Source: Pentalab

Since the first release on February 1st, the price of GNS has risen from $ 4.64 to $ 6.2 in two weeks, achieving amazing increases from two weeks.

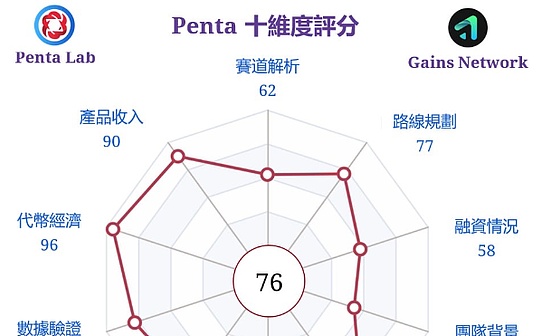

The following sections are selected from the “Project Introduction, Product Revenue, token Economics, data verification, valuation, valuation, valuation, valuation, valuation, valuation, valuation, valuation, valuation, and valuation,Risk analysis “,” Circuit analysis, code assessment, competition comparison, media community, team background, financing situation and line planning “, please refer to the complete report.

Project introduction

GAINS Network is a decentralized synthetic asset leverage trading agreement founded on Ethereum. Its flagship product is GTRADE using synthetic asset transactions, supporting cryptocurrencies, foreign exchange, stock, stock index and commodity high leverage forever forever forever forever forever foreverContinuous contract trading platform.The platform supports 150 times cryptocurrency and stock leverage, up to 1,000 times foreign exchange leverage.GTRADE is special because his structure allows it to provide a lot of leverage on extensive assets.It uses a synthetic asset system to do this, which means that users can trade any assets compatible with GTRDE prophecy.The project binds the user with its ecosystem through the $ GNS tokens. Users can obtain APY by pledge $ GNS, which not only enhances the community’s participation, but also enhances the practicality of tokens.When it was first launched on Ethereum, GAINS Network was not immediately welcomed by the market, but the business gradually increased after migrating to the Polygon chain, and the market after integrated the Arbitrum chain was really detonated.

Product income

Cost income disassembly

According to the Token Terminal data, Gains Network’s 30 -day charging amount ranks 3/50 on the derivative track, which belongs to the first echelon.From January 2022 to January 31, 2024, the total transaction volume processed by the decentralized leverage trading platform in the past two years is about 54.9 billion U.S. dollars, the cost income is about 34 million US dollars.EssenceThe daily transaction volume and expense income fluctuate greatly.Among them, on February 17, 202, Binance issued an announcement saying that GNS will be launched in the Innovation Zone and opened spot transactions to GNS/BTC, GNS/USDT.The peak and continuation of daily transactions and fees.

Figure 2: Cumulative transaction costs have increased with the transaction volume coordinated

Source: Token Terminal, Penta Lab

Figure 3: In February 2023, Binance caused an increase in transaction volume

Source: Token Terminal, Penta Lab

User role and growth

At present, in addition to the most basic traders, users of the GTRADE platform can also participate in the construction of the platform through 4 other characters and obtain benefits:

-

Trader: Earn investment income by making more and short assets;

-

Valley liquidity provider (LIPIDIDITITY PROVIDER, LP): By providing liquidity to DAI vault, DAI reward

-

Token holder: obtain DAI rewards through the GNS in the pledged hand;

-

Liquidity provider: GNS rewards are obtained by providing liquidity by providing liquidity for the GNS/DAI pool;

-

Referrals: Participate in the recommendation plan and get GNS rewards.

-

In October 2021, the team changed the name from GAINS.FARM to Gains Network to reshape the brand of derivative exchanges.

-

The version was updated to V6 on January 27, 2022, and continuously optimized small repeated operations.After Luna mines, GNS no longer uses GNS as a mortgage, but is changed to DAI.

-

On May 3, 2022, Gains Network released three blue -chip stocks AAPL, FB and Googl on Polygon’s main web, and 6 days after the successful test, other 20 -file stocks were launched.This is the first time that the leverage trading stock price can be used on the chain (the transaction is a synthetic product that uses the median aggregation price of the selected stock).

-

In September 2023, GAINS Network was listed 18 new foreign exchange pairs.In addition, GAINS Network submitted a 7 million US dollars of ARB token application and a $ 100,000 GNS gift matching offer as part of the ARBITRUM short -term incentive plan.

-

On October 1, 2023, the GTRADE V6.4.1 was launched. This update involved a number of changes, including depreciation of GNS NFT (in exchange for GNS tokens) and reorganizing the income from the development fund to the $ GNS pledged.The income increased by about 70%, and the total cost of GNS increased from 30%-60%.

-

On January 27, 2024, GAINS Network announced the launch of the new version of GTRADE V7, introducing Geth, GUSDC and adding more mortgage deposits functions. Mortgage means that traders can choose from a series of cryptocurrencies. At presentYou can choose USDC, ETH, or DAI. The new version of the V7 will also introduce liquidity income token GUSDC and Geth.

The rewards of the recommender and liquidity provider are paid to the cast GNS token. At the same time, the DAI of the equal amount will enter the vault to support mortgage.

According to the token terminal data, as of January 31st, at the derivatives, the number of monthly active users of Gains Trartwork was 6121, ranking 4/30, located at the forefront.Recently, Gains Network participated in the Arbitrum STIP program. From December 29, 2023 to March 29, 2024, it provided dealers and liquidity providers of GNS and GDAI with 38.25 million and 675,000 ARB tokens, attracting attractionA large number of users, the number of active users was tripled within 1 month.

Figure 4: Monthly active users have been tied 3 times within 1 month

Source: Token Terminal, Penta Lab

Product iteration, innovation and market adaptability

GAINS Network has never stopped computing the trading platform and expanding the transaction pair since its launch.By continuously adjusting the trading model, making up for the vulnerability, using a new prediction mechanism, and continuously adjusting product positioning. From cryptocurrencies to stocks, foreign exchange and commodities, the main form of GAINS Network has been stable.GAINS Network executes all asset -paired transactions by using a single -liquidity pool and DAI vault. It has extremely high liquidity efficiency and can provide the most extensive transaction pairing and leverage choices.A total of 187 transactions, including a total of 187 transactions, reflect a strong repeated operation and adaptability.

Token economy

GNS token

Total supply of tokens

GAINS Network’s initial tokens are GFARM2 assigned on Etheria, Development Fund and Governance Fund each accounted for 5%(10%) of token distribution, and received the Polygon chain in the bridge to the Polygon chain.After going up, the GNS tokens were split at a ratio of 1: 1000.GNS is currently distributed on the Polygon chain and the Arbitrum chain. The initial supply is 38.5 million, and the maximum supply is 100 million.The maximum supply is only used as a fault safety mechanism, which will not be achieved theoretically.According to Dune data, as of January 31, the total supply volume of GNS was 33,942,395, which was lower than the initial supply and was in a contracted state. The number of token casting was lower than the amount of destruction.

GNS casting and destruction

GNS is an applied tokens. Its casting and destruction are inseparable from the GTOKEN vault (Vaults), which can maintain the dynamic balance of the mortgage rate of the vault.The vault is the opponent of all transactions on the platform. The assets pledged by the liquidity provider, the trading costs incurred, the losses generated by the trader, and the profitable trader.GTOKEN represents the ownership of mortgage assets on the bottom of the vault.At present, Gains Network has introduced three types of mortgages: DAI, WETH and USDC, forming three GTOKENS and vaults: GDAI, Geth and GUSDC.The part of the hybrid asset in the vanguard constitutes the Over-Collateralization Layer, which is a buffer between traders and lenders.

If the vault mortgage is excessive, a part of the trader’s losses (expressed by the mortgage, such as DAI, the income for the vault) will be transferred to a pool for off -site transactions (OTC), and the user can weigh the average price of 1 hour (Time Weight Price sells GNS for assets, and the Sale GNS will be destroyed.The advantage of OTC transactions is that there is no price sliding point and does not affect the GNS price of the exchange.When the price of GNS fell rapidly, TWAP is higher than the market price of the exchange. The holder will tend to sell GNS in the OTC market for DAI, and to buy GNS at the market price with DAI, to a certain extent formed a price balance mechanism.If the vault is lower than the mortgage, GNS is cast and sells it through off -site transactions for assets to supplement the treasury.The GNS that can be cast every 24 hours does not exceed 0.05%of the total supply, that is, the highest inflation rate is 18.25%per year without destruction.

It can be seen that the actual supply of GNS is dynamic.When the GTRADE trading platform has sufficient cost income, and the total loss of traders is greater than profit, the vault is in an excess mortgage state. The GNS will be destroyed in the OTC market.Someone’s income distribution.It can be found that the vault is a short -term opponent of all transactions on GTRADE, and GNS has a long -term opponent through this mechanism.

GAINS Network is improving and developing the platform’s governance framework. GNS has now become the platform’s governance tokens. A GNS token is equal to one vote.After obtaining consensus and improvement in the Discord forum, the proposal can be transferred to the Snapshot platform for the holder to vote.

GNS NFTS

Prior to V6.4.1, the NFT robot (NFT BOTS) was responsible for performing all the profit and stop loss and price limit orders on the GTTRDE. Only the NFT holder can operate the NFT robot and get the distribution of platform charges and GNS rewards.GAINS Network distributes NFT points for the liquidity provider with at least 1% of total liquidity providers to cause NFT.Different levels of NFT (divided into brass, silver, gold, platinum, and diamond level) need different points. Accordingly, the benefits level that the holder can get is different.NFT holders pledge it after pledgeing, and can get a discount on a maximum of 25% of the fixing spread and increase the GNS pledge income with a maximum of 10%.

After the version is upgraded, after the function of the NFT robot, it is borne by the Chainlink prophecy of the machine, and the NFT has been abandoned in V6.4.1.The holder can convert NFT to GNS tokens, and the number of NFT exchanges at different levels is different.There are two options for the exchange method: one is to get $ GNS linearly within 6 months from the date of exchange (mortgage during the whole casting period); the other is to obtain $ GNS immediately, but a fine of 25% (fine will be fined (the fine will be the fine willFor governance funds, the community decides for strategic use or destruction).

Income distribution and token value capture

Taking DAI as an example, the costs charged by the platform are allocated to the governance fund (DAI Staking), GNS pledges, recommenders, and prophet networks that perform limited orders in a decentralized manner.

From the perspective of the distribution of specific costs:

1. The loan fee will all enter the DAI vault;

2. 18.75% of the open positions and liquidation fees of the price limit order are allocated to the governance fund, 62.5% are allocated to GNS pledges, and 18.75% are allocated to DAI pledges;

3. At 18.75% of the market price orders and the closure fee of the liquidation fee are allocated to the governance fund, 57.5% are allocated to GNS pledges, 18.75% are allocated to DAI pledges, 5% are allocated to the prophet network;

4. The exhibition fee, poor point, and dynamic point difference can be charged through direct or indirect (opening price) to affect the trader P & AMP; L, and enter the DAI vault in the form of a trader P & AMP; L.

From the perspective of user characters:

1. Pay the reward obtained by the pledged GNS token to pay with the transaction mortgage (DAI, WETH, and USDC).According to the official information of GAINS Network, because about 70% of the transactions on the platform are market orders, on average, 61% of all orders will be assigned to GNS pledge;

2. 18.75% of all orders’ transaction costs will be assigned to DAI pledges;

3. 18.75% of all orders will be assigned to the governance fund;

4. Refferal Reward is extracted from the “governance fund” cost. According to the official instructions of Gains Network, it accounts for about 22.5% to 30% of the opening costs.quantity.

Data verification

According to DEFILLAMA data, as of January 28, 2024, Gains Network has been deployed on the Arbitrum and Polygon chains, and TVL accounts for 88% and 12%, respectively.

As of January 30, 2024, GAINS Network’s market value /TVL (Market Cap /TVL) was 3.62, compared with the historical average of 4.84 in the past 24 months at a relatively low position.

Chart 5: Gains Network Circulation Market value /TVL is at a historical low

Source: Defillama, Penta Lab

Valuation

Although the GNS TVL volume is only less than 7 % of GMX, the ratio of the market value ratio is three times that of GMX, which implies the market’s recognition of its loan efficiency, growth potential and security.In six months, we believe that with the income of Geth and EUSDC and the expansion of new features, TVL has the opportunity to exceed the $ 100 million mark. According to the average market value of the past two years/the ratio of TVL is 4.84, the estimated market value of six months is 4.84$ 100 million.

Main risk

The management risk of funds, the risk of extrusion, and the risk of attack.