Author: Silvio; Source: X, @SilvioBusonero; Compiler: Shaw Bitcoin Vision

L1 token valuation is a comprehensive reflection of multiple factors:Meme effect, fees, security and its on-chain applications.The least understood among them is the so-called“Currency Premium”:

The currency premium exists because of demand generated by market participants using the asset as a store of value or medium of exchange.

Store of value is directly tied to the liquidity and decentralization of assets, so it is not really a viable go-to-market strategy.

On the other hand, it might be easier to be a medium of exchange.Tokens can serve as a way of exchanging and measuring value in the blockchain economy.

This is the same role that tokens play in the Web 2.0 economy:

Robux is Roblox’s in-game token and has a high exchange value.

When meme coins became popular, people purchased SOL to participate in meme transactions.Since SOL is the default currency on the Pump.fun platform, most traders do not switch back to USD but keep some SOL for emergencies.A similar situation occurred in Ethereum during the NFT craze in 2021.A large number of users began to use native assets to trade, which effectively created the utility of a medium of exchange (MoE).

But does this premium still exist?

noThis premium is quickly disappearing.Users are increasingly inclined to use stablecoins for transactions.

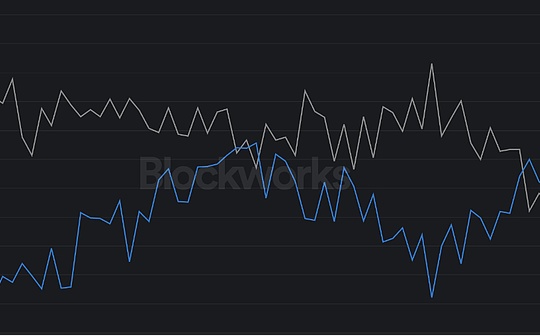

Ethereum: Stablecoins have become a medium of exchange

On-chain transaction volume for top tokens, Ethereum is no longer the primary medium of exchange it once was.

Ethereum’s (ETH) dominance as a medium of exchange has declined, while USDC and USDT are rising in popularity on trading volume charts and top pools like Uniswap.

For L2 platforms like Arbitrum, the story is much the same:

Solana: SOL has a clear advantage, but USDC follows closely behind

USDC is catching up with the new Launchpad making it the default pairing.

SOL remains the primary medium of exchange on Solana and the most traded asset (but USDC is quickly approaching).This is because Pump.fun and Raydium prefer to use SOL as the trading currency, while other platforms have a different attitude (e.g. Meteora).Emerging platforms like MetaDAO are setting USDC as the default trading pair.

BNB and USDT go head-to-head

In 2021-2022, BNB was absolutely dominant as a medium of exchange, but then USDT gained market share and surpassed BNB.

The market chooses the medium of exchange, and stablecoins are the first choice

There is no so-called legal currency on the chain.

Some products adopt a “quoted asset” strategy, using their own tokens as the medium of exchange, such as Zora and Virtuals.In practice, this will increase transaction fees for users and projects, but will have a minimal impact on the price of the token itself.Ecosystem tokens could try a similar strategy through asset issuance platforms that quote specific tokens, but this may not be cost-effective.

User experience and liquidity in on-chain markets are constantly improving, and currency premiums in the past were also caused by a lack of choice and illiquidity.The next billion users will use the same medium of exchange as in real life(such as USDC, EUR, etc.).