Author: 100y, encryption researcher; compiled: 0xjs@bitchain vision

Unichain debuted.Breaking news in the crypto industry: Leading AMM DEX Uniswap officially announced its L2 solution Unichain on October 10.

A few years ago, I had speculated that Uniswap might develop its own network and was opposed by potential user experience challenges.However, with Unichain’s unveiling, my predictions proved wrong.

To put it bluntly, Unichain’s white paper only has three pages, but a closer look reveals it is a masterpiece.It brings together Uniswap’s long-standing focus on UX, Flashbots’ latest MEV research, and a vast ecosystem built by OP-Stack.While brief, the white paper covers complex topics such as TEE, priority sorting, and MEV tax, which can be challenging for readers who are not familiar with the basics of MEV.Therefore, this article aims to quickly and simply break down the main functions of Unichain for easy understanding.

1. Problem

Uniswap is the leading AMM DEX in the Ethereum ecosystem and is currently deployed in 25 networks with a total TVL of approximately US$4.5 billion.Although Uniswap is already one of the most successful protocols, it still faces limitations on the network it runs.

For example, the Ethereum network provides huge liquidity, but is less scalable, and is vulnerable to malicious MEV (maximum extractable value).To address these issues, various rollup solutions emerge, but most are currently operated by a single sorter, resulting in potential single point failures such as active failures and reviews.

Additionally, the block building process on Ethereum and most Rollup networks involves a public memory pool, creating an environment in which users (searchers) extract MEVs (for better or worse) from other users.Furthermore, due to the structure of the MEV value chain, there is an imbalance in which value is disproportionately acquired by the proposer rather than benefiting the user.

2. Enter Unichain

2.1 Overview

Unichain is an Ethereum Optimistic rollup based on OP Stack, launched by Uniswap, Flashbots, OP Labs and Paradigm, aiming to solve the above problems.Unichain provides several key benefits through 1) Verified Block Building and 2) Unichain Verification Network:

-

Quick status update

-

Enable applications to extract and internalize MEVs

-

Achieve rapid settlement through rapid economic finality

In addition to being a Rollup based on the OP Stack, Unichain plans to participate in the Superchain ecosystem.In addition to its native fast settlement capabilities, this integration is expected to provide users with a seamless liquidity experience through cross-chain solutions within the Superchain ecosystem.

Now, let’s take a closer look at how Unichain implements these features.

2.2 Verified Block Construction

Verified block building is implemented through Rollup-Boost, a feature developed in collaboration with Flashbots.Rollup-Boost provides two key features: Flashblocks and verifiable priority sorting.Similar to MEV-Boost, Rollup-Boost acts as a sidecar software.

2.2.1 Flashblocks

Flashblocks is a pre-confirmation released by TEE builders (we will discuss it in detail below).Unichain generates partial blocks, divides a single block into four parts, creates partial blocks every 250 milliseconds and sends them to the sorter.

Flashblocks is a pre-confirmation released by TEE builders (we will discuss it in detail below).Unichain generates partial blocks, divides a single block into four parts, creates partial blocks every 250 milliseconds and sends them to the sorter.

The sorter continuously downloads these partial blocks while executing transactions, providing users with early execution confirmation.The sorter ensures that these partial blocks are included in the final proposed block.This process speeds up status updates, reduces latency, improves user experience and mitigates malicious MEVs.

2.2.2 Verified Priority Sorting

2.2.2.1 Priority sorting

Priority sorting is a block construction mechanism proposed by Paradigm’s Dan Robinson and Dave White.It assumes that block proposers sort transactions based solely on priority fees and do not review or delay operations.This model is only feasible if there is a single or trusted block proposer.In a competitive environment such as Ethereum L1, multiple proposers build blocks, and prioritization is not feasible.

The purpose of a privacy order is to allow dApps on the main network to impose MEV tax on transactions that interact with them, thereby withdrawing some of the MEV values.This value can be used internally by dApp or reassigned to users.MEV tax is a fee charged by a smart contract on a transaction and can be set according to the priority fee of the transaction.Let’s look at an example.

The 100y DEX on Unichain L2 wants to extract the MEV value directly from the MEV transactions that occur on its exchange.Since it knows that blocks on Unichain are built using priority sorting, this means that the MEV value of any transaction is entirely determined by its priority fee.The MEV tax set by 100y DEX is equal to 99 times the transaction priority fee.

If an arbitrage opportunity worth 100 ETH appears, how much is the most preferred fee for the searcher to pay to get it?The answer is 1 ETH.Setting the priority fee to 1 ETH results in a MEV tax of 99 ETH, totaling 100 ETH.If the searcher sets a priority fee of more than 1 ETH, the total cost will exceed 100 ETH, resulting in a loss.Therefore, 100y DEX can capture up to 99 ETH in 100 ETH MEV values.

For the average user who does not get the value of the MEV, the priority fee will be set much lower, which means that the 100y DEX will not extract the value from these transactions.Instead, it only acquires the MEV value represented by the priority fees.This setup allows the application to extract MEVs directly, thus opening up various potential use cases.

2.2.2.2 Verified?Use TEE!

The key here is to ensure that the entities responsible for block building use a prioritization mechanism.To achieve this, Unichain implemented two measures: 1) it separates the sorter and the block builder, similar to the PBS model; 2) it forces the block builder to use TEE (Trustable Execution Environment) to allow anyPeople verify that the priority mechanism is being used.

A Trusted Execution Environment (TEE) is a secure part of hardware (such as a CPU) that runs independently of the rest of the system to process sensitive data securely.TEE ensures that trusted code runs safely, even if the external environment is compromised.Highlights include TrustZone for ARM and SGX for Intel.A common example is how biometric data (such as fingerprint or facial recognition) is processed on mobile devices in TEE.

This design even prevents the operating system or programs with administrator privileges from accessing secure areas.To ensure that the code running in TEE is trustworthy, we used the authentication process.This verification ensures that TEE remains secure and untampered.For example, in Intel SGX, a hash value is generated to represent the code and data in SGX, while a hardware-managed private key proves the integrity of the code.

Unichain’s block construction process takes place in the Trusted Execution Environment (TEE) of the TEE builder.Thanks to the TEE nature, these builders can first submit a proof to the user that they are using the priority sorting block building mechanism.These combinations of features ensure that applications on Unichain can reliably extract some of the MEV revenue.

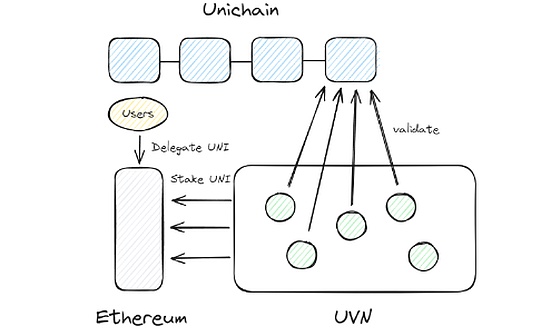

2.3 Unichain Verification Network

The Unichain Verification Network is a decentralized network composed of node operators that are responsible for verifying the latest status of Unichain and providing fast final certainty to achieve seamless cross-chain transactions through economic security.This concept is similar to AltLayer’s MACH, which uses EigenLayer to achieve fast finality, as well as Nuffle’s fast finality layer and the latest fast finality concept proposed by Symbiotic.

The Unichain Verification Network is a decentralized network composed of node operators that are responsible for verifying the latest status of Unichain and providing fast final certainty to achieve seamless cross-chain transactions through economic security.This concept is similar to AltLayer’s MACH, which uses EigenLayer to achieve fast finality, as well as Nuffle’s fast finality layer and the latest fast finality concept proposed by Symbiotic.

To be a decentralized node in Unichain, participants must stake UNI on the Ethereum mainnet.Each period, the node with the highest UNI balance is selected into the active set and participates in the verification by running the Reth Unichain client.Additionally, similar to other networks, UNI holders have the option to entrust their pledge.

3. The final thought

Uniswap has achieved a strong product market fit as a dApp, and I am very optimistic about its transition to Ethereum-based application-specific L2, especially as it seeks to expand its ecosystem.However, since liquidity fragmentation remains a challenge, the key is to observe how the Uniswap team provides a seamless cross-chain trading experience between Ethereum L1 and Unichain L2.

From an investment perspective,It is particularly interesting that UNI tokens will now be used as staking tokens for UVN.Given the strong performance of staking protocols such as EigenLayer, Symbiotic and Karak, we can expect a large number of UNIs to be pledged in UVN, which will greatly promote the value growth of UNI.

UNI has risen by about 12% after the October 10 announcement, ranking among the top 20 market caps.Given that UNI’s market cap is already high compared to other tokens, it will be interesting to observe the impact of UNI staking on its future prices.