Author:NDV

The NDV research team recently conducted a systematic analysis of the price relationship between Bitcoin (BTC) and gold (XAU).The reason for focusing on this topic is that these two types of assets are often regarded by the market as “stores of value” and “hedging tools”: gold, as a traditional safe-haven asset, has been a “safe haven” for global investors for decades; while BTC is called “digital gold” by an increasing number of investors and has gained a new status in the context of rising macro uncertainty.

The starting point of the research is: in a portfolio with a high Crypto weight, how to balance volatility and improve the Sharpe Ratio (Sharpe Ratio, which measures the level of return under unit risk) by allocating gold and BTC.

In other words, are the two substitutes or complementary?

After analyzing the data and market mechanisms of the past four years, the conclusion is:

·In most scenarios, BTC and gold show a “conditional complementarity” relationship: they have the same general direction, but they have obvious differences in risk budget and volatility performance, and they complement each other;

·Under a few extreme narratives, gold has the attribute of “phased substitution”: when liquidity tightens, geopolitical conflicts or financial system risks are exposed, gold’s hedging function is significantly better than BTC, and it can partially replace its allocation;

·In terms of asset allocation logic, they should be regarded as “anti-fragile pairings across mechanisms”: gold relies on central bank reserves and institutional endorsement, while BTC is driven by the total cap and halving mechanism.The two come from completely different systems, but because of this, they often complement each other in different market environments.By regularly rebalancing between the two (making adjustments when trends diverge), investors can better diversify risk and achieve more stable, risk-adjusted returns over the long term.

The following is a detailed analysis.

1. Long-term perspective: BTC and gold trends are highly consistent

From 2021 to now, the trends of BTC and gold have been highly consistent, indicating that macro liquidity and monetary policy are the common drivers of both.

The stage of rising and falling simultaneously

Led by macro policies and market risk sentiment, Bitcoin and gold often rise or fall simultaneously, such as:

End of 2022 to early 2023: Inflation peaks + interest rate hike slows → BTC and gold both rebound;

March 2023 Banking Crisis: Safe-haven demand rises → Gold rises, while BTC also rises, benefiting from the “decentralization” narrative;

Q1 2024: The Fed switches to interest rate cut expectations + BTC ETF is approved → Gold approaches a record high, BTC breaks through a record high.

stage of differentiation and divergence

When the market becomes dominated by “respective narratives”, the prices of Bitcoin and gold will diverge, such as:

Gold is strong, BTC is weak: Spring and summer of 2021: Gold strengthens due to inflation concerns, and Bitcoin plummets due to Chinese regulations and Musk’s remarks; From the end of 2021 to the beginning of 2022: Geographical conflicts push up gold, but BTC weakens due to the Fed’s tightening and the correction of technology stocks; In the first quarter of 2025, trade frictions and conflicts in the Middle East → Gold exceeded $3,000, while BTC entered a high correction after “good news cashing in”.

BTC is strong, gold is weak: At the end of 2024, Trump wins + ETF capital inflow → BTC rises independently, gold trades sideways.

Therefore,Statistically, BTC is highly consistent with gold in its long-term direction, but behaves independently in the short-term.This is why it can bring additional revenue streams.

2. Why BTC’s yield is higher than gold

Although BTC and gold are highly correlated in terms of long-term price trends,From a return perspective, BTC has more advantages.We think there are mainly the following reasons:

1. Comparison of asset attributes: same narrative, different functions

Common ground (narrative level):

·Scarcity: Gold is supported by natural scarcity and high mining costs, while BTC is supported by a total cap (fixed at 21 million) and a halving mechanism (continuously increasing scarcity);

·Transaction and settlement: Gold has strong physical properties, long settlement chain but mature system adaptation; programmable settlement on the BTC chain, high cross-border efficiency and trustlessness, but there is a separation between on-chain and offline liquidity;

·Volatility and risk budget: Gold’s annualized volatility is roughly stable in the mid-to-low range over the long term (historical average is about 15%, data source: State Street Global Advisors); in extreme periods of the market, its pressure is relatively low.In contrast, Bitcoin’s volatility is much higher than that of traditional assets (historically common ranges are 50%–80%, and extreme cases even exceed 100%, data sources: WisdomTree, The Block), so it is more like a high-beta risk asset;

·System adoption path: Gold is a global central bank reserve asset with strong institutional anchoring; BTC is in the process of institutionalization (ETF listing, compliance custody, institutional allocation), but will still be subject to regulatory disturbances in the short term.

Summary: In terms of the narrative of “inflation hedging” and “value storage”, BTC and gold have certain substitutability; however, in terms of risk budgeting, system adoption and settlement functions, the two are significantly different, so they show complementarity.

Fund flow differences:The incremental buying of gold mainly comes from the central bank and some hedging positions, and the increase is limited; while the new funds of BTC are more explosive, covering ETF capital inflows, institutional allocations, and retail investor participation (data source: CME Group, CoinShares flow report).

Historical performance confirms:Over the past decade, gold’s annualized return has been approximately 4%–5% (in USD, not adjusted for inflation, data source: StatMuse); while BTC’s long-term annualized return has been significantly higher.

Technical verification:systemThe statistical test shows that the correlation between the yield and volatility of BTC and gold is close to zero (modeling methods such as DCC-GARCH and Granger did not show significance, data source: NDV internal model), indicating that the excess return of BTC is independent of gold, and gold cannot provide the same high elasticity.

Therefore, in most cases, when the two go in the same direction, directly holding BTC can obtain higher risk compensation and excess returns; while the value of gold is more reflected in extreme risk environments as a defensive supplement to the portfolio.

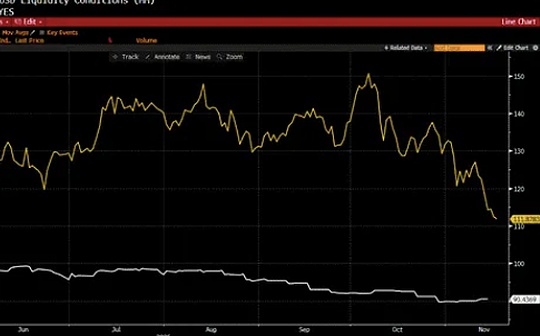

[Explanation of technical analysis chart]

Return Correlation: Statistical tests show no significant correlation between BTC and gold’s daily returns.This shows that the short-term fluctuations of the two are not linked, and the rise and fall of BTC are more driven by its own market events.

Volatility correlation: Through DCC-GARCH dynamic correlation modeling, it is found that the conditional correlation coefficient between the two is lower than 0.1 most of the time, which means that the volatilities are almost independent and the linkage effect between assets is low.

Causality test: The results of the Granger causality test show that there is no significance between BTC and gold in the analysis of the 1-10 day lag period, which means that neither of them shows a lead in each other’s return changes, and the price trend of one asset cannot be used to better predict the future price trend of the other asset.

3. Medium-term perspective: Holding gold is more effective than US dollar cash

In the current macro environment, the hedging effect of gold is more prominent than that of US dollar cash..The reason is that the U.S. fiscal deficit continues to expand, the safe-haven status of national debt and the U.S. dollar has been weakened, and even institutional investors who have long supported U.S. dollar assets have begun to reassess their allocations.At the same time, inflation remains high and market expectations for future interest rate cuts continue to exist, which means that real interest rates are constantly falling. Holding cash not only has no interest advantage, but also faces the risk of erosion of purchasing power.In contrast, gold, as a physical asset with “no counterparty risk”, does not rely on any credit endorsement. In the context of frequent geopolitical conflicts and trade frictions, its demand for hedging has increased significantly.Looking back at history, whether it was the stagflation period in the 1970s or the repeated escalation of the inflation cycle in recent years, gold has demonstrated better value preservation capabilities than cash.

Therefore, we believe that gold is a more effective defensive asset than USD cash in the medium term.

4. Configuration inspiration

Combined with our analysis, we can draw three levels of configuration ideas:

First of all, under normal circumstances, BTC is still the core position of the portfolio because it has higher elasticity and growth potential, keeping pace with gold in the general direction, but the increase is usually more considerable.

Secondly, in extreme risk environments, for example, when global liquidity suddenly tightens, geopolitical conflicts escalate, or uncertainty arises in the financial system, the defensive properties of gold will be significantly better than BTC.During these stages,Moderately increasing gold positions and replacing part of BTC can help the portfolio reduce drawdowns and enhance stability.

Finally, looking more broadly, under the current macro backdrop, gold can play a more effective hedging role than US dollar cash.Rather than passively holding cash and waiting for depreciation, it is better to achieve defense and preservation of value through gold allocation.This dynamic allocation idea is a manifestation of our continuous improvement of investment framework and optimization of risk and return structure.

5. Conclusion

The relationship between BTC and gold is essentiallySame frequency in the long term, differentiation in the short term.

We firmly believe that BTC is still the core asset of the portfolio, carrying higher growth and flexibility; while gold shows unique defensive value in extreme risk environments andBetter than cash as a hedging tool.The two are not substitutes, but complementary.This dynamic allocation idea allows us to capture growth while ensuring that the portfolio remains robust in an uncertain macro environment.

What’s more,We have a strong belief in the long-term value of BTC.Historically, BTC has experienced wild cyclical swings, but long-term returns have significantly outperformed any traditional asset.If BTC rises another 10 times in the next ten years,We are confident that through active management strategies, we can grasp the cycle, capture fluctuations, and continue to create α on top of β, so that the overall performance of the fund will be significantly better than simply holding BTC.

The value of gold lies in supplementation and defense, while the value of Bitcoin lies in long-term growth.For us, the direction is clear:BTC Outperforms Gold and NDV Fund Aims to Outperform BTC.Through rigorous risk control, flexible allocation and in-depth research, we not only follow the rising cycle of this generation of digital assets, but also strive to continue to deliver long-term returns for investors that exceed the assets themselves.