Author: Revc

Although the DEFI leading position has dropped to the lowest level in three years, the percentage of the market value of Defi accounted for the global cryptocurrency market value has fallen to 2.84%.However, in the past month, the DEFI track agreement has been supported by the agency’s large financing support, indicating that in the current market environment, the institution is still optimistic about the CEFI agreement’s cash blood vessel.New trend.

oneAs well asMorpho

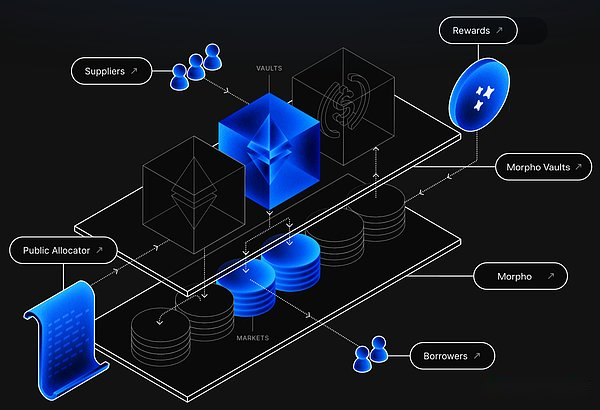

MORPHO is a decentralized finance protocol, which aims to optimize the efficiency of the lending platform.It directly matches the user with the best interest rate to achieve higher capital efficiency and lower mortgage requirements.The design goal of Morpho is to increase the overall yield of the lending platform (such as AAVE and Compound).The official website shows that its total loan amount has reached8DollarsEssence

MorphoIn the near futureAnnounce the completion of the $ 50 million strategic rotation financing, Ribbit Capital led, A16Z Crypto, Coinbase Ventures,Variant, Pantera, Brevan Howard, Blocktower, and Kraken Ventures participated in the investment. The specific valuation information has not been disclosed.

>

Features

Direct matching mechanism: Morpho directly matches the borrower and the lender through its agreement to achieve higher interest rate returns and lower loan costs.Optimize the utilization of funds.

Seamless integration: Morpho can be seamlessly integrated into the existing lending platform. Users can enjoy optimized interest rates without transferring funds between protocols.

twoAs well asVessel

Vessel is a decentralized finance protocol,The aim is to optimize borrowing and liquidity management through innovative ways.It builds on the existing Defi ecosystem to provide users with higher capital efficiency and optimized interest rates.

VesselIn the near futureComplete the $ 10 million seed round financing, Sequoia Capital, Scroll co -founder Sandy Peng and Ye ZHANG, Avalanche Foundation, Algrand Foundation, IMO Ventures, Folius Ventures, Incuba Alpha, and a group of angel investors participated.The funds of this round of financing will be used for: combining CEX efficiency with DEX transparency, improving liquidity efficiency, and developing advanced ZKP solutions for DEFI.

>

Features

Interest rate optimization: The interest rate optimization function provided by Vessel can help users get the best borrowing interest rate under various market conditions.Through smart contracts, dynamic adjustments to interest rates are achieved to ensure efficient use of funds.

Liquidity management: The platform supports users to participate in multiple liquidity pools and provide flexible liquidity solutions.Automation tools help liquidity providers (LPS) optimize their income.

Seamless integration: VESSEL is designed to seamlessly integrate into the existing DEFI protocol and platform, providing wider market options.

threeAs well asEssential

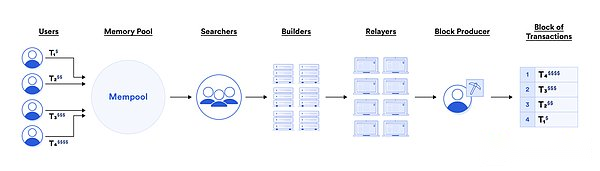

Essential is an intention to build an infrastructure and tools based on the transformation of the concentratedization of the existence of MEV from the transformation of the intention to satisfy the intention of the intention.The goal of Essential is to minimize the extrusion behavior and maximize user satisfaction.

EssentialIn the near futureAnnounce the completion of $ 11 million in Series A financing,Archtype led by, iosg, Spartan, Mirana, Amber Group, Maven 11, Bodhi Ventures, Big Brain Holdings, Heartcore Capital, Selini, DCLM, and PropellerHeads, and from Celestia, Hashf LOW, ENSO, Barter, LI.Fi, Astaria, Gluex,The founders and angel investors of Bebop, Sorella participated in the investment.

A new round of financing will be used to promote the goal of Essential, that is, by re -designing blockchain interconnection from the first principle, the global developers and users are easier to understand and use blockchain technology by statement and intention -based architecture.Essential also introduced Pint, which is a constrained programming desire that allows developers to directly restrain the status on the Essential blockchain.In the field of web3, the openness of the Essential technology stack provides possibilities for developers to test in the declaration environment for the first time.

>

Features

Smart Contract Management: EssentialProvides the writing, testing and deployment tools of smart contracts, so that developers can manage the contract life cycle more efficientlyEssenceSupport a variety of blockchain networks to ensure compatibility and flexibility.

Development tool kit:Including a set of tools for building and testing DAPP, including IDE integration, debugging tools and simulation environments.Support mainstream programming language and framework to reduce the threshold for development.

Decentralization storage: Provide decentralized storage solutions to ensure the security and persistence of DAPP data.Through the integration of decentralized storage networks such as IPFS, developers can easily realize the upload and management of data.

Authentication and permissions management: Essential provides secure user authentication and permissions management tools to ensure the user access security of DAPP.Support multiple authentication methods and permissions control models.

Analysis and monitoring: Real -time analysis and monitoring tools help developers track the performance and user behavior of DAPP.Provide detailed report reports for developers to optimize.

Four, Chaos Labs

CHAOS LABS is a platform that focuses on protecting and optimizing decentralized protocols and capital efficiency.Its service packageIncluding risk management, simulation, analysis platforms and tools to help decentralized finance (DEFI) projects and agreements respond to challenges in market risk and mechanism design.

Chaos labsexistA round A financing led by the venture capital company Haun Ventures raised $ 55 million in round A financing,Other participants include F-Prime Capital, Slow Ventures and Spartan Capital, as well as LightSpeed Venture Partners, Galaxy Ventures and PayPal Ventures.Chaos Labs also received the support of angel investors such as Anatoly Yakovenko and Phantom’s Francesco Agosti.

>

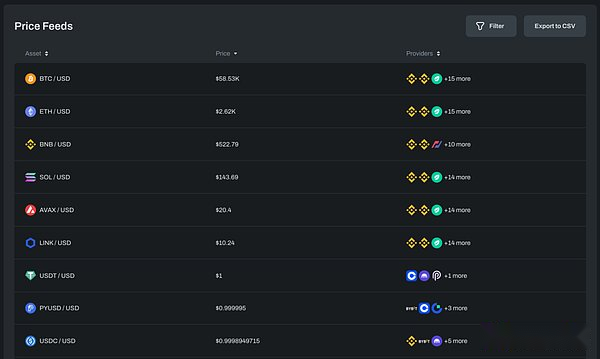

CHAOS Labs’s current main product is Oracle Risk Portal, which aims to help the DEFI protocol management and prediction machine -related risks by providing real -time risk analysis and monitoring.

Features

Real -time risk analysis: Provide real -time risk analysis of various data sources of various prophecy machines, and help agreements to identify potential loopholes and risk factors.Comprehensive analysis of market dynamic data and historical data.

Monitoring and alarm system: Real -time monitoring of data flow and price updates to ensure the accuracy and timeliness of data.Provide alarm mechanism to notify the agreement operator in time when abnormal or potential risks are detected.

Simulation and testing environment: Provide analog environment to perform the performance and stability of testing machines under different market conditions.Help protocol developers optimize the use of prophecy machines and reduce operating risks.

Reports and indicators: Provide detailed reports and risk indicators to help the agreement better understand the operating and risk status of the prophecy machine.

Recently, other large -scale financing projects worthy of attention include: Get the Union Square Ventures of $ 15 million in Sling Money; Parafi Capital, a $ 10 million encrypted infrastructure company Parfin;Sahara AI, a $ 43 million in financing blockchain platform.