On November 25, the global market received a shot in the arm.Investors who were still worried about a rebound in inflation and another tightening of policy suddenly found that the wind direction had changed – and it was completely dovish.

Two key figures speak out: Is the interest rate cut in December basically confirmed?

First, Fed Governor Waller publicly stated that he supports an interest rate cut at the December interest rate meeting.He acknowledged that inflation has picked up slightly recently, but stressed that he “still expects inflation to fall again.”

More importantly, he mentioned that January next year will be a critical node, and a large amount of economic data will determine whether the Federal Reserve needs to continue to cut interest rates.

Immediately afterwards, Daly, chairman of the San Francisco Federal Reserve Bank and 2027 FOMC voting member, also stood up and stated: “I support an interest rate cut in December.”She believes that the risk of a sudden deterioration in the job market is far greater than the risk of another surge in inflation, and once a deterioration in employment occurs, it will be more difficult to deal with than high inflation.

When two key figures within the Federal Reserve released dovish signals on the same day, the market immediately chose to believe it.

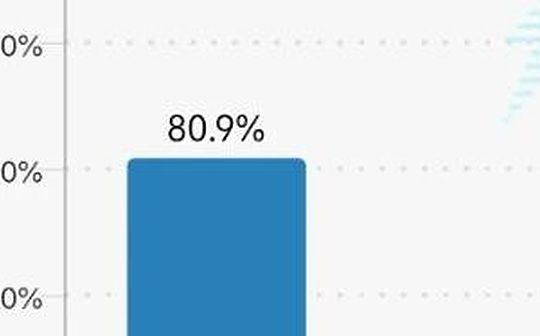

CME: The probability of a rate cut in December soars to 80.9%

The market has begun to regard an interest rate cut in December as the “default option.”This is a completely different market expectation structure than the one in the third quarter of this year where “it still depends on whether to cut interest rates.”

U.S. stocks took off immediately, with technology stocks leading the gains

After expectations of interest rate cuts were ignited, all three major U.S. stock indexes closed higher on Monday:The Dow +0.44%, the S&P 500 +1.5%, and the Nasdaq +2.69%.

The strength of the Nasdaq shows that the market has brought out liquidity trading again – technology stocks, growth stocks, and long-term assets have all benefited.

The market logic is simple:

Interest rate cut → lower cost of capital

Declining capital costs → Less pressure on technology valuations

Technology valuations are under less pressure → Nasdaq welcomes “blood recovery”

The good link is very smooth.

Bitcoin Can’t Hold It: Approaching $90,000 Again

Stimulated by the expected loosening of liquidity, Bitcoin also experienced a strong surge, briefly exceeding US$89,000. As of press time, it was trading at US$88,337.13, a 24-hour increase of 1.64%.

Bitcoin has historically responded to such macro expectations more quickly than traditional assets because:BTC is the purest macro-expected trading target. It is extremely sensitive to changes in liquidity and market sentiment responds faster than U.S. stocks. When interest rate cuts become a high-probability event, BTC often moves ahead of schedule.

Why did the Fed suddenly turn dovish?

The main reason is very clear:

The job market has begun to soften, with hiring numbers declining and layoffs re-emerging in some industries.

Although inflation has rebounded, the overall trend is still downwardCore inflation and service inflation are both within controllable ranges.

The risk of over-tightening has outweighed the risk of inflation, and it would be more costly to wait until employment deteriorates before cutting interest rates.

Economic pressure begins to emerge in 2025

As corporate financing needs decline and consumption momentum weakens, the Federal Reserve needs to pave the way in advance.

Simply put, the Fed is now more afraid of a “hard landing.”

If the Fed officially cuts interest rates in December:

U.S. stocks have the opportunity to continue their rebound, technology stocks will become the first choice for funds, U.S. bond yields will further decline, and the Bitcoin and crypto markets may usher in a major wave of gains. Especially in the context of a rebound in risk appetite, crypto assets tend to rise faster than traditional assets.

However, we still need to be wary of the data-intensive period in January next year.If the data is not as good as expected, the Fed’s dovish attitude may be revised again.