Author: Jiawei @IOSG

In the mid-to-late 1990s, Internet investment focused on infrastructure.At that time, the capital market was almost entirely betting on fiber optic networks, ISP service providers, CDNs, and server and router manufacturers.Cisco’s stock price soared, and by 2000 its market value exceeded US$500 billion, making it one of the world’s most valuable companies; fiber optic equipment manufacturers such as Nortel and Lucent also became popular, attracting tens of billions of dollars in financing.

Under this boom, the United States added millions of kilometers of optical fiber cables between 1996 and 2001, and the construction scale far exceeded the actual demand at the time.The result was severe overcapacity around 2000 – transcontinental bandwidth prices fell by more than 90% in just a few years, and the marginal cost of accessing the Internet approached almost zero.

Although this round of infrastructure boom allowed the later-born Google and Facebook to take root on cheap and ubiquitous networks, it also brought pain to the enthusiastic investors at the time: the valuation bubble of the infrastructure quickly burst, and the market value of star companies such as Cisco shrank by more than 70% in a few years.

Does it sound similar to Crypto in the past two years?

1. Might the era of infrastructure come to an end?

Block space changes from scarcity to abundance

The expansion of block space and the exploration of the “three impossible aspects” of blockchain have generally occupied the theme of the early development of the encryption industry for several years, so it is suitable to be mentioned as an iconic element.

▲ Source: EtherScan

In the early stages, the throughput of the public chain is extremely limited, and block space is a scarce resource.Taking Ethereum as an example, during DeFi Summer, when various on-chain activities are superimposed, the single cost of DEX interaction is often US$20-50, and the transaction cost reaches hundreds of US dollars during extreme congestion.In the NFT era, market demand and calls for expansion have reached their peak.

The composability of Ethereum is one of its major advantages, but it overall increases the complexity and gas consumption of a single call, and the limited block capacity will be occupied first by high-value transactions.As investors, we often talk about L1’s fees and burning mechanism, and we also use this as an anchor for L1’s valuation.During this period of time, the market priced infrastructure at a very high price, and the so-called “fat protocols and thin applications” argument that infrastructure can capture most of the value was recognized, which triggered a construction boom and even a bubble in a series of expansion plans.

▲ Source: L2Beats

Judging from the results, key upgrades of Ethereum (such as EIP‑4844) migrate the data availability of L2 from expensive calldata to lower-cost blobs, causing the unit cost of L2 to drop significantly.Mainstream L2 transaction fees have generally dropped to the order of several cents.Modularity andThe launch of the Rollup-as-a-Service solution has also significantly reduced the marginal cost of block space.Various Alt-L1s supporting different virtual machines have also emerged.The result is that block space changes from a single scarce asset to a highly fungible commodity.

The above figure shows the changes in the costs of various L2 on-chains in the past few years.It can be seen that from 2023 to early 2024, Calldata accounted for the main cost, and the single-day cost was even close to 4 million US dollars.Then in mid-2024, the introduction of EIP-4844 caused Blobs to gradually replace Calldata as the dominant cost, and the overall on-chain cost dropped significantly.After entering 25 years, overall expenses tend to be lower.

In this way, more and more applications can directly put the core logic on the chain, instead of adopting a complex architecture that is processed off-chain and then uploaded to the chain.

From this point on, we see value capture begin to migrate from the underlying infrastructure to the application and distribution layer that can directly accept traffic, improve conversion, and form a closed loop of cash flow.

Evolution of income level

Following the discussion in the last paragraph of the previous chapter, we can intuitively verify this point of view at the income level.A cycle dominated by infrastructure narrativesHere, the market’s valuation of the L1/L2 protocol is mainly based on its technical strength, ecological potential and network effect expectations, which is the so-called “protocol premium”.Token value capture models are often indirect (such as through network staking, governance rights, and vague expectations of counterparty fees).

The value capture of applications is more direct: generating verifiable on-chain income through fees, subscription fees, service fees, etc.These revenues can be directly used for token repurchase and destruction, dividend distribution, or reinvested in growth, forming a tight feedback loop.The application’s revenue source becomes solid – coming more from actual service rate revenue rather than token incentives or market narratives.

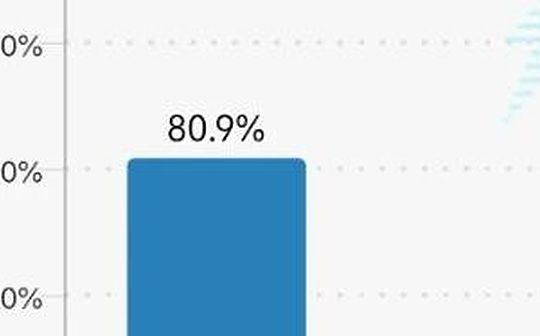

▲ Source: Dune@reallario

The chart above provides a rough comparison of revenue from protocols (red) and applications (green) in 2020 so far.We can see the value captured by applications gradually rising and reaching a level of approximately 80% this year.The following table lists the 30-day protocol revenue ranking calculated by TokenTerminal. Among the 20 projects, L1/L2 only accounts for 20%.Particularly prominent are applications such as stablecoins, DeFi, wallets and trading tools.

▲ Source: ASXN

In addition, due to the market reaction brought about by buybacks, the correlation between the price performance of application tokens and their revenue data is gradually increasing.

Hyperliquid’s daily repurchase scale is approximately US$4 million, providing significant support for the token price.Buybacks are considered one of the important factors driving price rebounds.This shows that the market is beginning to directly link protocol revenue and repurchase behavior to token value, rather than just relying on emotions or narratives.And the author predicts that this trend will continue to strengthen.

2. Embrace the new cycle where applications are the main theme

The Golden Age of Asian Developers

▲ Source: Electric Capital

▲ Source: Electric Capital

Electric Capital’s 2024 developer report shows that blockchain developers in Asia account for 32% for the first time, surpassing North America to become the world’s largest developer gathering place.

In the past ten years, global products such as TikTok, Temu, and DeepSeek have proven the outstanding capabilities of the Chinese team in engineering, products, growth, and operations.Asian teams, especially Chinese teams, have a strong iteration rhythm, can quickly verify needs, and achieve overseas expansion through localization and growth strategies.Crypto is also highly consistent with these characteristics: it needs to iterate and adjust quickly to adapt to market trends; it must serve global users, cross-language communities, and multi-market regulation at the same time.

Therefore,Asian developers, especially Chinese teams, have structural advantages in the Crypto application cycle: They have strong engineering capabilities, sensitivity to market speculation cycles, and strong execution capabilities.

Against this background, Asian developers have a natural advantage in that they can deliver globally competitive Crypto applications faster.What we saw this cycle like Rabby Wallet, gmgn.ai, Pendle, etc. are the representatives of Asian teams on the global stage.

It is expected that we will soon see this change in the future: that is, the market trend will shift from being dominated by the American narrative in the past to a new path of launching products in Asia first and then expanding into the European and American markets.Asian teams and markets will have more say in the application cycle.

Primary market investment under the application cycle

Here are some views on primary market investment:

-

PMF still has the best PMF for trading, asset issuance and financial applications, and it is almost the only product that can go through the bear.The corresponding ones are perp such as Hyperliquid, Launchpad such as Pump.fun, and products such as Ethena.The latter packages funding rate arbitrage into a product that can be understood and used by a wider user group.

-

If there is greater uncertainty about investment in a subdivided track, you can consider investing in the beta of the track and think about what projects will benefit from the development of the track.A typical example is the prediction market – there are about 97 public prediction market projects on the market, and Polymarket and Kalshi are the obvious winners. At this time, the probability of betting on a long-tail project and overshooting is very low.Investing in tool projects that predict the market, such as aggregators, chip analysis tools, etc., is more certain and can reap dividends from the development of the track.⼼A difficult multiple-choice question becomes a single-choice question.

-

After having the product, the next step is to make these applications truly accessible to the public.In addition to common portals such as Social Login provided by Privy and others, the author believes that the integrated transaction front-end and mobile terminal are also very important.In the application cycle, whether it is perp or prediction market, the mobile terminal will be the most natural contact scenario for users. Whether it is the user’s first deposit or daily high-frequency operations, the experience on the mobile terminal will be smoother.

The value of the aggregation front-end lies in the distribution of traffic.Distribution channels directly determine user conversion efficiency and project cash flow.

Wallets are also an important part of this logic.

The author believes that the wallet is no longer a simple asset management tool, but has a positioning similar to a Web2 browser.The wallet directly captures the order flow and distributes the order flow to block builders and searchers to monetize the flow; at the same time, the wallet is also a distribution channel. Through the built-in cross-chain bridge and built-in DEX, it is connected to third-party services such as Staking, becoming a direct entry point for users to contact other applications.In this sense, the wallet controls the order flow and traffic distribution rights, and is the first point of entry for user relationships.

-

Regarding the infrastructure throughout the cycle, I believe that some public chains created out of thin air have lost their meaning; while the infrastructure that provides basic services around applications can still capture value.A few specific points are listed below:

-

Provide customized multi-chain deployment and application chain infrastructure for applications, such as VOID;

-

Companies that provide user Onboarding (covering login, wallet, deposit and withdrawal, deposit and withdrawal, etc.) services, such as Privy, Fun.xyz; this can also cover wallet and payment layer (fiat-on/off ramps, SDK, MPC hosting, etc.)

-

Cross-chain bridge: As the multi-chain world becomes a reality, the influx of application traffic will urgently require secure and compliant cross-chain bridges.