Author: Matthew Nay, Research Analyst for Messari Protocol Services; Compiled by: 0xjs@Bitchain Vision

The Bitcoin ETF will be effective from January 11, 2024, and the Ethereum ETF will be effective from July 23, 2024.

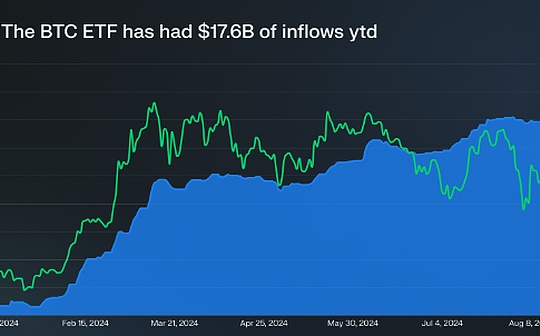

Let’s take a look at the performance of capital inflows since then and compare it to the price trends in these periods.

Data so far this week refer to the week from August 16 to August 22.

Bitcoin ETFs continue to show positive flow.

However, Ethereum ETF continues to see capital outflows.The good news is that most outflows occur within the first seven days of the transaction.

-

Grayscale’s ETHE ETF has flowed out nearly $2 billion as investors shut down transactions after the trust was converted to an ETF.In early January 2023, the actual value of the trust was once negatively premium of 60%.

BTC ETF capital inflow Vs. BTC price trend

When Bitcoin first broke $60,000 in February, inflows reached $7.4 billion.Six months later, the price of Bitcoin has been hovering between $50,000 and $73,000.

-

However, capital inflows continue, and many large institutions continue to increase their holdings.As of the second quarter, 60% of large hedge funds have disclosed their holdings in Bitcoin ETFs.Millennium disclosed holdings of over 27,000 BTC.

BlackRock has the most inflows of IBIT ETFs, reaching $20.6 billion, while Fidelity has the second largest inflow of FBTC, reaching $9.8 billion.

-

Since Grayscale’s transition from trust funds to ETFs, they have flown out $19.7 billion as investors turn to lower-cost ETFs.Grayscale costs 1.5%, while the second highest cost is 0.25%.

ETH ETF inflow Vs. ETH price trend

on the other hand,The story of Ethereum ETF is completely different.

on the other hand,The story of Ethereum ETF is completely different.

There is controversy over whether L2 is beneficial to Ethereum or harmful, and rumors about Solana and Avalanche ETFs being approved in the United States have also begun to heat up.Brazil has approved two Solana ETFs.Bloomberg ETF analysts say the likelihood of more crypto ETFs being approved depends on whether there will be leadership changes in November this year.Currently, the Solana ETF on Polymarket is 6% likely to be approved in 2024.

The rest of the year will be crazy, and all we can do now is to wear a seat belt and enjoy the journey!

Inflows are negative, and Ethereum price has fallen by 24.7% since the ETF was founded.

-

However, BlackRock continues to dominate the ETF market.They have injected $1 billion into ETHA, and the inflow of Ethereum ETFs has reached $1.8 billion without including outflows from Grayscale products.At this time, the crypto community has differences over the future of Ethereum as the dominant smart contract platform.