Author: jiayi plus one; Source: X, @mscryptojiayi

Introduction

Every time the market goes down, the same scene always appears: a group of people jump out and say, “Look, I told you it was a scam.” Then when the market turns, the same group of people line up again, chasing higher prices, and shouting that they are awesome.This extreme reciprocation of emotions, after eight years in this industry, I have become numb.

It’s not because people don’t want to believe in the future, but – when the bear market comes, people don’t dare to believe in the future.

But the fact is: when we are talking about price, we are actually talking about the future.Because price is never “now”, but the market’s discount of the future.If we continue to focus solely on price, the future will pass before our eyes.

What’s more, the bear market has a very real pattern: what everyone sees is a decline; what I see is stratification.Emotions are ebbing, industries are being screened, and the future is being rearranged.

At the same time, I am also thinking, “Why are there more and more new projects, but fewer and fewer truly meaningful things?” “We all know that the industry is going to change, but how will it change?”

That’s why I wanted to write this article.It’s not for the sake of excitement, nor to shout that “the bull market will come back”, but to use the simplest and most authentic way to show you clearly “what is happening now” and “what will happen in the future” in this industry in Jiayi’s eyes.

The bull market is noisy; the bear market is the magnifying glass, microscope, and demon mirror.In the emotional fog, I want to take you to a higher position to see where the future channel will be after the tide recedes.

1. Why do I say that bubbles are the biggest benefit in 2025?

There is a very conspicuous fact in 2025 that most people are unwilling to admit: we did not wait for the “copycat cow”, but ushered in a round of systematic defoaming in advance.

Many people interpret this as a bad thing, but if you extend the time, you will find that this kind of “kill first before it rises” years is actually the best period for the industry to develop a truly mature structure.

Why?Because all this is exactly the same as in the early days of the Internet, except that the speed is amplified by the leverage of crypto.

If you want to truly understand today’s crypto, the easiest way is to think of it as an “accelerated version” of the early Internet.

Many people believe that crypto’s chaos, bubbles, and speculation are the unique “original sins” of this industry.But if you stretch out the timeline, you will find that this is not a special case at all, but a standard feature of almost all technological revolutions——

The Internet was just as crazy in 2000.

I wrote an article before that talked about this logic: on the premise that leverage efficiency is amplified, the market operation methods of Web2, the Internet, and crypto are essentially convergent.However, it took the Internet twenty years to complete its journey, and crypto may be handed over in less than ten years.The same logic applies to financial markets.

1.1 Internet finance has gone through the same “incomprehensible → fanaticism → collapse → reconstruction”

If you think crypto volatility is dramatic, it’s just because you’ve forgotten the first half of the internet’s life.

In 1999, anyone with “.com” in their name could raise money.eToys soared 900% on its first day of listing, and investors were as crazy as Crypto’s early copycat season.

Then the bubble burst.

The Nasdaq dropped from more than 5,000 points to 1,114 points; media covers read “Internet Scam”; everyone said the Internet was finished.

The sentiment was almost exactly the same as today’s crypto:

-

People who don’t understand call it a scam

-

People who understand are also confused by the bubbles

-

Trample together at the end

-

Then everyone is unified in doubting the future itself

But the irony is that the real Internet era began from the moment the bubble burst.When the tide goes out, there’s more to it than just knowing who’s swimming naked.It also helped us identify the real players who were most likely to swim to the other side.

In 2002, Amazon’s stock price was only $0.60.Google is not yet public.Those companies that were left behind, in the few years when they were least visible, built real infrastructure, business models, and profit methods.

What Crypto is most like now is 2002–2004: not the hottest year, but the most critical year.

The bursting of the bubble cleared away the noise, and trends, directions, infrastructure, and real players began to enter the “construction period.”

That’s why I say: the bubble of 2025 is a boon.Because the really important stuff will only appear after the bubble.

1.2 Negation of negation: The industry does not rise in a straight line, but in an upward spiral

I particularly like the concept of “negation of negation” because it is so suitable for describing the evolution of technology and industry.

“Negation of negation”: The development of things is never a straight upward line.It’s more like “going up in circles”: every time you think you’re back to where you started, you’re actually on a higher level.

The most typical example is the three iterations of the computing architecture.

-

1950s: IBM Mainframe – Centralized Computing power is concentrated in the hands of a very few institutions – governments, banks, large enterprises.This is the first concentration: whoever has the machine has power.

-

1980s: PC Revolution – Decentralization Steve Jobs said “the computer is the people’s bicycle”.Computing power moves from the computer room to everyone’s desktop, and everyone has their own computer. This is like a denial of “centralized power.”Computing begins to decentralize, become personal and localized.

-

2010s: Cloud computing – centralized “negation of negation”, standing on higher-level AWS, Alibaba Cloud, and various public clouds, re-centralizing computing power back to the data center.On the surface, this looks like a return to the “mainframe era”; however, a few giants have mastered massive computing power.

It seems that cloud computing has returned to “mainframe concentration”, but the essence is not at the same level at all: terminal sovereignty comes from PC, elastic computing power comes from the cloud, and the advantages of the two generations of technology are integrated.

Crypto and Internet finance are now going through the exact same path:

-

The first stage: no one understands, but the direction is vaguely there

-

The second stage: everyone is crazy and the bubbles are blown to the sky (we have just experienced it)

-

The third stage: bubble burst → remove the false and retain the true → spiral upward (this is 2025)

Do you think the industry is “back”?In fact, we are not returning to the starting point, but returning to a higher “original point”.Trends, technology stacks, capital structures, and regulatory paths are all rearranged in this round.

2025, the most important signal before the next round begins.

2. 2025 is the prologue, 2026 is the main text: the real trend of the industry is taking shape

Whoever solves the direction issue of “Comprehensive Integration of Crypto x Traditional Finance” will own the world in the next five years.

The year 2025 actually feels very strange.

The K-line is very much like a bull market, but the sentiment is very much like a bear market; regulation is advancing, but expectations are declining; narratives are flying everywhere, but making money is harder than ever.

I boldly predict the future.Pure Crypto Native innovation will face bottlenecks.Real breakthroughs and effective innovation will occur in the direction of ‘Crypto ✖️ Complete integration of traditional finance’, that is, compound innovation that can simultaneously solve the needs of Web2 and Web3 financial markets.

2.1 Everything that happens in 2025 points to the same thing: the industry is “rearranging its skeleton”

Bitcoin rushed to 126,000 US dollars, and mainstream assets followed suit, but the copycats basically became colder one after another.The second level seems to be rising, but the final balance of the account has not risen… This is the most magical experience in 2025.

But when you look at 2025 from a “structure” perspective, this year suddenly becomes very clear: this is the first time that the United States, Europe, and Asia have all launched policy “acceleration” in the same year:

-

For the first time, we see the US SEC becoming friendly towards ETFs and Crypto

-

BTC, ETH, SOL, and XRP have all opened spot ETFs.The door is open

-

The Stablecoin Bill gives a clear nationwide framework for the first time

-

European MiCA has truly taken off, with dozens of licensed institutions appearing

-

RWA has become a key pilot direction for local supervision

For the first time, Crypto was institutionalized into the global financial system.The earliest OG of Crypto shouted that he hoped Crypto would enter mainstream finance.Remember the title of our article?When we talk about price, we are really talking about the future.The rise of the market again requires a new story to be fulfilled. I personally think it is “the complete integration of Crypto✖️traditional finance”

2.2 Track level: The popularity is very high and the price is very weak. This is a typical “verification period”

RWA, AI, stablecoin, L1 (it lasted less than a month), prediction market, perpetual contract, on-chain asset management, DAT… every word can trigger a short-term emotion.Emotions are emotions, and the price cannot go up.Short-term euphoria is replaced by longer-term secondary malaise.

RWA in 2025: The bottom layer is completed and the regulatory framework begins to take shape, providing “implementable” conditions for the subsequent development of RWAFi

Let’s brag about Plume’s contribution to the implementation of RWA.I use Plume as an example here, not because I invested in it, not to mention that the recent performance of secondary stocks is really mediocre.However, I always think that PLUME best represents the kind of “infrastructure moment” that happened to RWA this year.

First, Plume makes it possible for the first time for real-world assets to:

-

Enter the income system on the chain in a compliant manner,

-

Participated by ordinary users (not only institutions can play),

-

Realize on-chain distribution (cooperating with traditional financial brokers)

-

Be DeFiized, composable, and liquid.

Just to name a few developments in the past two months: Securitize’s assets have been introduced into the on-chain revenue system; products from Apollo, VanEck, and BlackRock can be used by on-chain strategies; Bluprynt’s KYI brings “issuer transparency” to the chain; becoming a U.S. SEC registered transfer agent provides a grassroots interface with the SEC/DTCC to connect to the regulatory level.These things sound boring, and users sound like they don’t know how to handle the second level of FOMO.However, essentially you only need one sentence:

As the world’s first RWA Fi Layer 1, Plume has basically leveled the mountain in front of RWA and built the “required road” for the implementation of RWA.

Because there is a team like Plume building the framework for RWA in 2025, more excellent assets under the RWA-Fi system will have a chance to really take off in 2026.

3. AI × Crypto: There are not many truly valuable parts, but the value density is extremely high

To put it bluntly, I am afraid of offending others. The AI field seems lively, but there are actually very few things of real value.

3.1 Too many false propositions

Take the grand narrative LLM, which causes the most FOMO in the market, as an example. I think the large language model of traditional AI has matured to the point that “Crypto cannot be rolled over at all.”

ChatGPT, Claude, Gemini, DeepSeek, behind these models are truly huge global capitals, which are piled up by billions of dollars of computing power, data, distributed training systems, and engineering teams.

Web3 Want to “remake an LLM”?It’s not that dreams don’t work, it’s that the laws of physics don’t allow it.And what can’t the current traditional AI large language model satisfy you?Web3 eliminates the need to reinvent the wheel.It is recommended that for this type of project, stop burning money on technology and quickly find real demand scenarios as a way out.After all, there is another typical feature of 2025: users are not easily fooled.

I hope that with an example, everyone can understand why most AI projects in 2025 are easy to “fade in vain”?

3.2 Build the foundation for the complex innovation required by Web2 and Web3 financial markets

The first direction: Build a “value incentive and collaboration structure for AI. It is built around an on-chain incentive mechanism that traditional AI does not have, a global settlementable economic system, a traceable contribution network, etc. After all, models, data, computing power, and agents all require incentives, collaboration, and distribution. This is the problem that Sahara AI wants to solve.

The second direction: Agent’s economic system and execution system, the truly strongest intersection between Web3 and AI.Or focus on the limited agent capabilities of Web2 to better solve the scenario needs of automatic decision-making, automatic execution, automatic trading, and automatic settlement.

In the Web2 world, Agent’s capabilities are currently stuck in:

-

Unable to pay independently

-

Can’t manage assets

-

Cannot be called across systems

-

Cannot perform tasks without permission

-

Behavior cannot be tracked transparently

In the Crypto world, these are native capabilities:

➡️Wallet

➡️Smart Contract

➡️ DeFi Strategy

➡️ On-chain identity

➡️ Stablecoin settlement

This is the direction that most people in the Web3 AI project are currently building: building the underlying “execution system” for the future Agent era.Starting from the implementation related to the financial scenario, it is also clear that it is the most urgent and largest rigid demand market.

3.3 The third direction: AI payment, the world’s biggest disruptive direction in the next five years

If I were to sum up the super trend in the next five years in one sentence, it would definitely be the innovation of payment methods driven by AI Agents.When the Agent starts to execute all execution instructions from humans to the application terminal for the user, such as selection, order placement, asset allocation, policy management, etc.Payment will no longer be the end point of user actions, but the “underlying capability” for the operation of intelligent agents.

In such a world, security, verifiability, global availability, extremely low cost, second-level settlement, and 7×24-hour programmable capital flow will be the basic requirements for AI Agents.

Traditional payment systems cannot do this.But with AI coupled with stablecoins and on-chain identity systems, everything becomes feasible.In the future, you will see that more and more AI applications begin to allow Agents to

-

Automatically transfer stablecoins

-

Create multi-signature

-

Set up hosting and policy

-

Manage on-chain identities

Seamlessly access the value delivery itself just like calling an API.

Even PayPal, a giant that has been doing traditional payments for decades, has begun to accelerate its layout and invest in new generation projects with “AI native payment capabilities”, such as Kite AI.Many people will say: Kite currently does not really provide payment technology services to AI Agents on a large scale. Is it just empty?

Let’s go back to the title again, “When we talk about price, we’re really talking about the future”.The real question to ask is never “how many Agents does it serve today?” but in the future economic form dominated by AI:

Who is already building the foundational capabilities needed for the future?Who is laying the foundation for the value network in the AI era?

Just like after Coinbase released the 402 protocol, dozens of “new cryptography projects” popped up within a few days.Bad currencies will overdraw market expectations in advance, because when everyone discusses prices, they represent the future in their minds.The efficiency of currency issuance in the industry, the prosperity of Crypto promoted by MEME and junk copycats, also make it more difficult for entrepreneurs.However, good projects are always scarce in the market. In this regard, increasing the threshold for entrepreneurship is not a bad thing.

4. Stablecoin: The most early-recognized track in 2025, but the most worthy of ALL-IN recognition

Frankly speaking, if there is a track that is “quiet but must be paid attention to” in 2025, it is stablecoins.I think it is still in the early stages of the narrative, and the market has not understood it at all. Most of the stablecoin-related projects that have emerged in the past 25 years are applications that are neither stable nor profitable. I personally think that the market has not yet entered the real FOMO stage.

1. The most eye-catching stablecoin event this year: It’s…the Trump family’s currency issuance

Yes, the Trump family openly issued a stable currency: World Liberty/World Finance.The less the content, the bigger the thing.

2. The real demand scenario for stablecoins in 2025 is quietly accelerating

1.National debt reserves become mainstream → Compliance is accelerated.All leading stablecoin issuers are basically moving towards transparency and compliance in their reserves.

2. On-chain payment has been “forced to upgrade”.Please refer to the AI payment content in the previous section

On-chain payment is an infrastructure that is driven by demand under the development trend of AI Agent.Please note that this market is not limited to the Web3 market.As I mentioned before, the future trend market must be a larger market that combines web2 and web3.

Once on-chain payment matures, the ceiling of stablecoins will be directly lifted.

3. Stablecoins appear “structural stratification” for the first time

In the past, stablecoins seemed to have only one logic: “Is it USDT or USDC?”

But structural stratification begins in 2025:

– Centralized Stablecoins (USDT, USDC) → Policy/Institutional Scenarios

– Exchange Stable Coin (FDUSD) → New scenarios for intra-exchange trading

– Native stablecoins on the chain (DAI, USDL, etc.) → DeFi scenario

– RWA stable currency → financial institution scenario, on-chain settlement

– Payment stable currency → AI Agent, cross-border e-commerce scenario

3. The vast majority of stablecoins are “junk projects that are hot-potting and eager to cash out.”

Whenever a track starts to be seen, a bunch of “pseudo-theme projects” will appear.In order to launch the concept coin of stable currency, the team naively thought that they had come up with a genius scenario, and then mass production of shells began on the market.Qing Yishui’s TVL subsidy activity + external packaging is actually a revenue scenario that is token overdraft. Users like to play anyway, so btcfi’s gameplay will follow the same old path as TVL’s, and it will be packaged and listed on the exchange, regardless of whether it will be a piece of cake in the future.

It is true that users will be FOMO in the short term, and it is also true that in the medium term they will be disappointed with the entire stablecoin track because of these “fake” stablecoin projects. In the long term, real giants will emerge here, and it is also true that the secondary value of stablecoins has been seriously underestimated.

There are only two core values of stablecoins: stability; usefulness.You can’t even achieve “real reserves + consensus usage scenarios”, so it’s meaningless no matter how many white papers you publish.I guess someone here said that the USDT reserve is not 1:1.Sorry, the usage scenario of USDT’s consensus is one that the Trump family cannot currently surpass.To put it bluntly, the essence of currency is that if everyone believes it is stable, it will be stable.The core of USDT is that the first-mover advantage brings the earliest market consensus and many years of “maintaining stable” operating experience.I stubbornly believe that this innate advantage cannot be overtaken by a project just by randomly deciding on an unstable asset through a so-called story.

4. The explosion of stablecoins is bigger, more stable, and longer than anyone imagined. The stablecoin track will develop in a structural form.

-

Policy recognition and strategic layout of various governments

-

Entry of financial institutions

-

Various payment scenarios represented by AI Agent, growth of cross-border payments, etc., daily payments of L2, etc.

-

The lowest cost understanding for new users to deposit Crypto; CEX reserves; OTC legal currency demand

-

RWA mass liquidation

-

Crypto ✖️ A media that completely integrates traditional finance

Let me temporarily define stablecoins as the “underlying fuel” for all future tracks.

There are many tracks that will perform well in 2025, as long as they focus on more efficient or more forms of financial investment.Gambling is human nature and the track is eternal.What matters is experience.I won’t go into details.

5. When we talk about price, we are actually talking about the future

How to use “the next 5 years” to predict current opportunities?As I write this, you can probably already feel one thing:

If you agree with me that the most important theme in the next five years is “Crypto – the complete integration of traditional finance”, then in the bear market, you should adjust from focusing on secondary prices to thinking about industrial value opportunities and pricing.Just like the earliest MATIC in the L2 sector (later renamed Polygon), it broke early and fell to SOL of 9 yuan.In a bear market, people are anxious about prices and ecstatic about future value opportunities.

What is the price pricing from a market perspective?It’s about determining the emotion; it’s about determining the ups and downs of expectations; it’s about determining the heat of the narrative.

But I think who is determining the real value proposition at this moment: who is laying the foundation for the next five years; who is building a financial infrastructure that serves both Web2 and Web3; who is embedding himself into the “financial system of the world under future liquidity integration”, rather than just enjoying himself on the chain.

So, if you agree with the logic I mentioned earlier, then there is a very direct question:

So how should we view the current price?

-

First think about the underlying logic:

In the next five years, the vast majority of unicorns will not be “pure Crypto Native giants”.

“Pure Crypto Native innovation” is the ultimate innovation on the chain in a market context that is not connected to the traditional financial market; it is also a crop driven by the economy where the foundation of blockchain or Web3 infrastructure has not yet been built.In the past 10 years of blockchain history, we have reached countless climaxes:

-

Native public chain

-

Native DeFi Lego

-

Native NFT & Game Narrative

-

Native DEX, derivatives, lending protocols

The last round of giants (exchanges, public chains, leading DeFi protocols) have basically occupied the high ground of “on-chain native infrastructure”.

Most of the things that are “purely on-chain” are either micro-innovations, reskinned, or evasive supervision.

“There are more and more new projects, but there are fewer and fewer things that are truly meaningful.”

Because true next-level innovation must meet three conditions:

-

Can connect to Web2 and serve Web3

-

Can be used by real-world users, institutions, and funds

-

It can be embedded in the real financial market, rather than just circulating within the currency circle.

In other words:

Whoever can truly connect Crypto to “real world money flow” and “real financial system” will be qualified to get the largest valuation premium in the next round.

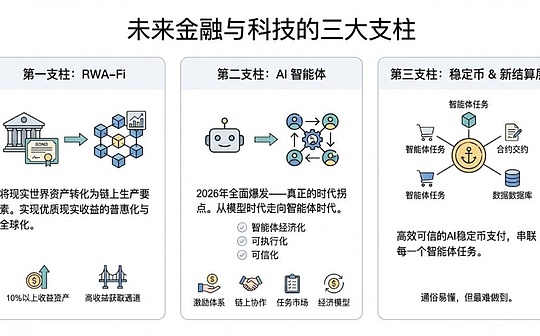

2. Based on the three main lines in the next five years, we can infer what is a “worthy track” now

Main line one: RWA-Fi → Turn real-world assets into composable means of production on the chain → Inclusive globalization of excellent real-income assets

-

A large number of outstanding assets with an annualized rate of more than 10% have not flowed into Crypto, and there is currently a vacuum.Most of these assets have high user thresholds, and many people who want to participate are limited to institutions, large investors, and nepotists.

-

U.S. and Hong Kong stocks hit new prices

-

Real linkage between currencies and stocks, not limited to pure DAT fund financing and investment logic

Main line two: AI Agent 2026 fully blossoms – a true era-level turning point

Traditional AI companies have pushed the “big language model battle” to the limit in 2023-2025.The era of models is over and the era of agents has begun.For Crypto, the future breakthrough lies in making Agent economical, executable, and credible.

-

The “large-scale implementation period” of AI Agent, especially the formal surge in financial scenarios

-

Web3 will assume the most critical part in the implementation of Agent: the economic system will become the Red Ocean – Agent incentive system – On-chain collaboration system – Agent task market – On-chain economic model (income, payment, custody)

-

Efficient and reliable AI stablecoin payment will connect every Agent Task in series

Main line three: stable currency & new settlement layer (easy to understand but difficult to do)

Summary: Finally, let’s review the core discussion of the article:

-

When we talk about price, we are really talking about the future.If you only focus on the price, the future will definitely slip away from you.

-

The bull market is noisy; the bear market is the magnifying glass, microscope, and demon mirror.

-

The bubble in 2025 is not a bad thing, it is the “fracture period” before the industry truly grows.The cleaner the bubble bursts, the clearer the future will be.

-

Pure Crypto Native innovation is close to the ceiling.The latest narrative direction of the industry in the next five years: “Crypto ✖️ Complete integration of traditional finance”

-

RWA-Fi, AI payment, and stablecoins are the three super main lines in the next five years.It’s not the hot spot, it’s the foundation.RWA, AI, and stablecoins are all accelerating the integration of Crypto ✖️ traditional finance.RWA bridges skeletons and assets, AI solves actual efficiency and implementation, and stablecoins are the underlying fuel for all innovations.

-

Crypto is changing from a “stand-alone game” to a “plug-in for real-world financial systems.”Those who can connect with real finance are the long-term winners.

-

What is really important in the AI era is not the model, but execution: payment, settlement, custody, identity, and automated strategies.Whoever provides the agent with execution power, whose AIAgent impresses users the most, will eat up the future.

-

All short-term surges are expectations; all long-term rises are structures; price is a lagging indicator, and structure is a leading indicator.

-

If you can’t read 2025, you’ll miss the entire text of 2026.

Finally, some insights from Jiayi

Thank you 2025 for this cycle of confusion, confusion, and constant self-doubt.It is this kind of “uncomfortable” that forces me to take my eyes away from emotions, re-understand the structural changes taking place behind the industry, and see clearly what is true value and what is just noise.

Thanks to the warriors who still choose BUILD this cycle.The exploration and layout you made when the industry was at its most ambiguous will be the real starting point for the “negation of negation” in the future – I believe you are the group of people who will be followed by everyone in the next five years.

I also want to thank myself and the team that fights alongside me and is tortured by me every day.Thanks to us for always maintaining curiosity about the industry, awe of trends, and uncompromising knowledge in the past few years.

Only do things you cognitively believe in, and only support people you cognitively approve of.Do not cater to the short-term market sentiment and do not betray the long-term structural logic.

There will still be fluctuations in the future, but cognition will never decline.