Author: Jiawei Source: X, @0xjiawei

Inspired by @BanklessHQ and @KyleSamamani podcasts, I recently rethinked the Rollup-centric roadmap for Ethereum.This strategy has a profound impact on improving Ethereum’s scalability and maintaining decentralization, and has also brought about a series of trade-offs and valuation issues worth discussing.

1. Rationality of Rollup-centric Roadmap

@VitalikButerin proposed the “Rollup-centered Ethereum Roadmap” in October 2020, proposing that Ethereum should centrally support Rollup in the short and medium term.The rationality of this strategy is mainly reflected in the following two points:

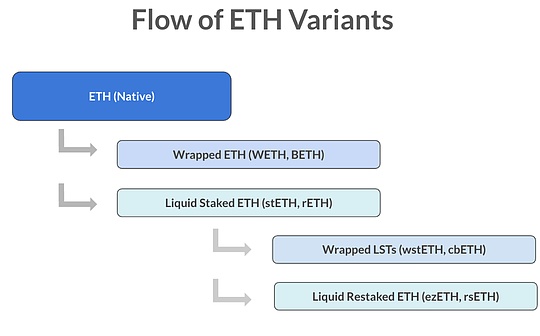

First, Ethereum’s basic layer expansion will focus on expanding the data capacity of the block, rather than improving the efficiency of computing or IO operations on the chain.Ethereum’s sharding design is designed to provide more space for data blobs (rather than transactions), and Ethereum only needs to ensure the availability of data without interpreting it.

Second, Ethereum is adjusting its infrastructure to better support Rollup, such as ENS’s L2 support, wallets’ L2 integration and cross-L2 asset transfers.In the future, Ethereum will become a highly secure, single execution shard and scalable data availability layer that everyone can handle.

In December 2021, Vitalik further described the final picture of Ethereum in “Endgame”: block output is centralized, but block verification is trustless and highly decentralized, and ensures resistant to censorship.The underlying chain provides data availability guarantee, and Rollup provides block effectiveness guarantee.The future of Ethereum is an ecosystem of multiple Rollups coexisting, all based on Ethereum’s data availability and shared security.Users can move between different Rollups through bridges without paying the high fees of the main chain.

These arguments determine the development direction of Ethereum: optimize the construction of the basic layer and provide services to Rollup.Rollup can obtain equivalent security to Ethereum and achieve super-scaling.Behind this strategy is the logic: Now that Rollup has been proven to be effective and well adopted, rather than waiting for complex and uncertain scaling solutions, focus resources on Rollup.

2. The trade-offs behind rationality

L1 delegates execution to L2, implies the following two main trade-offs:

-

Gas collection and deflation relationship

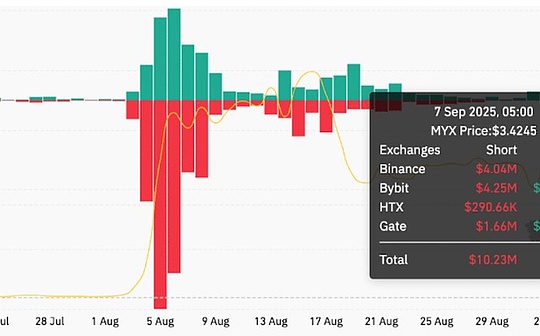

The transaction takes place on Rollup, meaning that the gas fee is charged by Rollup rather than Ethereum L1.gas fees are linked to ETH’s deflation mechanism.In London’s upgraded EIP-1559 proposal, the base fee for each transaction will be burned, directly affecting the supply of ETH.

After “The Merge” turned to PoS, Ethereum entered a 20-month deflation cycle due to the significant reduction in ETH issuance and combustion mechanism.However, due to the sluggish L1 trading in the past few months, L1 gas prices tend to be below what is required for deflation.Ethereum may enter inflation again as more transactions turn to Rollup. -

Capture of MEV (Maximum Extractable Value)

When transactions occur on Rollup, the MEV is captured by Rollup, not Ethereum validators benefit.Although Rollup pays Ethereum L1 fees such as data availability (DA) and proof verification, these fees are incomparable to the value captured by the execution layer.In addition, DA fees will be further reduced after EIP-4844 is implemented.

3. Is the current situation of L2 consistent with expectations?

The actual development of L2 did not fully meet early expectations.Technically, Rollup can be regarded as Ethereum’s “computing sharding”, but in reality, each L2 faces a series of problems that need to be solved urgently, such as the interoperability problem mentioned by Vitalik.Currently, L2s are numerous and highly competitive. Although ETH is the main valuation unit, this position may be replaced by L2 native tokens.More Rollup moves to Alt-DA solutions, which may also undermine L1’s profitability.

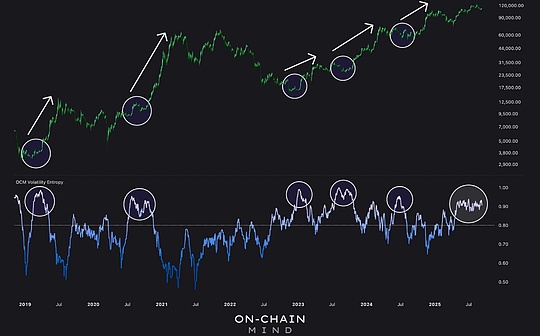

4. How should Ethereum be valued?

Kyle Samani mentioned that due to the particularity of Bitcoin, people view Bitcoin and Ethereum in different ways.Ethereum has the completeness of smart contracts, so it can be valuated from the perspective of “company”.In the future, the question we need to think about is: Should Ethereum perform valuation and pricing from the perspective of the execution layer or from the perspective of the security layer?How will Ethereum’s valuation standards and direction evolve in the next few years, or even in ten years?

Summarize

The Rollup-centric roadmap is an important strategic choice for Ethereum to improve scalability and maintain decentralization, but it also brings implicit trade-offs and challenges.The development of L2 is not exactly as expected, and the competitive situation and interoperability issues of various Rollups still need to be resolved.Valuation of Ethereum requires finding new ways to balance execution and security, laying the foundation for future growth and development.