Author: Yue Xiaoyu Source: X, @yuxiaoyu111

The trend of currency stock integration is accelerating!

I just saw the latest information that the US listed company CIMG (NASDAQ: IMG) and FLock jointly built an AI health monitoring product.

There are actually many things you can see behind this, so here are some of your own opinions.

1. At present, the integration of currency and stocks is still in the first stage: hoarding coins.

This is a very basic form and of course the simplest way to combine.

But in the long run, it will inevitably undergo a transition from hoarding coins to using coins in the future.

Listed companies purchase cryptocurrency assets to hoard coins, and they can only rely on the long-term rise in token prices to bring narrative space to listed companies.

The key is that cryptocurrencies are very strong in cycles. When the bear market comes, the tokens will continue to fall generally, which will lead to double kills in currency stocks and a spiral decline and collapse.

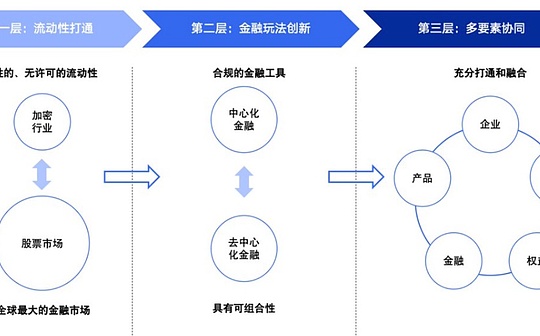

The opening of liquidity is only the first layer, and the deeper integration is the innovation of gameplay after the combination of traditional finance and decentralized finance.

Tokenization can not simply represent equity, but can also combine various equity, which can be combined with the business of the entity company.

For example, the listed company Pop Mart can hold its tokens in the future, not only can it distribute dividends, but it can also have the right to buy the physical labubu.

Stocks are not simply 1:1 mapping, but from a closed world to an open world, the chain has stronger composability and more gameplay.

This can fully open up a company’s narrative ceiling.

2. Some projects have begun to promote the transformation from hoarding coins to using coins.

From hoarding coins to using coins, a typical case is FLock.io.

This project did not stay conceptually, but made clear progress.

FLock is a decentralized AI project that has been implemented in government affairs, finance, medical and other industries.

FLock is recently bringing privacy protection AI to consumer health vertical scenarios.

In consumer health scenarios, privacy protection can be said to be crucial.

Public U.S. companies will add FLOCK to their corporate vaults, mainly because their business requires the privacy protection AI technology provided by FLock.

The two companies are jointly developing LifeNode (AI Health Monitoring and Recommended Product), a product that combines privacy protection AI and blockchain technology to directly provide users with customized health management and recommendation services.

Buying coins is to use coins, and using coins is to improve business. This is the model that can drive the coordination between stock prices and business in the long run.

3. Summarize it

It turns out that I thought the currency-stock fusion would develop in three stages:

The first phase: open up liquidity, traditional enterprises obtain global liquidity, and currency circle projects receive financial support from compliant institutions;

The second stage: An innovative financial gameplay emerges to make full use of the composability of the on-chain financial system;

The third stage: the deep integration of tokens and actual businesses, and these key elements can be fully connected and integrated.

At present, innovative financial gameplay has not yet appeared, but the combination of tokens and business has first appeared, that is, from hoarding coins to using coins.

We can keep an eye on such projects.