Author: Sylvia To, Coindesk; Compilation: Five baht, Bitchain Vision Realm

In the past six months, the market value of stablecoins has increased significantly from US $ 122 billion in October 2023 to $ 157 billion in April 2024.Among the stable currency providers, Tether (USDT) occupies a huge market share, exceeding 100 billion US dollars, accounting for 70%of the stabilized coin market.

Based on this momentum,The first quarter report of Tether revealed that the profit holding US Treasury bonds reached a record $ 4.52 billion, generating a net profit of $ 1 billion.As of April 28, the number of active Tether addresses (non -zero) increased to 5.6 million.

This raises a question: How much is the growth space of this stable currency giant?

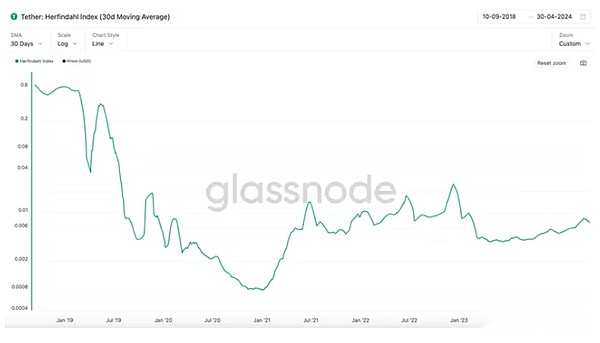

We further study the decentralization of these wallets through the Herfendal Index.The index aims to measure the market concentration of the Tether wallet, and calculate the total supply of the total supply held by different addresses by the square requirements of each address balance in the network.High scores indicate that the supply is concentrated in the hands of a few people, and low scores indicate that the supply is more uniformly distributed in many addresses.

Source: GlassNode as of April 30, 2024.

Above, we saw itThe HerfindAhl index score of different stablecoins: USDT is 0.00708164, USDC is 0.00981202, and DAI is 0.00331652.Among the top three stable currency providers, DAI’s address supply distribution is the most uniform, followed by USDT, and then USDC.

Recently introducing USDT on the TON network may reduce its Herfindahl score and achieve a more uniform supply distribution.Telegram claims to be 900 million active users per month, and the company announced in April that Ton will natively support USDT.This may have a significant impact on the distribution of Tether wallets.

Source: Defillama as of May 6, 2024.

When examining the usage of the top three blockchain platforms and its stable currency, the TRON transaction is mainly USDT, with a dominant position of 98.2%.On TRON, USDT transfer usually ranges from 95 US dollars to about $ 2, but the GAS fee may be different.At the same time, the Ton wallet is integrated into the Telegram application, allowing users to perform free point -to -point USDT transactions in the Ton wallet.According to reports, the trading between the two USDT users outside the wallet will incur a network cost of 0.0145 TON. As of May 6, 2024, it is equivalent to about $ 0.09.

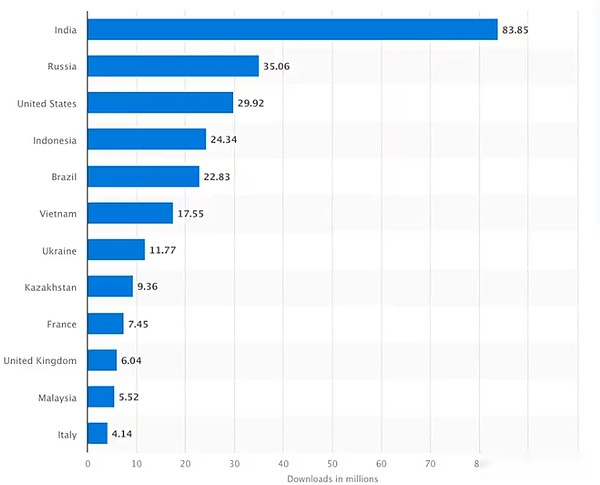

Source: Statistics as of 2023.

The integration of USDT on TON, with its lower cost and faster transaction speed, may promote users to switch from TRON to TON for frequent small transactions.This is particularly important for the major user countries of Telegram in 2023: India, Russia, the United States, Indonesia and Brazil.

Most of these countries are the main participants in the global remittance market.India is one of the world’s largest receiving countries, while Russia sees a lot of funds from the diasporas from their European and former Soviet countries.Indonesia has benefited from remittances from Malaysia and Middle East immigrants.On the other hand, Brazil is famous for immigrants through the United States, Japan and Europe.

The integration of Tether and TON network, coupled with its huge market share and the potential of distributed wallet systems, can support the expansion of USDT in the Telegram user group, thereby increasing its use in the main remittance market.