On July 30, Eastern Time, a document that was highly anticipated by the crypto industry is about to be released – the White House’s first digital asset policy report.It is not only the first systematic expression of the Trump administration’s stance on cryptocurrency regulation, but it is also considered a roadmap for industry development in the coming years.

This upcoming report stands out in a number of legislative progress and regulatory games, and its impact may far exceed the regulation itself.

The “top-level design” created by executive order: Starting from Order 14178

In January this year, U.S. President Trump signed Executive Order No. 14178, formally demanding the establishment of the “President Digital Assets Working Group” led by the Secretary of the Treasury.The group includes many core regulators such as the SEC Chairman and the Minister of Commerce. Its mission is to comprehensively evaluate the development trend of digital assets and put forward targeted policy recommendations.

Now, after 180 days of preparation, this major report is finally coming soon.Bo Hines, executive director of crypto affairs at the White House, has confirmed on social media that it will be officially announced on July 30, saying that “the United States is leading the global digital asset policy trend.”

Now, after 180 days of preparation, this major report is finally coming soon.Bo Hines, executive director of crypto affairs at the White House, has confirmed on social media that it will be officially announced on July 30, saying that “the United States is leading the global digital asset policy trend.”

The timing of the report is also quite subtle – key legislation such as the GENIUS Act and the CLARITY Act are making substantial breakthroughs, and the dual advancement of executive orders and legislation has sent a strong policy signal: the United States no longer waits for and sees digital asset governance, but is involved in full.

The core of industry concern: the “clear-text era” of regulation is coming

After years of vague regulatory competition and bulls, the industry’s most urgent expectations for this report are focused on “clearity” and “sense of boundaries”.

Cody Carbone, CEO of the American Digital Chamber of Commerce, bluntly stated: This will be “a programmatic document for all relevant regulations and guidance in the next three and a half years.”

Judging from the existing information, the report is expected to focus on the following four major areas:

1. Stablecoin regulatory framework

The report may propose institutional designs on the issuance threshold, reserve mechanism and audit transparency of the US dollar-pegged stablecoins, laying the foundation for the stablecoin ecosystem with an ever-expanding market size.

2. Bank access and cooperation mechanism

Focusing on the issue of “legal identity” of crypto companies in bank accounts, payment channels, etc., the report is expected to propose policy ideas for integration with traditional finance, and at the same time strengthen risk isolation.

3. Enter the national security perspective

In response to the potential problems of digital assets in cross-border transactions, sanctions avoidance and money laundering risks, the report will emphasize the construction of “compliance technology” and promote the connection between technical means and regulatory needs.

4. Technical neutrality and regulatory boundary demarcation

“Supervision by function rather than technical” may become the main tone of the report, clarifying the functional boundaries of various regulatory agencies, and solving the “multiple management” and “regulatory gaps” that have plagued the industry for many years.

Cody Carbone pointed out that if the bottom line of “can be done and cannot be done” can be clarified, it will greatly enhance the industry’s confidence.

Mystery of holding positions: How much BTC does the US government hold?

In addition to the regulatory blueprint, another highly-watched part of the report is the first official disclosure of the U.S. government’s crypto asset holdings.

For many years, the claim that “the US government holds the most Bitcoin in the world” has been widely circulated on the Internet.According to the platform BitcoinTreasuries estimates, the US government’s holdings are about 198,000 BTC, far exceeding other countries.

However, independent journalist L0la L33tz recently applied for holding data from the Ministry of Justice through the Freedom of Information Act (FOIA), but the results showed that there are only 28,988 bitcoins under the name of the Ministry of Justice.This number is far lower than market expectations, causing the question of “Has nearly 170,000 Bitcoins been sold?”

However, independent journalist L0la L33tz recently applied for holding data from the Ministry of Justice through the Freedom of Information Act (FOIA), but the results showed that there are only 28,988 bitcoins under the name of the Ministry of Justice.This number is far lower than market expectations, causing the question of “Has nearly 170,000 Bitcoins been sold?”

The more neutral explanation comes from community user Shifu Dumo.He believes that the FOIA data only reflects the current realizable portion of the U.S. Marshals (USMS), a subsidiary of the Justice Department.Some assets may have been frozen, used to compensate victims or held by other agencies and are not included in the Department of Justice’s statements.

However, this also means that the amount of Bitcoin that truly belongs to the US federal government and can be used for the “national strategic reserves” may be far lower than the outside world imagined.

Crypto commentator “The ₿itcoin Therapist” asked Bo Hines, executive director of crypto affairs on social media: “How much bitcoin is held by the U.S. government? Isn’t this important to reveal it?” This sentence fully expresses the community’s desire for transparency.

This upcoming White House report is expected to reveal the true situation of the U.S. government in bitcoin holdings and give an official explanation of these “disappearing” bitcoins, thus answering long-standing questions from the market.

Industry reaction: Signals of entering the “adoption period”

The industry has generally received positive responses to this upcoming report.Summer Mersinger, CEO of the Blockchain Association, believes that it marks the entry of the crypto executive order into a substantial implementation stage.

Wintermute policy director Ron Hammond viewed the report as an “important step in Trump’s fulfillment of his commitment to the crypto industry.”

In the view of Jordi Visser, managing director of 22V Research, we are at the turning point of the crypto industry moving from “trying” to “acceptance and adoption”.He likens the current stage to the “ChatGPT moment in the crypto world”.

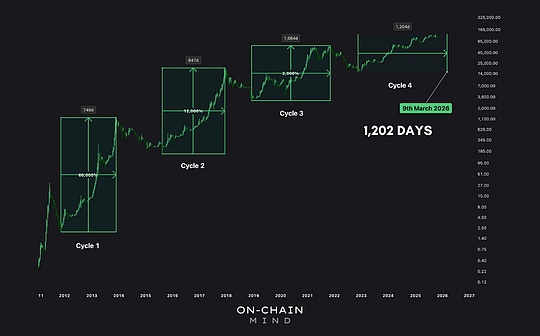

With the clear regulatory expectations and the pace of institutional entry speeding up, Bitcoin price rebounded strongly recently, once exceeding the $120,000 mark.As of press time, it is still stable at more than US$117,000, with a total market value of US$3.85 trillion.

This report is not only a systematic presentation of the Trump administration’s crypto policy, but also an important “moment” in the global crypto market.How will it find a balance between encouraging innovation and preventing risks?Can it also solve the trust gap in US strategic holdings?These answers are about to be revealed.