The yen exchange rate has plummeted in recent years. The listed company Metaplanet has announced many large-scale purchases of Bitcoin since April, and its actions are frequently considered to be following the example of the American company MicroStrategy.

Transform to invest in Bitcoin

As of May 23, Metaplanet Company held a total of 141.07 bitcoins with a market value of approximately $9.6 million.Metaplanet CEO Simon Gelovich said in a recent interview that although becoming the Japanese version of MicroStrategy is a difficult goal, he hopes to provide Japanese investors with opportunities to access Bitcoin investment through a similar strategy.

Recently, Metaplanet quickly drove market sentiment after transforming into Bitcoin, and was driven by multiple rounds of good news. After a long period of sluggishness, the company’s stock price ushered in a strong growth of up to 360% in two months.This trend is similar to the rising trend of MicroStrategy’s stock price after investing in Bitcoin, and has also attracted the attention of many users.

Metaplanet’s predecessor was Red Planet Hotels. It was once a popular economy hotel brand among young people. It has business layouts in Thailand, Japan, the Philippines, Indonesia and other places.However, due to the impact of the epidemic, Red Planet Hotels has experienced a sharp decline in operating income and personnel cuts.

The company then laid out its Web3 and Metauniverse businesses.Including WEN Tokyo project, Takumi-X project, and NFT trading platform.Now, as the yen continues to decline against the U.S. dollar, it continues to adjust its corporate strategy.

Metaplanet’s official website shows that the company’s business is undergoing transformation.The official website said: “Metaplanet Company (stock code 3350), a company listed on the Tokyo Stock Exchange, has begun to implement strategic transformation.

The company’s strategic focus shifts to Bitcoin, and Metaplanet uses Bitcoin (BTC) as its main treasury reserve asset and uses excess cash flow to further accumulate Bitcoin.This strategic shift is due to the unique attributes of Bitcoin, such as its absolute scarcity and depoliticized monetary policy.”

In the company’s business column, Metaplanet has added a “Bitcoin Consulting” service: “Metaplanet provides specialized consulting services to help companies adopt Bitcoin.

The company provides strategic guidance aimed at maximizing the potential within the existing enterprise framework while overseeing the entire enterprise restructuring.From developing strategies to facilitating integration, Metaplanet helps businesses use Bitcoin as the fundamental pillar of future development.In addition, Metaplanet is actively developing strategic partnerships to promote the popularity of Bitcoin worldwide.Through collaboration with industry leaders, Metaplanet has promoted Bitcoin to continue monetization on its way to becoming a major reserve asset.”

Japanese version of MicroStrategy

On June 25, Metaplanet said on X Platform that it has set up a wholly owned subsidiary in the British Virgin Islands to strengthen strategic management of BTC assets.

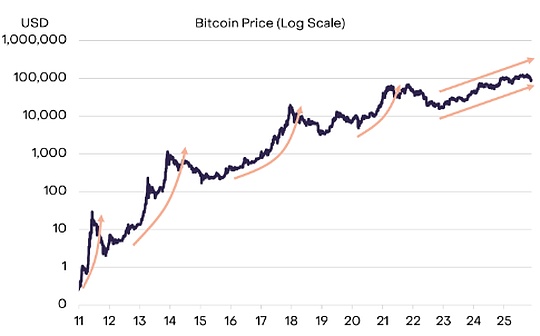

As the largest long bull in Bitcoin at present, MicroStrategy was originally an IT company focusing on research business, but after announcing its successful transformation in August 2020, its stock price rose rapidly.Despite mixed reviews in the process of repeatedly borrowing and accumulating Bitcoin, its share price is now 10 times its initial price.As of June 20, MicroStrategy held 226,331 bitcoins, with a total value of nearly $15 billion.

“Although becoming the Japanese version of MicroStrategy is a difficult goal, we hope to provide Japanese investors with opportunities to invest in Bitcoin through similar strategies.

Regardless of short-term price fluctuations, we plan to continue buying Bitcoin…We hope that Bitcoin will account for the majority of the balance sheet in the future.”He said the company “will be committed to spreading the positive role of Bitcoin widely to Japan and abroad.”

When asked if we were considering buying digital assets other than Bitcoin, Gelovich replied: “We only focus on Bitcoin. Because we believe that Bitcoin is the only truly decentralized digital asset. Despite Bitcoin’s “Proof of Work”(Proof of Work) The consensus mechanism is often seen as a weakness by proponents of other crypto assets or securities, but in fact, it is one of the biggest advantages of Bitcoin. Directly linked to the physical world through power input makes Bitcoin a raredigital assets.”

Simon Gelovich said MicroStrategy shares traded at a premium of 1.75 times their Bitcoin holdings.“We believe that if Metaplanet also maximizes holdings per share, we can enjoy a similar premium. In addition, we plan to do business in the Bitcoin ecosystem and look for additional earnings opportunities.”

Are you planning to “held” Bitcoin price fluctuations?Gelovich said there would be various approaches to consider, but basically plan to invest and hold Bitcoin for a long time.We maintain an unwavering attitude towards price fluctuations.We regard volatility not only as “risk” in the traditional sense, but also as opportunities.

Buying Bitcoin frequently, and the stock price rose sharply in two months

Since April, Metaplanet has been buying Bitcoin very frequently.On April 9, Metaplanet announced a partnership with Sora Ventures, Morgan Creek Capital’s Mark Yusko and others to add $6.56 million worth of Bitcoin (BTC) to its balance sheet.Two weeks later, the company purchased an additional 19.87 bitcoins.

On May 13, Metaplanet further announced that it would use Bitcoin as a strategic reserve asset to hedge against Japan’s growing debt burden and yen fluctuations.

On May 23, the company’s shares rose 158% in the previous week.The Tokyo Stock Exchange suspended its stock trading for two consecutive days due to a sharp rise in stock prices.On June 11, Metaplanet announced another increase in holdings of 23.35 bitcoins, bringing its total holdings to 141.07 bitcoins, worth approximately $9.6 million.

The day before yesterday (June 24), Metaplanet announced that its board of directors had approved the use of 1 billion yen (approximately US$7 million) to purchase Bitcoin, which will come from the issuance proceeds of the company’s second phase of ordinary bonds (with guarantees).According to the company announcement, the bonds are at an annual interest rate of 0.5%, and are expected to be paid on June 26, 2024 and expire on June 25, 2025.

Driven by the news, Metaplanet’s stock price has risen by 360% in two months since its transformation to invest in Bitcoin after a long period of silence.As of June 25, the company’s share price rose to 92 yen from 20 yen on April 1.The highest point of the stock price came on June 13, reaching 112 yen.On June 25, Metaplanet’s market value reached 16.15 billion yen (about 101 million US dollars).

This share price trend of Metaplanet is very similar to the rise in MicroStrategy’s share price after investing in Bitcoin.Michael Saylor, chairman and co-founder of MicroStrategy, has also experienced significant growth in the company’s share price since 2020.

Fill in the void

At present, Metaplanet’s vision and ambition are not only lying in investing in Bitcoin, but also leveraging opportunities within the Bitcoin ecosystem for diversified development.Asked if Japan launches Bitcoin ETFs, Gelovich said: “There is currently no Bitcoin ETF in Japan, which means that Japanese investors cannot easily invest in Bitcoin through securities accounts, so Metaplanet is committed to filling this gap.”

He said, “Unlike ETFs, as an operating company, Metaplanet can enter the capital market and raise funds on conditions that are beneficial to shareholders. As the first Japanese listed company that strongly supports Bitcoin, we have the ability to expand through our business andThe spread of information has promoted Bitcoin to become a widely accepted monetary asset around the world. “

Overall, Metaplanet’s strategic adjustment can be seen as a bold and innovative attempt, but it may also face challenges in the future.Over time, the market will witness how Metaplanet continues to create value in the Bitcoin journey, and its journey of exploration has just begun.