As the exchange rate of ETH/BTC fell below 0.05 again, Ethereum once again ushered in group ridicule.

Opacity of Ethereum Foundation spending became the fuse, and the fire quickly spread toward various Ethereum FUDs.For a time, being less active than new public chains, concentration of ideology, and insufficient innovative application became the original sin of ETH. Even the personal life of V God was criticized, and users’ disappointment with price performance escalated into a systematic debate of criticism.

But looking back at Ethereum in the past year, in addition to the pledged unlimited dolls, the good story of L2 has also begun to be unable to move forward.The narrative is limited, the currency price is sluggish, and the Gas is new low. Even in the storm of ETH this year, it is almost unmoved. The reality of following the decline but not rising makes users’ dissatisfaction continue to accumulate.Could it be that Ethereum can only stand firm in the name of orthodoxy?

It’s time for Ethereum to find its own new story.

01Ethereum Foundation “Battle” Liantian

On August 23, the Ethereum Foundation address changed abnormally, transferring 35,000 ETH (94.07 million US dollars) into Kraken.For the foundation, large expenditures are quite frequent. Judging from the data, the Ethereum Foundation has sold 239,000 ETH since January 1, 2021.But a transfer that I was used to with was suddenly fermented in the market and became a whirlpool of public opinion.

The market has begun to speculate about the reasons why the Ethereum Foundation made such a huge sale, and discuss whether it will have a negative impact on ETH prices.The Ethereum Foundation also responded very quickly, and executive director Aya Miyaguchi posted a message on the X platform to respond: “This is part of the Ethereum Foundation’s fund management activity, which has an annual budget of approximately US$100 million, mainly composed of grants and wages, and some recipients can only accept fiat currency.For a long time this year, the Ethereum Foundation has been told not to engage in any funding activities because regulation is complicated and plans cannot be shared in advance at present.However, this ETH transfer transaction does not mean sales, and may be sold gradually in a planned manner in the future.”

Fortunately, the response was not responded, but it was even more severely criticized. The Ethereum Foundation, which has more than 270,000 coins, has not disclosed detailed expenditure data in the past two years, and the latest report that can be checked has remained for 21 years.The $100 million described by the executive director is obviously a huge expenditure. Where did so much money be spent?Ignas | DeFi also added another fire on X, saying that the Ethereum Foundation allocated as much as $30 million in the fourth quarter of 2023, but compared with the third quarter of 2023, the allocation was only $8.9 million, and this year’s payment isMore than three times that of last year, although the foundation supports innovative projects, it lacks a comprehensive and transparent total spending report.

Although Sundial Mirage co-founder SIGNAL and former editor-in-chief Liu Feng and other industry insiders expressed their understanding of the $100 million budget, saying that considering the foundation’s huge scale, the $100 million operating budget is still within controllable scope..SIGNAL is similar to Netflix,Netflixe, with a market value of $295 billion, offered $80 million in salary for only two executives, while Ethereum has a market value of $332 billion, slightly higher than Netflixe. In comparison, $100 million is already very cautious.However, the market still failed to cover up the fire, and doubts about “opacity” of expenditures were difficult to stop, and gradually rose from opaque to the foundation’s failure in discovering ETH value.

As the community controversy grows, the foundation finally responds. ETHGlobal member Hudson Jameson said Ethereum is currently preparing the latest spending report, which will unify the 22-year and 23-year spending statistics and will be held in November’s Devcon SEA.Release before the conference.

Hudson used charts to describe the approximate purpose of expenditure. The largest expenditure in 22 years was L1 research and development, accounting for 30.4%, including funding to external project teams and internal expenditures of Jinhui, of which 38% of the expenditures wereShare, external expenditure is 62%.Community development is also the big one, accounting for 21.8%.

In 23 years, the largest expenditure has been transformed into funding for new institutions. The “new institutions” type includes projects such as Nomic Foundation, 0xPARC, L2BEAT, etc., accounting for 36.5%.What is quite interesting is that the founder V God responded in the comment section that his personal annual salary is 182,000 Singapore dollars, which also caused heated discussion. Many supporters believe that V God, who has made great contributions with such low salary, is a real construction..

Public opinion seems to be about to turn, and doubts about the Ethereum Foundation are only the most superficial fuse. The core reason is ETH’s original sin – a disappointing price performance in recent years.

02Ethereum without new stories

Ethereum has no new stories since last year.

If we look back at the development of blockchain, in addition to Bitcoin, which is the key to value, Ethereum is truly widely promoted in its application.Computers in this world undoubtedly play their role. From the 20 years of sensational market Defi, to the 21 years of NFT and chain game hype, to the MEME fanaticism, almost every industry breaks the circle.Open critical infrastructure Ethereum.The data also proves this point. As of August 29, according to DefiLlama data, Ethereum TVL reached US$4.7 billion, accounting for 56.37% of all public chains, becoming a well-deserved leader in public chains.ETH naturally also rose all the way, from a few hundred dollars to around $2,500 today, and has firmly stood firm in the No. 2 position except BTC.

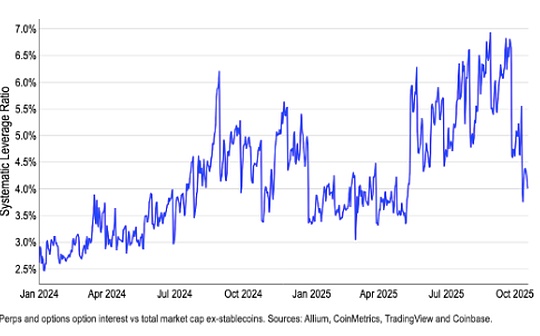

Back to the present, is there any narrative on Ethereum?Since Ethereum switched from POW to POS, technology upgrades are the main narrative, Layer2 is a concentrated hype ecosystem. After that, the internal narrative effect weakened, and ETFs became a new external narrative.But from the actual situation, no matter what kind of narrative it is, it has failed to really drive the price of the key indicator – ETH.In a strong contrast, BTC, as a value currency, is constantly strengthening.Judging from the exchange rates of the two, the degree to which ETH weakens relative to BTC can be seen from the naked eye, currently only 0.042, while a year ago, this ratio was still 0.07.

Even if it is not compared with BTC, ETH growth has begun to frequently weaken other currencies such as SOL and BNB in terms of price trends.The weakening of the currency price can indirectly reflect the decrease in activity, while the decline in Gas actually reflects the weakening of the ecosystem.According to Etherscan data, the average Gas of Ethereum is 0.758Gwei, which has reached the historical bottom. Of course, there is the role of Cancun upgrading to introduce “Blobs”, but with such a low Gas, the most intuitive presentation is the popular applications on Ethereumlack of.Data from The Block also shows that Ethereum’s monthly transaction volume has been at its lowest level in months.

This is true in realityDeFi Summer is temporarily difficult to reproduce, NFT and chain games have fallen to the bottom, and even the MEME narrative is surrounded by Solana. With the rise of Ton and Base and other ecology, the market is inevitably filled with a singular voice, and Solana surpasses Ethereum.There are endless arguments.In addition, the number of token holders ranks third, the number of monthly active users ranks seventh, and the number of transactions ranks 11, and the data does not seem to match the leading title of Ethereum.

Against this background, the discussion on the feasibility of the Ethereum system has gradually fermented, and the conversion to POS has also become a new point of controversy.Regardless of the in-depth discussion of security,onlyThe complexity of protocols, development directions, MEV and Flashbot, and governance brought about by expansion requirements have been formed layer by layer, forming inseparable dark clouds covering the top of Ethereum’s building, further increasingEthereum’s vulnerability.

Discussions about Ethereum by industry insiders on X, source @NPC_Leo

Taking Rollup, a technical path that now accounts for 87% of all daily transactions, as an example, under this expansion plan, Gas fees have been successfully cut significantly, but the inflation avoided through mechanisms has reappeared.Some analysts believe that Rollup as the center can promote L2 to absorb the Ethereum space and bring traffic and expenses in the long run. However, in actual use, L2 may develop a unique ecosystem and split it into independent chains to reduce the pair of L2.Ethereum expense contribution.

It is hard to deny that most Ethereum L2 currently prefers to choose commercial narrative-level pledged leveraged dolls, and the shared components are introduced into the layer3 application chain.Even if you don’t choose this path, the L2 narrative is becoming less popular, the dividends of technology upgrades are decreasing, and the on-chain data is less than expected. ZKS and Blast also performed poorly after the tokens were released.

Against this background, the market’s dissatisfaction with Ethereum gradually accumulates, and finally the foundation explodes.Zhu Su, founder of Sanjiang Capital, admitted that the problem with the Ethereum Foundation is not to sell off when the tokens are not yet value-determined. They are born dumpers, and the biggest problem is that they are currently unable to provide a coherent roadmap and effective leadership for the ecosystem.

Web3 Venture Capital @LordWilliamUK is more radical, listing six crimes from the Ethereum Foundation, saying that the fund’s parliamentaryization is hunted by funds, scientific research on paper rather than actual innovation, opaque expenditure, ignoring application scenarios to maintain orthodoxy, and losing projects with high-quality potentialAnd iteration is slow.

Some people have even risen to V God, hoping that they will pay more attention to the price of currency and ecological construction rather than emotional life. V God is also quite interesting and directly throws out the codes written in the past two months to respond.

03No price, what’s the difference between salted fish

However, in response to various problems with Ethereum, the founder of this idealism seems to be quite optimistic, and has issued more than once a call for “the team is doing things, and the price of the currency is left to fate.” Or it is to release the biggest dilemma of Ethereum is “over-financial attributes”.”The remarks caused controversy, and just recently, he was besieged by everyone for expressing his dislike and criticism of DeFi.In response, some industry insiders joked, “If there was no DeFi, the price of Ethereum might still be at $400.”

Is Ethereum really not working?There are many different opinions on this issue.It cannot be denied that Ethereum is an extremely powerful community, and assets related to ETH are still an important basic market in the entire market.ETH is also the only currency recognized and successfully included in ETFs except BTC. Even in the mainstream world, Ethereum has been looked up to the top.In the waves of fierce new “Ethereum Killer” public chains, standing still proves the solid foundation of Ethereum’s development, and its builders have always adhered to the belief of long-term cultivation and paid attention to the practicality of technologyand convey values.

However, with the continuous evolution, Ethereum has entered a mature and steady medium-term development from its early geeky stage, with its growth rate gradually slowing down.When Ethereum is developing rapidly, any problem can be solved with focused technology, but when development starts to slow down and problems surface, small spikes will occasionally tease the sensitive hearts of users.

Especially in the current market with limited liquidity, finding new stories and new applications has become more important, even Ethereum is no exception.My friend Ono mentioned before, “No need to change. Even if you don’t need the so-called layer2, BTC can obtain the liquidity spillover of the US dollar. However, all coins other than BTC must grow. Only by growing can they grow.Get new liquidity, once it stops growing, it will slowly fall behind….. It is true that the poor performance of ETH ETF since its launch, and institutions have a slightly negative view of Ethereum, which can also be indirectlyTo confirm this.

Back in September 2018, V God was forced to ask about his views on the plunge in the ETH price during the Industry Summit. At that time, he mentioned that the price was not that important and said helplessly, “Don’t ask price questions anymore.” The follow-up updateThe question ended with “if ETH has no future, other digital currencies will be the same.”

I believe that he may still answer this answer four years later, but is the result really the case?The orthodoxy of Ethereum implies a promise that needs to be fulfilled: the project party hopes to obtain Ethereum’s technology and traffic and get a pie; users hope that ETH can always rise and meet their expectations for growth; and all this requires EthereumIt must always be on the road. Without actual benefits, the two trees may not have been dispersed.

Recently, Matrixport trader “Miner Zhaobei” wrote an article on the official account that it operates a strategic fund “Liuyuan”, which has stable unilateral risk control. Due to the one-way free fall of ETH, the entire fund was erased in just one week.After the increase in the entire bull market, “It’s time to date, the net value is gone and the position is still there.”Although most of the comments are joking about “It’s all the blame for Xiao V, not the teacher”, it can also give a glimpse of users’ narrow views on Ethereum.

Perhaps V God is wrong, the price is very important. After all, in the most money-friendly currency circle, there is no price. What is the difference between it and salted fish?