>

-

Metis, as the first Ethereum Rollup, adopted a decentralized sorter. With its unique value propositions, multi -aspects of surrender catalysts and competitive valuations, it occupies a unique position in the field of competitive Layer 2.

-

In the long run, Metis is expected to experience a significant growth due to the four main bullish factors: the implementation of the upgrade of the Cancun, the introduction of the spot Ethereum ETF, the introduction of the sorter pool, and the ecosystem promoted by the Metis Ecosystem Development Fundexpansion.

-

In order to explore the reasonable valuation of $ Metis, we have built a valuation model based on comparative analysis and considering factors such as the total lock value, the number of stable coins, and DEX transaction volume.The results showed that the potential price range of $ Metis was 188.17 US dollars to US $ 258.29, which shows that $ Metis may increase by 2 to 2.9 times from its current market price.

-

Looking forward to the future, Metis shows considerable growth potential.The new narrative of its sorter pool is expected to bring flow pledge and re -pledge in its ecosystem, which may catalyze new capital inflows.At the same time, Metis EDF is expected to help them shrink the gap between leaders of industry leaders such as Arbitrum and Optimism in terms of ecosystem stability.

>

Since the fourth quarter of 2023, the crypto market has experienced a significant recovery, and a variety of narratives have regained the motivation, and related tokens have also shown a strong performance.

Although Bitcoin-related narratives such as spot ETF and BRC-20/Ordinals are the main driving forces of the recent market, as the Bitcoin inscription activity slows down and the Bitcoin itself enters the adjustment period, the popularity of these narratives seems to be decliningEssenceThe changes in this market emotions provide us with an excellent timing to identify the new narrative that may become the trend in the future.

In this context, Metis has attracted our attention with its unique value propositions, multiple bullish factors, and competitive valuations compared with other second -level (L2) tokens.

In our previous report “Metis Breaking Circle into the Five of Layer2 -Behind the Secret Behind the Secret of its disruptive decentralization strategy”, we comprehensively analyzed Metis and discussed its technical characteristics and the latest development from the fundamental aspect.

This report turned to Metis from an investment perspective.The report first briefly review Metis and its main bullish factors.Next, we will explore the valuation of Metis through comparative analysis and evaluate its potential in the current market.Finally, we will provide insights on Metis’s future prospects and discuss strategies in investing on $ Metis.

>

Metis launched in May 2021 is a second -layer (L2) expansion scheme designed to optimize decentralized applications (DAPPS) and user experience.The three core features of Metis include decentralized sorters, hybrid RollUP technology and multi -functional tokens, which make it stand out among many projects.

At present, the challenges faced by the main Rollup technology in Ethereum are excessive dependence on centralized sorters. This not only violates the basic concepts of blockchain and cryptocurrencies, but also risk of single -point faults.Although networks such as ARBITRUM and Optimism have improved decentralization in developing anti -fraud and verification systems, the substantial progress in the decentralization of sorters has not yet appeared.This is not only related to the problem of network control and concentration, but also may cause risks to the entire network and encryption fields when the centralized sorter is attacked.

In contrast, Metis is walking on the forefront of decentralization of its sorter. This pioneer not only enhances security, but also shows Metis’s commitment to the community -oriented model.The decentralized sorter not only improves the elasticity of the network, but also contributes that the income of sorters is more fair distribution among users.This means that Metis takes an important step in the direction that makes the network operation and the decentralization principle of the cryptocurrency ecosystem.

>

Hybrid Rollup technology introduced by Metis in March 2023, combines Optimistic Rollup framework and zero -knowledge proof, is the top priority to develop Metis.This hybrid solution aims to combine the scalability advantage of Optimistic Rollup and the security and confirmation characteristics inherent in ZK Rollup.

In the field of ROLLUP technology, confirmation time and final determination time are two key indicators.Although the current optimistic convolution is fast, it has a long period of time due to a 7 -day challenge window.The zero -knowledge certificate can almost verify the authenticity of the transaction immediately after the proof of the proof of the proof of the proof.Therefore, the combination of these two technologies is expected to greatly enhance the expansion capacity of Ethereum.

Once the mixed convolution technology is successfully implemented on Metis, it will bring a number of major improvements.The most significant improvement is the acceleration of the final definition of the transaction, shortening the waiting time from 7 days to only 4 hours.In addition, the introduction of ZK proves will greatly enhance the security of transaction.At the same time, ZK’s efficient data management capabilities ensure that each transaction contains only necessary data, which further improves the processing capacity of the network.

>

Metis’s original currency $ Metis is unique in many second -level tokens such as $ ARB and $ OP with its diverse application function.$ ARB and $ OP are mainly used as governance tokens, while $ Metis is not limited to this. It has also expanded to the use of equity certificate (POS) pledge and network gas costs.$ Metis, as a dual -purpose tokens for pledge and gas costs, gives fundamental value itself.

With the continuous expansion and application of the METIS network, the demand for $ Metis is also increasing, which is mainly due to its actual application value in network operations.In terms of governance, although the concept of decentralization often emphasizes the importance of governance as a token function, for profit -oriented encrypted investors, the opportunity to earn additional benefits through pledge may be more attractive.Therefore, the versatility of $ Metis has increased its significant attraction for it, making it look different in many second -level tokens.

For more details about the Metis technical architecture, please check our previous reports.

>

>

For the Ethereum network, the Ethereum Cankun upgrades released this year will be a major progress. Among them, EIP-4844 is its most significant feature.The goal of the upgrade is to introduce a new trading type called “Blobs” to greatly reduce the cost of the second (L2) solution.It is estimated that BLOBS may reduce the cost of L2 by up to 90%.Such significant cost reduction is expected to promote network activity of the L2 platform including Metis.

L2Fees data shows that Metis is already the second highest choice for the cost and benefits of $ ETH, and the third low cost option for tokens.After the implementation of the Cancun upgrade, it may further enhance the advantage of Metis in terms of expenses, which is expected to drive the growth of its network activities.

>

In addition, major upgrades like Cancun often cause market speculative behaviors, especially around $ ETH and ETH Beta tokens.Market participants often actively participate in speculative activities that lead to major updates.As the main Ethereum L2 token, with the approaching of Cankun’s upgrade, $ Metis may see the inflow of speculative capital, leading to an increase in transaction activities and increased interest in the tokens.

>

The discussion of the Ethereum Etch Ethereum is increasingly valued.After being approved by Bitcoin spot ETFS, reasonable expectations of Ethereum may be the next assets that have been recognized by similar regulatory recognition.The potential approval of the spot Ethereum ETF not only symbolizes the government’s recognition and reputation, but also may cause a lot of capital inflows and push its price.

Although Ethereum is different from Bitcoin, which may make its approval process more complicated, the speculative behavior of the market may lead to multiple fluctuations when each related press release and deadline is approaching.This phenomenon has occurred on Bitcoin, and it is also likely to occur for Ethereum, especially in other narratives such as the Cancun upgrade surrounding Ethereum.

Although the approval of the Bitcoin spot ETFS seems to be a “selling news” incident, because Bitcoin is currently in the adjustment stage, the launch of the spot ETFS provides the public with unprecedented ways to enter the Bitcoin market, bringing long -term benefits for long -term benefitsEssence

>

Therefore, especially the second -level tokens of Ethereum, which have strong value -based, will benefit significantly.As Ethereum price rises, its related second -level tokens are usually called “ETH Beta”. Due to the small market value, greater benefits may be seen.With its unique characteristics and solid value propositions, Metis has potential to surpass peers in this market movement.

>

As one of its core value propositions, Metis’s decentralized sorter is the main driving force for recent market attention.At present, the sorter pool is undergoing the first stage of community testing in three stages.At this stage, users experience Metis’s DAPPS through the Sepolia Test Network. At the same time, developers perform pressure testing and optimization of the sorter pool to prepare for their official launch.

This community testing stage is an important indicator of the development of the sorter pool, which indicates that it is about to be launched.It is expected that successful deployment will have a positive impact on the price of $ Metis, because the main agreement upgrade often plays a catalytic role in the encryption market.In addition, due to market efficiency problems, prices usually continue to rise within a period of time after the announcement of such news.

The launch of the sorter pool also means that mobile pledge/pledge will be introduced into the Metis ecosystem, which has received significant attention in the DEFI field, and the growth of the Ethereum mobile pledge ecosystem in the past year can be seen.Migrant pledge provides many possibilities, such as borrowing agreement and mortgage debt locations based on $ Stmetis, or using various forms of pledge protocols to pledge $ Metis tokens.

>

These applications may significantly increase the total lock value (TVL) of the METIS network and increase the demand for $ Metis, which may create a virtuous cycle of growth.Even if Metis’s mobile pledge ecosystem does not reach the scale of Ethereum, a small part of its growth has shown huge potential.Once the mobile pledge in the Metis ecosystem starts to attract attention, $ Metis may experience a shock of supply.

>

When evaluating the inherent value of L2 token, considering the scope of economic activities supported by the Internet is very important, it reflects the use and adoption of the network itself.Therefore, incidents that stimulate economic activities in the L2 network ecosystem can be regarded as the bullish factor of its native token.

In December 2023, Metis launched the Metis Ecosystem Development Fund (Metis EDF), which is an important measure. It allocates 4.6 million $ Metis to promote the development, liquidity, activity and more wide use of the Metis ecosystem.EssenceMost funds are used to motivate sorter pledge, and about 35% are used for the development of ecosystems.

Similar measures, such as ARBITRUM’s Stip and Retropgf of Optimism, have positively affected their ecosystems.Considering that the scale of protocols in Metis is generally small, and small market value tokens usually provide higher percentage returns, Metis EDF is expected to have a significant impact, attracting users who pursue income to go to the Metis ecosystem to seek a significant gain.

Developers play a key role in the growth of the network ecosystem.Even a single popular DAPP can greatly enhance the TVL of the chain, taking GMX on Arbitrum as an example.On January 8, Wagmi announced that it would be deployed on Metis.

Wagmi was developed by well -known developer Daniele Sestagalli. Its project has attracted billions of dollars in ecosystems like Avalanche and Fantom. Wagmi transferred to Metis is considered active progress.

Although it is too early to claim that Wagmi will copy Daniele’s past success, this deployment undoubtedly adds positive factor to the growth trajectory of Metis, showing the developer’s recognition of the potential of the network.

In addition, the Metis community uses a platform called Candidac to conduct project approval to start new projects.At present, more than 30 projects in Candidac’s approval queue highlight people’s interest in the growing interest of Metis ecosystems.This also proves the founder’s confidence in Metis’s potential and ability.

>

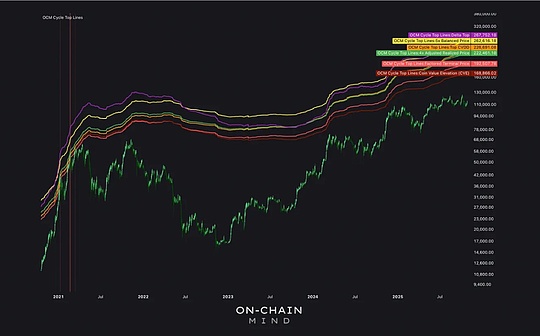

In order to discuss the reasonable valuation of $ Metis, we have developed a valuation model based on comparative analysis.This model is selected by selecting specific indicators to evaluate the relative position of $ Metis in the field of the second network (L2).The goal of the model is to assume that $ Metis reaches the industry average or median level, thereby estimating its potential price range.In addition, considering the impact of bullishness and littering factors on token prices, the model also incorporated various discounts and premiums in the calculation.

Our analysis starts with market data collecting each L2 network.These data include key indicators such as price, market value, complete diluted value, total lock value (TVL), the number of stable coins on each network, and the transaction volume of the centralized exchange (DEX) 30 days.

Based on these data, we calculated three ratios: FDV/TVL, FDV/stablecoin and FDV/transaction volume.We chose TVL, stablecoin and DEX transaction volume as the key indicators, because they can reflect the stability of a L2 network and the economic health and activity of the L2 network.

>

Our analysis then calculates the range of each indicator (FDV/TVL, FDV/Stables, FDV/Volume).This is to reduce the deviation that can be caused by the extreme value of data concentration.By considering the average and median simultaneous consideration, our goal is to be more balanced and more representative to understand the positioning of $ Metis in the second network (L2).

In order to make the analysis more accurate and consider the possible changes in the market, we introduced a discount and premium range of -10% to +10%.This range is applied to the low -end and high -end of the price range of $ Metis.

Specifically, the low -end price interval is calculated by taking the average value of each indicator or a lower number of each indicator, and it is calculated by 0.9 (representing 10%discount).On the contrary, the high -end price interval is determined by taking the average value of each indicator or a higher medium number of each indicator, and it is determined by 1.1 (representing a 10%premium).

>

When determining the final price range of $ Metis, our valuation model made a weighted average calculated based on the price estimate calculated based on the three ratio (FDV/TVL, FDV/Stables, FDV/Volume).The weight distribution is as follows: FDV/TVL accounts for 40%, FDV/Stables accounts for 20%, and FDV/Volume accounts for 40%.This distribution is based on the view that FDV/TVL and FDV/Volume can better reflect the Internet’s economic activities compared to the number of stable coins.

The result of this weighted method is the final price range of $ Metis from $ 188.17 to $ 258.29.This shows that the price of $ Metis has the potential of 2 to 2.9 times from the current market price.

It should be noted that this model and the result are based on the current market conditions and the importance of different indicators.The actual market performance may be different due to many factors, including but not limited to market dynamic changes, wider economic conditions, and Metis networks or a wider second -layer (L2) ecosystem.

Therefore, the proposed price range should be used as a rough assessment, not the exact prediction of future prices.Readers should consider this model as one of the various tools in the decision -making process and conduct their own research and analysis before making investment decisions.

>

From a fundamental point of view, $ Metis is quite attractive for its unique value propositions, multiple bullish factors, and reasonable market value growth potential.Although these incidents can be traded to make profits, this requires accurate market timing and selection of professional knowledge from entering points, especially when using leverage.

For many retail investors, an effective strategy may be in batches (DCA).This method involves regular investment in fixed amounts, which helps to gradually establish investment positions while reducing market fluctuations.

In the batch, investors can continue to invest in any market conditions, thereby reducing emotional pressure that often accompanies the timing of the market, which is particularly common in a highly volatile encryption market.This strategy can also purchase an average cost of time.When the bullish factor appears, investors may consider reducing the risk of some positions.The degree and timing of such actions should be determined based on personal investment goals, time perspectives and risk tolerance.

However, it should be noted that this strategy is based on the premise of positive views on the long -term prospects of tokens.Therefore, it is very important to conduct thorough research and due diligence before starting any investment.Considering the unpreparedness and high volatility of the cryptocurrency market, you should also ensure that only the funds you can bear the loss should also be ensured.

>

As Ethereum Rollup, which adopts decentralized sorter, Metis has significant positioning in the field of fierce competitive (L2) network.This is important to decentralized steps, showing the consistency of the core values of Metis and the cryptocurrency community.

Seeing projects like Metis not only recognize the importance of decentralization, but also actively innovate in this field. This is very exciting.

Looking forward to the future, Metis shows considerable growth potential.The concept of the introduction of flow pledge and re -pledge in its ecosystem may attract new waves of capital inflows in its ecosystem.

In addition, the Metis Ecosystem Development Fund (METIS EDF) plays a key role in accelerating the growth and development of the network ecosystem, which helps the gap between leading competitors like Arbitrum and Optimism.

Considering these development, Metis will be the focus of our attention, and we will continue to pay close attention to its progress and future development.

Reference information

[1] https://drive.google.com/file/d/1-hgl4mj8hltwv8jlt6zrz63yky14cvyr/view

[2] https://www.metis.io/blog/metis-edf-a-new-chapter-FOR-Metis

[3] https://www.metis.io/blog/introping-hybrid-rollups

[4] https://www.metis.io/blog/Metis-Pommunity- testing

[5] https://coinmarketcap.com/

[6] https://defillama.com/

[7] https://l2beat.com/scaling/summary

statement

This report is an original work completed under the guidance of @GryphsisIsACADEMY @bc082559, and was completed under the guidance of @cryptoscott_eth.The author is responsible for all the content. This content does not necessarily reflect the view of Gryphsis Academy, nor does it necessarily reflect the view of the organization who entrusted the report.Edit content and decision -making are not affected by readers.Please know that the author may have cryptocurrencies mentioned in this report.This document is for information reference only, and should not be used as a basis for investment decisions.It is strongly recommended that you conduct your own research and consult the neutral financial, tax or legal consultant before investing in investment decisions.Remember that the past performance of any asset does not guarantee future returns.