Author: jaden, jill, LD Capital

1. Basic introduction

Solana is based on POH’s Layer1 blockchain. It focuses on high -energy efficiency, high transaction speed, and low costs. It was founded in 2017 by former Qualcomm executive ANatoly Yakovenko.After the FTX mine, the price of SOL tokens and the entire ecology suffered a fatal blow. In the last year, the Solana ecosystem was in a state of extreme downturn.

At present, Solana ecology has restored its vitality, mainly including the following reasons:

1) The overall market recovers.According to Artemis data, on October 1, 2023, the market value of the stable currency in the blockchain market was 130B, and the market value of the stable coin in the fourth quarter of 2023 increased to 135.5B. As of March 36, 2024, the number of stable coins in the market increased to the current current.156.5B.The market value of the stable currency on Solana increased from 883.9m to 97.5B, with a growth rate of about 170,000%.

2) A number of new projects appear in ecological projects, which attracts users with potential airdrops.Jupiter, the largest trading polymer on the Solana chain, announced in January 24th that the airdrop, BONK, airdropping the SOGA mobile phone holder, and a series of new protocols in the Solana ecosystem, Drift Protocol, Backpack, Maginfi, Magic EdenBefore issuing coins, it has caused users to interact enthusiasm for new projects in Solana ecology.

3) High -performance characteristics have prompted Meme culture to prevail.As the price of ETH tokens rises, the Ethereum chain interaction fee is too high compared to other public chains and the second floor, which prompts non -giant whale users to disperse to other chains.Bonk, as the first MEME tokens on Solana, has a market value of $ 1.5 billion in mid -December. The MEME rich effect on Solana has begun to spread.

Second, tokens

The total amount of SOL tokens was 573 million, with 444 million circulation, and 360 million token pledge.The current market value is 87.2 billion US dollars, which has exceeded the previous round of bull market high.

Three, ecology

The current Solana TVL is $ 4.99 billion, and the ecology is in a stage of rapid recovery.It is only one step away from the last bull market’s TVL high.The number of daily active users and the number of new addresses has continued to reach a new high since May 2022.The number of active addresses in March 2024 was 3743, and the number of new addresses was 2784.

Meme

Meme, Chinese is “the cause”, is defined as “the basic unit of culture, which can be transmitted through non -genetic methods, especially imitation.” In Internet society, the cause is considered to be a culture that can cause viral transmission., Form can be language, pictures, videos, behavior, etc.The replication characteristics of the cause should have three characteristics, namely genetic, mutation and selection.After the use of spontaneous screening information, it is difficult to get the information that they recognize the information. It is difficult to get the information that the public recognize will often fade out of the public’s attention, thereby achieving cultural genetics and choices.In the process of dissemination, the characteristics of re -creation should be possessed so as to realize the re -creation of culture.In addition, it is necessary to pay attention to the force of subconscious emotions. Only when there are enough transmitters and fully add their emotions and emotions, can it be possible to reach the outbreak result.

The MEME tokens with the top 100 market value are Doge, Shib, PEPE, WIF, Floki, Bonk.Except for the MEME tokens on Ethereum, only the market value of the Solana Meme tokens entered the top 100.In the Meme culture of the blockchain, the “Doge” dog culture can be regarded as the original cultural unit. Shib and Floki are the dog culture on the Ethereum chain, while Bonk and WIF are re -created by dog culture on Solana.EssenceThe WIF community contains a wider range of community foundations, so it surpassed Bonk in the later period and became the leader on Solana.

Market value (data is taken from Coingecko; March 24, 2024)

Dogwifhat (wif)

Dogwifhat’s factor map was originally popular between the Night of the Fortress and the players of the Rocket Alliance.On November 6, 2019, the Fortress Night Professional Player ISSA first set his Twitter’s personal information picture to a Shiba Inu photo wearing a pink woven hat. Twitter users @Vapurly commented “Dogwifhat”, and then released “Join Dogwifhat”Twitter content.Subsequently, a large number of influential celebrities used this picture as a social media avatar, including the Fortress Night anchor VRAXITO, the Rocket Union player Spoodah, NXTSABO and so on.

Dogwifhat tokens were inspired by the picture and launched in November 2023.On March 1, 2024, Robinhood announced that it would add new support WIF on its encryption platform.On March 2nd, Arthur Hayes, co -founder and CEO of the cryptocurrency exchange Bitmex, issued a push that he was optimistic about WIF.

Bonk (bonk)

Bonk was launched on December 25, 2022 as a Christmas gift for the Solana community. 50%of the tokens used for airdrops. The purpose of the project challenged the leading position of VC tokens and opposed low -circulating high -inflation tokens.

The Bonk token is highly accepted in the Solana community. It is accepted as a payment option for NFT by the Penbook and ORCA platform as a pledge of NFT for platforms such as Solfarm and Bonkstake.BONK also expands its further influence by airdropping the airdropping of the Solana Saga encryption.

BOOK of Meme (BOME)

Book of Meme is a CC0 MEME library, which can also be decentralized social networks, which can link all NFTs, and mini GIFs on the Solscan network, which is issued by PEPE Meme artist Darkfarm.The project was originally planned to raise 500 SOL, and finally raised a total of 10,131 SOL.All the raised SOLs are added to the LP pool, which provides good initial liquidity for it, so that giant whales can easily participate in the transaction.

SLERF (SLF)

On March 17, SLERF released the news of fundraising through its Twitter account. It successfully raised more than 50,000 SOL. The funds raised will be used for pre -sale, and the other half is injected into the liquidity pool (LP).The rules of the MEME project are consistent, and there is no color.However, on the 18th, the founder of the SLERF project @slerfsol announced in X that the operation error caused the LP and airdrops to be accidentally destroyed and the coin permissions were permanently removed. This incident became a catalyst for SLERF’s soaring price.

MyRo (myro)

Named after the pet dog Myro, the co -founder of Solana co -founder, Raj Gokal.MyRO holders can use tokens to purchase limited edition MyRO products, including T -shirts, hats and sweaters.The project also regularly organizes community activities, including voice chat, forums and competitions to strengthen community cohesion.The team chooses a 0%transaction tax on the tokens to ensure that users do not incur additional costs when dealing in transactions.In addition to abandoning contract ownership, developers also burned their LP tokens, which further strengthened the decentralized attributes of the MEME token.

Wen

Wen is a MEME tokens based on the LFG Launchpad platform launched by the Jupiter project.

The tokens are allocated as: 70%for airdrops. The airdrop objects include Jupiter users, OVOLS NFT holders, blue chip NFT holders, Genesis Saga NFT holders, MockJup test users, etc.20%is used to build liquidity in DLMM; 10%is retained to the treasury, of which 0.75%of the Wen will be given to the Jupiter Dao, and 0.25%will be given to the Jupiter team; after the airdrop application is completed, all unsubscribed wen will be destroyed.

DEX

Jupiter (jup)

Brief introduction: Jupiter was launched as a DEX polymer on Solana in September 2021. It aims to provide a better trading experience for Solana users by transmitting liquidity from multiple sources.At present, the four major functions of transaction aggregation, price limit, DCA/fixed investment, and Jupiter Start.

According to the ranking of coingecko decentralized exchange trading volume, Jupiter’s 24 -hour transaction volume is only lower than Uniswap, occupying the second place, and recently surpassed Uniswap several times.On the one hand, due to the hotness of the Solana ecology, the transaction volume is extremely active, and on the other hand, due to its good liquidity, Jupiter has now become the first choice for Solana user transactions.

In order to allow the Jupiter community members and users to learn more about the new projects in the Solana ecosystem, Jupiter launched the Jupiter Start business. One of the key functions Launchpad launcher (LFG) has been launched, and it is currently the only active self -brought launch on Solana.DEX of the stage.At present, LFG Launchpad has opened the first round of voting on March 7th to issue its tokens for the supported candidate projects. The first round of candidate projects is Zeus Network, Sharkyfi, and Uprock.Zeus Network has confirmed that LFG LAUNCHPAD will be launched.

In the voting process designed by Jupiter Dao, Jup holders are locking the JUP token to obtain the voting right and actively vote for the proposal and LFG candidate project without the minimum pledge limit.There is a 30 -day cooling period for pledged currency unlocking, and voting can still be participated during this period, but the voting right will gradually decrease.

Jupiter plans to allocate 100 million Jup tokens and 75%of Launchpad costs to pledges.According to the historical data of Jupiter DAO, there are about 22,000 wallet addresses in the first round (March-June) voting for pledge.Wen) is distributed and distributed, and the other 50 million will be used in the next quarter, which means that the pledge yield in the first round (90 days) of JUP can reach at least 84%(0.5/2.4/90*100%*365).

And Jupiter set up Jupiter Labs for incubation infrastructure. The currently tentative products are derivatives DEX and LSD stablecoins. LABS is independent of Jupiter and eventually operates independently.Derps PERPS is similar to the GMX V1 protocol. It has launched the BETA version and supports three assets of SOL/ETH/WBTC. The most active SOL transaction has a 24 -hour transaction volume of 200 million US dollars. It is enoughMore market users and funds.The stabilized currency protocol XYZ has not yet been launched, and users can use mortgage SOL to cast a stable currency SUSD.

At present, Jupiter has aggregated most of the transaction volume on Solana, and under its huge user traffic and project resources, Jupiter Start and Jupiter Labs can promote the improvement of the Jupiter and Solana ecosystem, and can form a certain extent.The linkage effect further expands the market potential of Jupiter.

Team and investment:

The main staff of the team are Meow and Ben Chow, and the two set up a Jupiter in May 2021. At the same time, they are also members of the METEORA on the liquidity platform on Solana.Jupiter has not announced any financing.

Token condition:

The project was officially issued on January 31, 2024. The total token was 10 billion pieces, of which 40%were allocated to the community through 4 rounds of airdrops.Subsequent airdrops are still expected to motivate users.

The current market value is $ 1.605 billion, and the mainstream exchanges on the line include Binance and Gate.JUP’s circulation was 1.35 billion. The first round of voting pledged 240 million tokens, which was equivalent to locking 18%of liquidity, and there were fewer chips in market circulation.Under the action of high yields and reducing circulation, it may further promote the rise in JUP token prices.

Raydium (ray)

Introduction: Raydium is the first AMM and liquid provider built on Solana. Its core product is Raydium DEX.The uniqueness of Raydium is that the integration of the order book book enables market participants to be more flexible to trade digital assets, and Raydium’s liquidity pool contributes the order book of Serum, which enhances the overall liquidity.This integration ensures that anyone on Serum can trade orders on Raydium, and vice versa.

Raydium also comes with the Launchpad launcher function. It was the most popular DEX on Solana. The previous hot Star Atlas game project also completed IEO on the platform.Raydium Playing a new pool can be available for Ray Pool and Community Pool. Community Pool is to complete some social platform interaction tasks according to the requirements of the project to participate in IEO.Ray tokens empower.

However, the project suffered a hacker attack in December 2022, lost about 4.4 million US dollars, and then compensated investors through the project treasury.Due to the decline of the Solana ecology and the negative impact of hackers, Raydium entered a period of development, and its market value was once surpassed by ORCA.

Team and investment

RDYDIUM’s team has many years of experience in the quantitative cryptocurrency and the market in the market, and is introduced by the FTX team into the Solana ecosystem.Raydium has not announced the relevant financing amount.

Token condition:

The total amount of Ray token was 555 million, launched on February 21, 2021.The current market value is 500 million US dollars, FDV is 1.07 billion US dollars, and token circulation has reached 46.7%.In the Ray economic model, 22%of the tokens are assigned to teams and consultants. It is reported that this part of the tokens have at least 3 years of locking period, which means that some tokens in the team may face unlock in 2024.

Depin

NoSana (noS)

Introduction: NoSana is a distributed GPU network that allows anyone to rent computing power. By using the potential ability of global idle GPUs to realize the GPU computing power on demand, solve the problem of GPU shortage in the market, provide AI users with a Yuan universe projectThe required computing resources.

NOSANA’s goal is to combine AI with blockchain technology to meet the demand for the growing GPU unit in AI reasoning.

With the explosive growth of the AI field, Nosana has quickly shifted to AI reasoning, so the token price has achieved relatively good performance.

According to data data from NOSANA browser, from mid -December 2023 to March 2024, the NOSANA AI reasoning shows a strong demand.

Token condition:

The total amount of NOS tokens is 100 million, with a current market value of 410 million US dollars and 83%of circulation.The mainstream exchanges on the line include Gate and Mexc.The liquidity is mainly concentrated in Raydium.

NOS is Nosana ecosystem native currency, which is used to pay service fees and purchase computing resources on NoSana. It also needs to have NOS tokens when deploying AI reasoning on NoSana.At the same time, NOSANA provides violin pledge for users to earn rewards.In the cost generated by the NOSANA network, 2%are used to reward NOS pledges, and NOS tokens can capture certain value in the NOSANA network.

Helium (hnt)

Brief introduction: Helium aims to promote the deployment of miners to deploy hotspots through corresponding incentives, provide wireless network coverage, and provide low -power, wide -coverage wireless network access for IoT equipment, and reward miners through original coverage mechanisms.Helium’s potential and prospects come from its mining mode. Its original POC (Proof of Coverage) is a type of optimized POW mining mechanism. It can also be regarded as a geographical POW mining mechanism.The energy consumption is low, and there is no need for a lot of electricity. The threshold for mining is extremely low, so it is welcomed by users.

On April 20, 2023, Helium network completed the migration of the Solana network, the strongest ecosystem and the strongest narrative dual BUFF superimposed.The current community covers nearly 990,000 hotspots and 400,000 active hotspots.

The 2024 DEPIN Global Hardware Conference will be held on April 8th in Digital Port in Hong Kong. The Helium Foundation CEO ABhay Kumar has been confirmed to attend.

Team and investment:

The Helium project was established in 2013. The project headquarters is located in San Francisco, USA. Since 2014, Helium has completed at least 4 rounds of financing. In 2022, it has completed $ 200 million in round D financing for $ 1.2 billion.They are very dazzling. Participating companies include A16Z, Multicoin, and Google Venture Capital.

Token condition:

HNT tokens have a total of 223 million, with a circulation of 163 million and a market value of 980 million US dollars.HNT is the main economic asset in the Helium ecosystem. The only way to pay network data transmission is to burn HNT.

Helium Mobile (Mobile)

Introduction: Helium Mobile wants to be a decentralized 5G network operator. It inspires individuals to share hot spots through tokens and use countless small scattered hotspots to replace large base stations, thereby achieving low -cost and high -coverage networks.Mobile is the Helium Subdao governance tokens. It introduces a broader Helium network through the community proposal HIP53. This token is proven by data transmission and coverage by 5G-CBRS and WIFI hotspots.The network proposes the mechanism of determining the tokens reward, which reduces the possibility of rewarding the device for air fraud to some extent.The project was in the early days, and the equipment participating in the network was very limited.

Token condition

The maximum supply is 230 billion pieces, and token mining starts from August 2022, and is halved every two years.Both hot spots and service providers must pledge MOBILE tokens to join the network.At present, token circulation is 85.6 billion, and the circulation rate is 37%, and Coinbase has been launched.

Shadow token (shdw)

Brief introduction: Shadow is a stable high -performance cloud platform developed by Genesysgo, which is supported by decentralized operators.Shadow Drive is decentralized, high -performance and scalable objects designed for Web3 builders.Shadow’s Solana RPC is built on the network of independent operators. By paying calculations directly to ecosystem operators, it truly decentralized the back -end API.

Earlier, NFT and other storage activities were carried out on Solana, and third -party storage solutions such as arweave and Filecoin were often used, but they were independent storage chains that were not compatible with Solana. Storage activities were paid with their own tokens.ShadowDrive is the original reserve system of the Solana ecosystem. It is designed to meet the growing demand of Solana’s growing storage of ecosystems.

According to the official documentation of the project, Shadow Drive’s storage costs are cheaper than any similar project on the market. On the one hand, thanks to the low cost of Solana’s GAS, on the other hand, due to the reasonable decomposition, scheduling and scheduling of storage tasks of ShadowDrive,Arrangement, here is involved in the data distribution and consensus engine of the project D.A.G.G.E.R. (Direct Acyclic Gossip Graph Enabling Replication), which can optimize fast data access and file processing to make the stored efficiency higher.

On January 17, 2024, the official announced the launch of the ShadowDrive V2 and D.A.G.G.E.R test network, and the project party provided a total of 600,000 SHDW tokens used to motivate node operators and users who contributed.

In addition, GenesysGo officially bluntly stated on the X platform’s mission in the first half of 2024 to deploy ShadowDrive V2 and D.A.G.G.E.R to the main network. The task in the second half of the year is marketing, marketing, and marketing.

Token condition:

The total number of tokens of SHDW is 169 million, the current circulation has reached 96%, the market value is 220 million US dollars, and the FDV is 230 million US dollars.It has not yet been launched on the mainstream centralized exchange, and the liquidity is mainly concentrated on Raydium.

Solchat (Chat)

Introduction: Based on the SOLANA blockchain communication protocol, users can perform voice calls, text messages and other operations through the Web3 environment, and all group chat information is stored on the chain. The user will perform encryption for privacy protection each time.It is currently in V1 version. It is expected to release V2 version soon. V2 is the final version. It will reduce the functions of use costs, support group chat, and add NFT avatars.The V1 version of the wallet and the wallet before the Facetime communication successfully prompted its token prices to rise.

Token condition:

The total amount of tokens is 10 million, 50%for pre -sale, 10%as LP, 10%assigned to the team, 10%for marketing, and 10%for centralized exchanges.The current market value is $ 90.6 million.

Solchat introduced a pledge mechanism that users can pledge it to the pledged pool to obtain 80% of the income share in the total pool.

Solcard (SOLC)

Introduction: Solcard is an encrypted virtual card that supports SOL recharge and KYC without KYC. The encrypted virtual card supports online shopping.Solcard charges a 5%handling fee for each user’s deposit, and plans to return 50%of the charge to the SOLC token holder.WeChat supports SOLCARD binding payment to promote its price to rise.

Token conditions: The total amount of tokens is 100 million, 80%are used for fair release, 10%are used for marketing, and 10%are used as reserves and operations.The current market value is 16 million US dollars.

Liquid pledge protocol

Since ETH has become a living asset after ETH to POS, the threshold for individuals directly involved in the pledge is high, and the pledge service launched by the exchange is highly centralized.Use and increase the use rate of funds, so as to be favored by the market.The inflation model of the SOL token economic model also inspires SOL holders to pledge its bilateral currency.

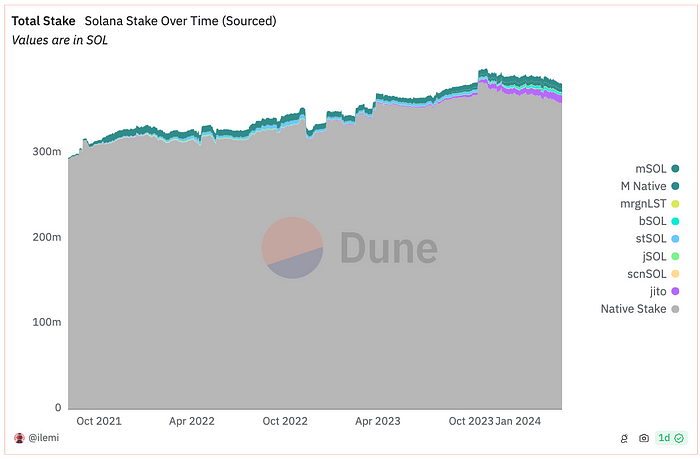

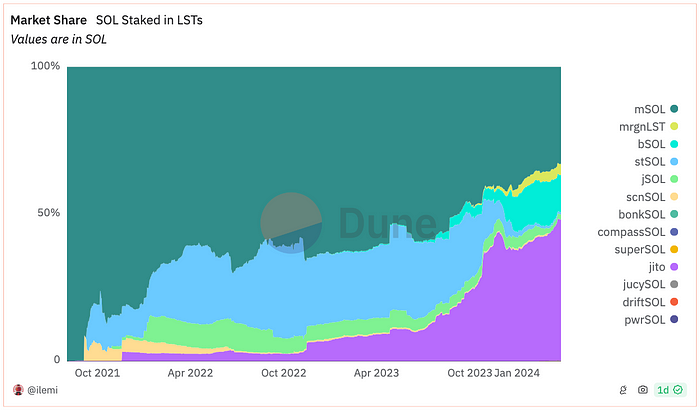

The number of SOL pledge reached a historical peak on October 30, 2023, with 398 million pieces.Due to the rise in the currency price, some tokens were selected for pledge. At present, SOLANA pledged 380 million SOL, of which 357 million pieces were pledged directly through nodes, and 23 million SOL pledged through the liquid pledge agreement.Among them, the three largest liquidity pledge protocols are Marinade Finance, Jito Network and Blazestake.

Jito network

Introduction: Jito Network is a liquid pledged agreement launched by Jito Lab. Jito provides pledged income for pledges and can capture the MEV income in the Solana network.Its products include: client Jito Solana, Jito Bundles, blockchain builder Jito Block Engine, MEV allocation system.Because its MEV business can distribute part of the MEV income to JISOSOL, the user income pledged through JITO is relatively high.The agreement TVL increased rapidly by November 2023. The number of pledges in the airdrop snapshot fell, and the number of pledge after January increased slowly.According to Dune data, Jito is currently the largest liquidity pledge agreement in the Solana ecosystem, with a pledged SOL number of 9.16 million pieces.

Investment institution:

Seed wheels received $ 2.2 million in financing.

A round A financing received $ 10 million, led by Multicoin Capital and Framework Ventures, and the co -founder of Solana Ventures and Solana Labs, Anatoly Yakovenko.

Token condition

JITO’s native token is JTO. The current market value is 331 million US dollars. It was officially issued on December 7, 2023. The total supply is 1 billion, and the current circulation is 11.7%.34.3%of the total amount of tokens are used for community growth; 24.5%are allocated to core contributors; 25%are used for ecological development; 16.2%are allocated to investors.100 million of the tokens assigned to the community are used for airdrops, 80 million pieces are assigned to Jitosol holders, 15 million pieces are assigned to verifications running Jito client, 5 million pieces are used to search for Jito MEV search to search for Jito MEV.For those.

Marinade

Introduction: It was officially launched in August 2021. It is the earliest mobility pledge agreement in Solana. Users can pledge SOL on the MarinaDe platform and obtain MSOL.MSOL’s unlocking time is usually 3 days, which is consistent with the EPOCH time of the SOLANA network pledge.MarinaDe also provides native pledge services that allow users to obtain pledge income without using any smart contracts (there is no LST).The number of SOL pledged on MarinaDe is 6.23 million.

As the earliest pledge agreement on the Solana chain, the maximum pledge volume of SOL in the history of MarinaDe was about 9 million, and subsequent was subsequently impacted by the pledge platforms such as Lido and JITO, and the business maintained a relatively stable level for a long time.The marketing capabilities are relatively average, so the market attention has been low.

Token conditions: The total amount of tokens is 1 billion, and the market value of circulation is 78 million US dollars. It has launched Coinbase.The token distribution of 35%(3.50 million) is allocated to liquidity mining, and about 0.17%(1.7 million)) awarded MSOL holders per week.

Blazestake

Introduction: Blazestake was launched in May 2022.On the Blazestake platform, there are two options for pledges: one is to join the standard entrustment pool, and the other is to choose any authenticator for SOL pledge.In any way, pledges can get BSOL as a proof of its liquid pledged income.The network pledge of the platform increased rapidly in November 2023, increasing from 600,000 SOL to 2.39 million SOL, with a growth rate of 400%, which may be hinted on the platform to carry out airdrops.

To token information:

The total amount of tokens is 10 billion, and the current market value is 19 million US dollars.No other token information was found.

Prophetic machine

Pyth network (pyth)

Introduction: Pyth Network is a price prediction machine solution developed by Douro Labs. The protocol product mainly serves Price Feed, Benchmarks (provided historical data on the chain and under the chain), and Entropy (random number).The Pyth network uses the first -party data network to publish data to Solana and PythNet, which supports data sources from traders, municipal merchants and DEFI protocols.Pyth uses the “push” model to solve the problem of traditional “pull” models, reducing delay, scalability and network costs.

In February 2024, Pyth’s transaction volume accounted for nearly 20%of the Solana network. Due to the popularity of the Sorana Meme tokens in March, Pyth’s transaction volume still accounted for nearly 10%of the Solana network.Because of its extensive partners, multiple agreements have announced that they will conduct token air investment on Pyth pledges.

Investment institution:

In December 2023, it was announced to complete strategic financing. crypto companies such as GITAL participated in the investment, and the amount of financing was not disclosed.

Token conditions: The maximum supply of tokens is 1 million, and the current token circulation rate is 15%. The next time the token unlocking time is May 20, and the circulation will increase to 36.2%.The pledged Pyth token can participate in the polling of the agreement governance. The current pledge volume is 127 million, accounting for 8.4%of the circulation.

Parallel EVM

Neon (neon)

Introduction: Neon is a Ethereum virtual machine on Solana, which is compatible with EVM. It allows developers to use Ethereum tools to build and deploy decentralized applications (DAPP) on Solana, which is built by NEON LABS.

Neon created an EVM code execution environment. Its working principle is to introduce the motivated Neon EVM operator to the Solana blockchain, which represents the Ethereum DAPP user to promote transactions.These operators receive transactions similar to Ethereum using Neon EVM DAPP.Then pack them into Solana transactions, and finally send these transactions to the Solana blockchain for execution.

Neon EVM allows DAPP based on Solidity and Vyper to use the advantages of the Solana network: low costs, high transaction speed and parallel transaction execution capabilities.

Team and investment

Neon CEO Marina Guryeva is a master’s degree in European Business Administration. CTO Andrey is a computer science in control system. Both have rich blockchain work experience.

NEON completed the 40 million US dollars of financing led by JUMP Capital, Three Arrows Capital, Solana Capital, Ideo Colab Ventures, which was led by Jump Capital on November 9, 2021.Later, on November 11th, the German blockchain incubation company Advanced Blockchain Ag announced that he had invested Neon Labs through his subsidiary.

Token condition:

The total amount of NEON tokens is 1 billion, the current circulation accounts for 5.77%, the market value is US $ 100 million, and the FDV is 1.74 billion US dollars.The NEON token was launched on July 17, 2023. The current part of the circulation is basically 5%of the public offering. Seed wheel investors, early contributors, teams and other related interests have a one -year lock -up period.Linear unlocking, unlocking period on July 17, 2024.

NEON’s main liquidity field is at Gate.io and ORCA, and on March 27, Coinbase included SHDW and NEON tokens in the upper map of the Shangbon.