Source: Aiying Compliance

Initially, stablecoins were mainly used for mortgage and settlement among cryptocurrency traders, but as technology and market maturity, its application scenarios rapidly expanded, especially in emerging markets with weak financial infrastructure.The latest research by Visa and Castle Island Ventures shows that stablecoins have surpassed their speculative uses and gradually become an important part of the global financial system, especially in emerging economies such as Brazil, Nigeria, Turkey, Indonesia, and India.Essence

Users in these markets have found that stable coins can not only be used as investment tools, but also provide them with more efficient remittances, payment and savings channels, especially when local currencies are unstable and bank services are not popular.Stable currency is subverting the traditional financial model, becoming an effective means to deal with currency depreciation and inflation in these markets, and also provide new thinking directions for global financial services.

Related articles:

-

>[Wanzi Long Cultural Research News] Stable currency track: mode, operating principle, trend, and thinking of stable currency in Hong Kong;

Aiying said that through VISA’s stable currency report, the process of stabilizing currency in the rise of stable coins in emerging markets, actual application scenarios, and its far -reaching impact on the global financial industry.

1. Global stable currency growth trend

In recent years, the growth rate of stablecoins has been remarkable, especially in the context of uncertainty in the global financial environment, stabilization has become an effective tool for many countries and regions to respond to economic challenges.In the first half of 2024, the settlement amount of the global stable currency reached amazing$ 2.6 trillion, This number is expected to rise to the whole year$ 528 trillionEssenceThis phenomenon shows that the use of stablecoins has surpassed the cycle fluctuations of the cryptocurrency market and gradually become a key tool in the global financial system.

1. The rapid growth of the supply

Since 2020, the supply of stable coins worldwide has continued to rise, especially the stable currency linked to the US dollar, such asUSDT(Tether) andUSDCEssenceAs of 2024, the total circulation supply of stablecoins has exceeded the amount$ 160 billionAnd in 2020, this number is only one billion US dollars.This significant growth not only reflects the market’s strong demand for stable currency, but also highlights its huge potential in solving cross -border payment, savings protection and currency conversion.

(The supply of stable currency is divided by the issuer)

2. Steady growth of users’ participation

With the increase in supply, the active activity of stablecoins has also increased significantly.The report shows that in 2024, every month exceeds more than20 million active addressesStable currency transactions are performed on the blockchain.In response to this, the number of transactions has also continued to rise steadily, showing that users’ daily dependence on stablecoins has continued to increase.Whether for personal savings or payment and remittances, stablecoins are increasingly incorporated into global economic activities.

3. Cross the cryptocurrency market cycle

It is worth noting that, although the cryptocurrency marketFrom 2022 to 2023, a large fluctuation and downward cycle was experienced, and the transaction volume and frequency of stablecoin were not significantly affected.This shows that stable currency is not just a tool in the cryptocurrency market, and its application scenarios are rapidly expanding to the real economy.Especially in emerging markets, the stability and global availability of stable currency make it an important means to fight currency depreciation and financial instability.

(Comparison of cryptocurrency spot transaction volume and stable coin monthly active sending address)

This trend of rapid growth shows that stablecoins are no longer just a sheltering tool for cryptocurrency investors, but in global, especially in emerging markets,It has become an important supplement for the limitations of traditional financial systems.As more and more countries and regions explore stable coins into the financial system, industry practitioners face huge development opportunities.

2. The US dollar trend of stable currency

According to the report data,98.97%of the stable coin supply is linked to the US dollar,andOnly 0.62%are linked to gold,,0.38%linked to the euroThe proportion of other types of hook assets is only0.04%EssenceThis shows that although there are other stablecoins linked to the euro, gold, and even RMB in the market, users and companies are more inclined to use stablecoins linked to the US dollar for transactions and savings.

(The proportion of asset hooks supplied by stable currency)

Different currencies in the global economyIncluding the proportion of US dollars, euro, yen and RMB in various financial fields.Specifically, this chart compares the global market share of these currencies in the following aspects:Foreign exchange reserves, international debt, international loan, international payment (SWIFT), foreign exchange transactionas well asStable currencyEssenceThe chart shows that the dollar occupies a dominant position in these fields, especially inforeign exchange reservesAs well asInternational paymentAs well asForeign exchangeandStable currencyIn terms of, its market share is close or more than 60%.

(The share of different currencies in the global economy)

Although some stable coins are linked to euro, gold, etc., their market share is very small.This is because the frequency and convenience of these currencies in international trade, savings and payment are far worse than the US dollar.The international influence and liquidity of the US dollar make it the dominant force in the stabilized coin market.

3. Stable currency revolution in emerging markets: Investigation insights in the Five Kingdoms

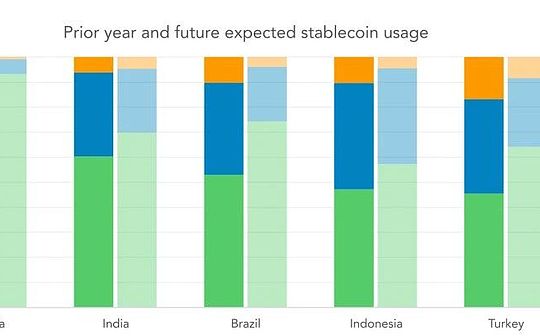

(The trend of changes in the use of stable coins in five countries)

In the report, through in -depth investigations of five emerging markets (Brazil, Nigeria, Türkiye, Indonesia and India), analyzed2541 cryptocurrency usersHow to use stablecoins in daily life.Users in these markets are gradually regarding stable currency as financial instruments to cope with the economic challenges of their respective countries, including currency depreciation, high inflation, and difficulty in cross -border payment.The following is a detailed analysis of the use of Aiying Aiying to report the use of stable currency in these five countries:

1. Nigeria: Avoid the depreciation of Nala, stabilize the currency into the US dollar alternative

Nigeria has performed the most prominent in the use of stable currency. It is the five emerging markets.The most extensive use of stablecoinOne of the countries.Due to the continuous depreciation of Naira, many Nigerian users will stabilize the currency, especially the stable currency (such as USDT) linked to the US dollar, as a risk shelter to protect their wealth from the influence of local currency depreciation.

-

use: The report shows that Nigeria users mainly use stable coins forUS dollar, Regard it as outside the local banking systemSavingsEssenceIn addition, stable coins are also widely used inmoney transferandPay products and services, Help users bypassed the banking system and complete daily payment and transactions.This makes stabilization coins an important part of the daily life of Nigerians, especially in the context of currency turmoil and severe inflation.

-

Actual scene: For example, Nigerian users often use stable coins to remit money to relatives who work abroad, or buy goods on an international e -commerce platform to avoid high foreign exchange costs and inconvenience of banking systems.

2. Türkiye: tools for high inflation and pursuit of income

Türkiye is also an important market for the use of stable coins, especially when facing the countryHigh inflationIn the context, more and more users use stable currenciesGainEssenceDue to the continuous depreciation of local currencies (Turkish lira), users hope to earn the benefits of ** decentralized finance (DEFI) ** platform through stablecoin to fight against the wealth brought about by inflation.

-

Preferred public chain: The report pointed out that when Turkish users use stable coins, they usually preferEthereumandBinance Smart ChainWait for the mainstream blockchain platform to trade.These platforms not only provide high liquidity, but also support rich decentralized financial applications, and users can obtain higher returns through holding stable coins.

-

Actual scene:manyTurkish users use stable currency to participate in financial activities such as decentralized lending and liquidity mining to earn additional benefits, thereby making up the economic losses caused by currency depreciation.

3. Indonesia: convenient tools for currency conversion and arbitrage

In Indonesia, the main use of stablecoin is concentrated inCurrency conversionandArbitrage transactionsuperior.The report pointed out that Indonesian users have the efficiency of currency exchange and international payment through stable currencyFar higher thanTraditional banking systems, this is also one of the main reasons for stable coins to popularize in the country.

-

use: Stable currency is widely used inCommercial paymentandCross -border transaction, Especially when it is required for foreign exchange exchange or large international transactions.The rapid settlement and lower transaction costs of stable currency enable enterprises and individual users to bypass the complex processes of traditional banks and save time and cost.

-

Actual scene: Small and medium -sized enterprises in Indonesia are carried out through stable coinsCross -border trade settlement, Greatly reduced the tedious procedures of traditional banks.In addition, some individual users use stable coins to conduct arbitrage operations between different trading platforms to obtain the profit brought by exchange rate fluctuations.

4. India: Multi -functional financial tools for savings and payment

Users in India’s cryptocurrencies and stable currencies are growing rapidly. Stable coins are gradually becoming an important financial tool in India, especially forSavings and US dollar transactionsEssenceBecause India’s local currency (rupee) is relatively unstable, some users choose to convert funds to stable coins linked to the US dollar to maintain value.

-

use: Indian users use stablecoins for stablecoinSavings, To avoid local currency depreciation.In addition, many users also use stable currency for stable currency forDaily paymentandCommercial use, Through it for transactions of goods and services, and even used as a wages of wages.

-

Actual scene: For example, some companies have begun to pay for overseas partners through stable coins to reduce the delay of cross -border transfer and high costs of traditional banks.

5. Brazil: Effective means of remittance and cross -border trade

In Brazil, stablecoin is mainly used formoney transferandCommodity paymentEssenceStable coins provide more convenient and lower cost solutions when dealing with cross -border remittances, so that their use in Brazil continues to increase.Especially those dependenciesCross -border tradeEnterprises and individuals found that settlement through stable coins can not only avoid complex banking systems, but also save a lot of transaction costs.

-

use: When Brazilian users can avoid the high handling fees of traditional banks through stable coins, they can also enjoy faster accounting time.Therefore, stablecoin gradually becomesRemittance toolThe first choice.In addition, some Brazilian companies have begun to settle cross -border trade through stablecoins, especially when large amounts of funds are required, the use of stablecoins is more flexible than traditional financial instruments.

-

Actual scene: For example, Brazil’s freelancers receive payment from global customers through stable currency, which greatly improves the settlement efficiency and reduces currency exchange losses.

Fourth, the use of stablecoin expansion: from speculation to actual application

Stabilization currency was originally used for value storage and risk aversion tools in cryptocurrency transactions, but with the unstable global economy, especially in some emerging markets, the use of stablecoins gradually expanded to a wider range ofActual application scenariosEssenceThe report data shows that users not only use stable coins for savings, but also through various activities such as salary distribution, commodity payment, exchange rate conversion, and income.This transformation shows the upgrade process of stable coins from pure speculative tools to daily financial instruments.

(Questionnaire: The main purpose of users using stable coins)

Aiying Aiying found that this questionnaire was surprisingNearly half of users use stable coins to conduct cryptocurrencies or NFT transactions, which shows that Meme has played a great role in promoting the popularization and education of Web3.

(The main use scenarios in the application of stable currency)

-

Pay products or services with stable currencyandInternational remittances through stablecoin(About 45%): These two applications are also very common, indicating that stablecoins are widely used in daily consumption and cross -border remittances, especially in scenarios that require faster and cheaper payment methods.

-

Used for commercial transactions and payment wages: More than 30%of users have used stable currency to handle commercial transactions or pay payments, indicating that stable coins are also being included in financial management by companies and enterprises, especially in the scenarios of multinational companies and remote work.

The summary is mainly to promote the following factors:

1. Savings: Avoid currency depreciation and provide the security of US dollar savings

An important purpose of stablecoin is to provide users withReplacement of US dollar savingsEspecially in countries with depreciation pressure or inflation in the country’s currency experience, stabilization coins have become a safe haven.The report pointed out,About 47%of usersChoose to use stablecoins forUS dollar savings, Avoid the wealth that shrink due to the depreciation of local currencies.

-

User motivation: In high inflation countries such as Nigeria and Turkey, users choose to deposit funds in stablecoins linked to the US dollar to ensure that wealth is not affected by the depreciation of its currency.Stabilization of stablecoins provides a way to bypass traditional banking systems, and users can quickly store and use US dollars worldwide.

-

Actual application scenarios: For example, users in Nigeria convert funds into USDT to save instead of depositing from their domestic bank accounts to avoid the loss of wealth caused by the depreciation of Naira.

2. Increase acquisition: Earn passive income through decentralized finance (DEFI) platform

along withDecentralization Finance (DEFI)The popularity of the platform, more and more users earn benefits by depositing stable coins into the DEFI protocol, similar to the traditional financeRegular deposit or investmentEssenceThe report shows,39%of usersIt means that they can obtain income through stable coins, and this phenomenon is particularly outstanding in emerging markets.

-

DEFI and income: DEFI platform allows users to passPledge stable currencyParticipate in liquidity mining or borrowing agreement, and then get interest or tokens.Compared with the low interest rates of traditional banking systems, the DEFI protocol can often provide higher annualized returns.

-

Actual application scenarios: Turkish users earn a higher return than traditional financial institutions by depositing USDT or USDC into the DEFI protocol such as AAVE or Compound, which is also a strategy to deal with local currency depreciation.

3. Exchange rate conversion: efficient currency exchange tool

Stable coins also provide users with more traditional banking systemsEfficient exchange rate conversionServices, especially in the field of cross -border payment or remittances.The cost of foreign exchange exchange for traditional banks is high and the process is cumbersome. The use of stable coins for currency exchanges is not only low, but also can be settled quickly.

-

User behavior: The report pointed out,43%userCurrency conversion through stable coins, especially when cross -border payment or international trade requires, the non -border attributes of stablecoin make it an ideal tool.

-

Actual application scenarios: SMEs in Indonesia use USDT or USDC for international payment, bypassing the foreign exchange exchange process and high costs of traditional banks, thereby completing the transaction with a more favorable exchange rate.In addition, when individual users travel overseas or cross -border consumption, they also tend to use stablecoins for exchange and enjoy the convenience of instant settlement.

5. The far -reaching impact on financial infrastructure

With the use of stable currency globally, especially in the rapid expansion of emerging markets, it has a significant impact on traditional financial infrastructure.Stable currency not only changed the pattern of cross -border payment, but also greatly improved financial inclusiveness, enabling more users to participate in the global economy.This change puts forward new challenges and opportunities for the characters and efficiency in the global financial system.

1. Cross -border payment: more efficient and more transparent payment methods

TraditionalCross -border payment systemOften due to the existence of intermediate links, the process is cumbersome, longer, and accompanied by high transaction costs.This particularly affects individuals and enterprises that rely on international trade and remittances, especially in developing countries. Such transactions may take several days to complete, and the cost is several percentage points of the transaction amount.

-

Advantages of stabilizing currency: The decentralization of stablecoin eliminates many intermediate links, so thatCross -border paymentMore transparent, efficient and low cost.Through blockchain technology, stable coins can complete global capital transfer within a few minutes, and the cost is only a small part of traditional bank transfer.This is particularly important in emerging markets, because users in many countries depend on remittance or international payment to maintain their livelihood or carry out business.

-

Actual application scenarios: For example, Nigeria’s individuals and enterprises use stablecoins (such as USDT or USDC) to remit money to foreign relatives or business partners, which not only saves the tedious process of the banking system, but also avoids high foreign exchange exchange and transfer costs.Similarly, SMEs in Indonesia used stablecoins for cross -border trade payment, which improved transaction efficiency by reducing intermediate costs and increasing profit margins.

-

Eliminate the intermediate link: The application of stablecoins eliminates intermediaries in traditional finances such as banks and payment processing agencies, which greatly shorten the settlement time, so that the funds can complete the liquidation within a few minutes, and through the transparency of the blockchain, all transactions can be possible.Tracked and verified in public ledger, which enhances trust and transparency.

2. Financial inclusiveness: Provide opportunities for groups that have not been fully served

Financial inclusiveness has always been a challenge for the global financial system. Especially in emerging markets, many people cannot get traditional banking services.These people may not be able to open bank accounts or obtain loans and savings services due to lack of sufficient identity certificate, credit history or living in remote areas.

-

Stable currency reduces the entry threshold: The application of stablecoins does not depend on traditional bank infrastructure. As long as users have Internet connections and encryption wallets, they can participate in global financial activities.It provides a way to storage, transfer and pay for those who have been rejected by the banking system, so that they canParticipate in the global economyEssence

-

The help of decentralized finance (DEFI): The combination of stablecoin and decentralized finance (DEFI) further enhances financial tolerance.Users can obtain loans by pledged stable coins, or to obtain savings returns through the DEFI protocol, without the need for high deposits or credit evaluation required by traditional banks.

-

Actual application scenarios: For example, Turkish and Nigeria users bypassed the restrictions of local banks through stable coins and used stablecoins for savings and payment.At the same time, many immigrants working abroad use stable coins to remit money in China. These funds can be quickly received and used for daily consumption by their families without the need to go through expensive and inefficient remittance services.Many small companies in India and Brazil also use stable currency to pay international suppliers to avoid delay and costs of traditional financial systems.

3. Reduce financial exclusion phenomenon

Traditional financial systems often require users to provide a large number of identity proofs and credit records, which makes a large number of low -income, weak bank accounts or credit records weak, and cannot participate in financial activities, especially in areas where rural or economic development is slow.Through blockchain technology and digital wallets, stablecoins have eliminated these obstacles, causing financial services to touch the user group that was originally excluded.

-

The key to solving problems: Stable coins do not require complicated account opening procedures. Users only need to download one digital wallet to store financial activities such as storage, payment, and cross -border transfer through stable coins.Most of these wallet applications can be used on smartphones, which is especially important for emerging markets with higher mobile phone penetration rates than bank account ownership.

-

Actual application scenarios: In remote areas in Indonesia and India, many users have obtained financial services through stable coins, and this is unimaginable before.Through mobile applications and stable coins, they can store savings in more stable digital dollars, avoid losses caused by currency depreciation, and can also participate in international trade and payment, thereby breaking the phenomenon of long -term financial exclusion.

6. Stable currency public chain: build a new global payment network cornerstone

The reason why stable coins can be quickly popularized and widely used in financial activities such as cross -border payment, savings, remittances, and remittances cannot be separated from the powerful blockchain technical support behind them.Different blockchain platforms provide different speeds, costs, and security, which directly affects the user’s experience and the use of stable coins.Here are several major blockchain platforms pointed out in the report and the choice of digital wallets commonly used by users.

1. Mainstream blockchain platform: balance, cost and safety balance

The issuance and transactions of stablecoins are inseparable from the support of the blockchain platform.According to the report,Ethereum (Ethereum)As well asBinance Smart Chain (BSC)As well asSolanaandTronIt is the most popular mainstream platform for users to use stable currency transactions.These platforms have their own characteristics, and users choose according to their specific needs, such as transaction speed, cost, platform security.

Each chain stabilizer currency transaction volume (monthly calculation)

(The number of monthly active sending addresses of different chain stablecoins)

(The trend of changes in the number of active sending addresses of each chain stable coin)

-

Ethereum (Ethereum)The

-

Popular reason: Ethereum is one of the earliest and most influential smart contract platforms. It supports the issuance of multiple stablecoins, such as USDT, USDC and DAI.Although Ethereum’s transaction costs (GAS fees) are relatively high, its strong security and ecosystems have attracted a large number of users, especially on high -value transactions and decentralized finance (DEFI) platforms.

-

Application scenarios: Users to conduct stable currency transactions on Ethereum, especially when they access income or participate in liquidity mining on the DEFI protocol, tend to choose this platform because it provides rich financial applications.

-

Binance Smart Chain (BSC)The

-

Popular reason: BSCLow cost and high speedIt is known, especially in the case of a large transaction volume, which has performed well, attracting a large number of users who need to quickly complete the stable currency transfer.Compared with Ethereum, BSC’s transaction costs are very low, so it is more advantageous when dealing with small payment and frequent transactions.

-

Application scenarios: Many small and medium -sized enterprises and individual users are more inclined to use BSC for stable currency transactions, especially when cross -border payment or product purchase, its fast settlement and low cost are very attractive to cost -sensitive users.

-

SolanaThe

-

Popular reason: Solana relies on itSuper high transaction speedandVery low transaction cost, Gradually become another popular choice in stablecoin trading.The ability to deal with thousands of transactions per second makes it an ideal platform in high -frequency transactions and large -scale payment scenarios.

-

Application scenarios: Solana is widely used in scenarios that require efficient payment and instant settlement, especially for cross -border e -commerce and large payment network users, it can greatly improve transaction efficiency.

-

TronThe

-

Popular reason: TronVery low trading feeFamous is the preferred platform for small payment and high -frequency trading users.The report pointed out that TRON has become an important choice for stable currency users in many emerging markets, because its transaction cost is almost zero, and at the same time, it can quickly handle a large amount of small transfer.

-

Application scenarios: TRON’s low cost structure is very suitable for daily remittance, payment and frequent small transactions.Especially in developing countries such as Nigeria and Indonesia, users are more willing to conduct cross -border transfer and product payment through TRON.

2. Use of digital wallets: choice for hosting and non -hosting

In addition to the blockchain platform, the digital wallet plays a vital role in the storage and use of stable coins.The report shows that users usually use exchange wallets and non -hosting wallets (self -custody wallets) to manage their stable currency assets.

(The most commonly used blockchain wallet for users)

-

Exchange walletThe

-

Binance Wallet: As one of the world’s largest cryptocurrency trading platforms, Binance provides users with convenient and secure exchange wallet services.Users can easily manage and transfer their stable currency assets on the Binance platform, and conduct various cryptocurrencies transactions and exchanges.

-

Trust Wallet: Trust Wallet is a mobile wallet related to currency and security, which widely supports various cryptocurrencies and stablecoins.It is known for its ease of use and support for a variety of blockchain assets, especially in emerging markets to have a huge user base.Users can pay, storage and transfer operations on mobile phones through Trust Wallet, which is convenient and fast.

-

Non -hosting wallet (self -custody wallet)The

-

Metamask: Metamask is one of the most commonly used non -hosting wallets. Users can directly manage their private keys through it and completely control their assets.Metamask supports Ethereum and other EVM and capable stable currency trading. Especially in the DEFI field, users participate in decentralized financial activities through Metamask, such as borrowing and liquidity mining.

-

Superiority: Compared to the exchange wallet, the non -hosting wallet provides a higher onesSecurity and privacyEssenceUsers directly control their private keys and funds and do not need to rely on centralized exchanges. This is very important for many users who value asset security.

7. Users’ trust in stable currency: Tether’s dominant position and the growth trend of stablecoin

With the continuous expansion of the application of stable currency globally, users have gradually increased their trust in their trust, especially in the actual needs of countermeasures to fluctuations in currency fluctuations and promoting cross -border payment, stable coins have played a key role.The report particularly emphasizes the dominant position of Tether (USDT) in the stabilized currency market. Although there are other competitors, Tether is still the first choice for users to choose from with its extensive liquidity, users’ long -term trust and huge market share.Essence

(Tether (USDT) market share changes in stable currency supply)

1. Tether (USDT) dominant position

As the earliest stable currency, Tether (USDT) not only has a long market history, but its market share has remained strong, becoming the highest stable currency in the world.According to the report data, Tether occupies most of the total supply of stable currency, especially in emerging markets and global cryptocurrency exchanges, Tether is widely used in trading, savings and payment.

-

Liquidity advantage: The biggest advantage of Tether is its powerful oneLiquidityEssenceBecause Tether and the US dollar are linked by 1: 1, users can easily exchange Tether to US dollar or other encrypted assets.This convenient liquidity makes Tether the preferred tool for cryptocurrency traders and cross -border payment users.Whether it is high -frequency transactions or large transfer, Tether can guarantee rapid and stable settlement.

-

User trust: The reason why users trust Tether is mainly based on its long -term stable market performance.Although in the past, it was questioned about Tether’s reserve transparency, but it was still recognized by wide users as the highest liquid currency in the world.In the global market, Tether’s transaction covers most mainstream cryptocurrencies, so that users can easily use Tether as intermediate tools during transactions.

-

Widely used network: Tether not only exists on Ethereum, Binance Smart Chain, TRON and other blockchains, but also supported by most cryptocurrency exchanges and decentralized financial platforms around the world.Whether the user is traded on a centralized exchange or participating in liquidity mining through the DEFI protocol, Tether is almost everywhere.The report specifically pointed out that this extensive network of Tether has made its trust in users high.

2. Behind the trust of stable currency: transparency and compliance

Users’ trust in stable currency still depends on the issuer’sTransparency and complianceEssenceThe reason why Tether can maintain its dominant position in the market is that in addition to its liquidity and long -term performance, it is also because of its continuous efforts to improve transparency and cooperate with global regulatory agencies to ensure the legitimacy and compliance of its operation.

-

Increased transparency: Although Tether has been questioned due to its reserve problem, in recent years, Tether has increased the transparency of its reserve and issued a audit report on a regular basis to prove to users that its stablecoin does have sufficient US dollar asset support.The improvement of this transparency helps to enhance the trust of users. Especially under the supervision of regulatory agencies, users are more convinced that the stable coins they hold are safe.

-

Enhancement of compliance: With the gradual strengthening of the supervision of cryptocurrencies around the world, stable currency issuers need to ensure that they meet the legal requirements of countries.Tether cooperates with regulatory agencies in multiple jurisdictions to ensure that they can operate legally and provide users with reliable services.The strengthening of compliance not only protects the interests of users, but also further enhances Tether’s trust in the global market.

8. Supervision challenges: regulatory attention caused by cross -border use and currency replacement

Although the role of stable currency in the global financial system is increasingly important, its widely used application has also aroused the attention of regulatory agencies in various countries.Especially on the issue of cross -border transactions and currency replacement, the potential impact of stable currency on sovereign currency has become one of the focus of regulatory discussions in various countries.

-

The complexity of cross -border use: Cross -border use of stablecoin provides unprecedented convenience for global users, but also brings a lot of challenges to regulatory agencies in various countries.Traditional cross -border payment and capital transfer have been strictly controlled by financial control, and central banks and governments of various countries have clear regulatory regulations on capital flows.However, stabilizing the currency bypassed these traditional systems, enabling funds to flow freely and freely, weakening the central bank’s ability to control the flow of funds.The rapid flow of capital may lead to potential threats of capital escape, monetary policy failure, and potential threats to financial stability.

-

Replacement risk of sovereign currency: The widespread use of stable currency, especially the US dollar stable currency, has become the actual “currency replacement” in many economic unstable countries.Due to the distrust of local currency, users and enterprises have stored a large amount of assets in stable coins, weakening the use and trust of their currencies.This phenomenon isHigh inflation countryIt is particularly obvious. In the long run, it may pose a threat to the status of sovereign currency, and even leads to the shaking of the national monetary system.

-

Uncertainty of supervision: As the use of stable coins is becoming widespread, regulators of countries around the world have begun to take action to try to formulate a clear rules framework for stable coins.Despite some countries such asU.S., the European UnionDiscussing and formulating relevant regulatory regulations has begun, but unified regulatory standards have not been formed worldwide.How to ensure the transparency of the reserve, how to cope with the risk of money laundering and terrorist financing, and how to integrate with the regulatory framework of various countries are the key challenges that the stable currency industry needs to face in the future.

-

Actual case: For example, ** in the United States“Stable Coin Transparency Act”andEU“Crypto Asset Market Act” (MICA)** has set up to establish the transparency requirements and reserve audit system for stable currency issuers.At the same time, some emerging market countries are considering strengthening the circulation of stable currency by strengthening the supervision of domestic currencies.In the future, the compliance of global stable currency will determine whether it can continue to expand rapidly and the legitimacy in the financial system.