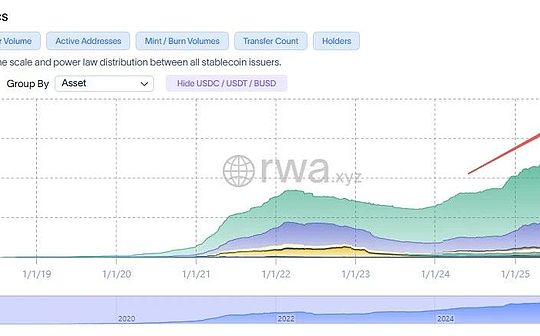

In the third quarter of 2025, the stablecoin market suddenly poured in 45.6 billion US dollars!

What’s the meaning?

The circulation of stablecoins is the currency issuance volume in the currency circle!

Second, it was only 10.8 billion in Q1, so it rose by 324% month-on-month!

01Major stablecoins performance

Let’s take a look at which stablecoins have been making efforts in the past period:

Old stablecoins

Big Brother USDT: It’s still the tough guy. Nearly half of the money I came in this time came from USDT.Why?

The second-ranked USDC is also good, with 12.3 billion inflows.

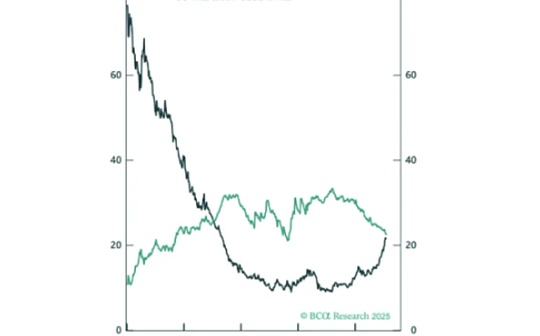

Despite this, the market share of these two big brothers has declined:

Emerging and specialized stablecoins

Because the share of USDe, a interest-generating stablecoin represented by Ethena, has begun to grow rapidly.

The USD1, which Trump’s strongest push, has come to a standstill:

Not only has the market value scale always stayed at more than US$2 billion (of which 2 billion was given by the Middle East tyrants: this Middle East tyrant fund investing in Binance is a bit awesome), but its activity has also declined sharply.

The transfer scale and number of active addresses have declined sharply compared to last month.

No wonder their family is in a hurry to copy Ethna and have a Falcon Finance (Can Falcon copy ENA success?).

During this period, Ripple’s $RLUSD is also catching up on volume. Although the rise is OK, its market value is still quite touching, with less than 800 million.

The one that really performs better is paypal’s $PYUSD:

The market value doubled from one billion in the last quarter to more than two billion, surpassing Trump’s $USD1 in ranking.

Some newcomers may not know that Founders Fund, who has been calling the wind and rain in the encryption circle recently, and his boss Peter Thiel, started out with Paypal.

02Public chain distribution

From the perspective of public chain distribution, the share of stablecoins of Tron chain has experienced a significant decline. Considering the close relationship between USDT and Plasma in the future (USDT exclusive public chains will issue coins! The stablecoin public chain battle is launched), Tron still has a lot of room for decline.

Ethereum’s share has further expanded, and now it is 59.18% close to a record high:

Considering that the share of Ethereum Layer2 in the TVL of the stablecoin here is separately counted, Ethereum is still terriblely strong in the stablecoin track.

Compared with the share at the beginning of the year, Solana is the most impressive, with almost doubled its share, surpassing Aribitrum to secure the third place.

Although the Base chain is closely related to USDC, its stablecoin share actually dropped from 1.72% at the beginning of the year to 1.42%.

Now the stablecoin battle is in full swing, with huge wealth (and loss) opportunities, and I will continue to focus on it!