “self-certification”, “self-trust” and “self-expansion” of value.