Author: Ana Paula Pereira, Cointelegraph; Compilation: White Water, Bit Chain Vision Realm

A newly proposed by the Brazilian Parliament plans to establish a federal Bitcoin reserve with sovereignty, which may reshape the country’s attitude towards digital assets.

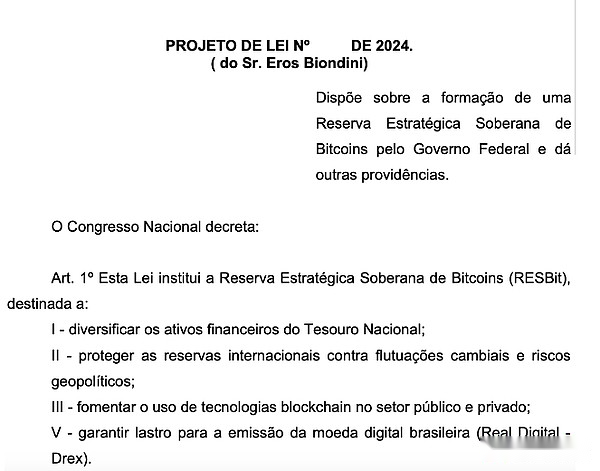

The bill was proposed by Congress Eros Biondini on November 25 that it aims to establish a sovereign strategic Bitcoin reserve called ResBit.

According to the legislation,Bitcoin reserves can protect the country’s sovereign reserves from the impact of currency fluctuations and geopolitical risks. At the same time, it can also be used as a mortgage of the country’s forthcoming central bank digital currency “Real Digital” (DREX).

Sovereign reserve is an asset pool held by a national central bank, which is usually used to support the country’s legal currency, stabilize the economy and support international trade.As of December 2023, Brazil has a reserve of $ 355 billion, which is mainly supported by assets linked to the global legal currency such as the US dollar.

According to the proposed legislation, Bitcoin reserves will purchase supplementary existing financial assets through stages, which can reach up to 5%of the country’s reserves.With the support of the technical consulting committee composed of security experts, the central bank of the country will still manage assets through public systems supported by blockchain and artificial intelligence technology.

Brazil’s ResBit Act.Source: House of Representatives

The bill shifted Salvador to Bitcoin as an example of progress.In 2021, this Chinese American country listed Bitcoin and the US dollar as a legal currency, seeking enhanced financial inclusiveness and encouraging foreign investment.

Since then, the El Salvador administration has been actively buying Bitcoin. As of November 26, the Salvador administration held nearly 6,000 bitcoin at $ 542 million.

According to the draft law proposed by Brazil, Bitcoin has helped Salvador to achieve economic diversification in the past four years.

The bill also includes penalties for Rybit’s violations or poor management, pointing out that offenders may face administrative or criminal sanctions.

The legislation is currently being reviewed by the Speaker of the House of Representatives of Brazil. Once approved, it will be submitted to various committees for debate.

Brazil has been advancing the guidance of digital assets.In June 2023, the country implemented a legal framework to award the power of the central bank to supervise and supervise virtual asset service providers.In addition, tokens that are qualified to be securities continue to be supervised by the State’s Securities and Exchange Commission.