Author: Zhang Feng

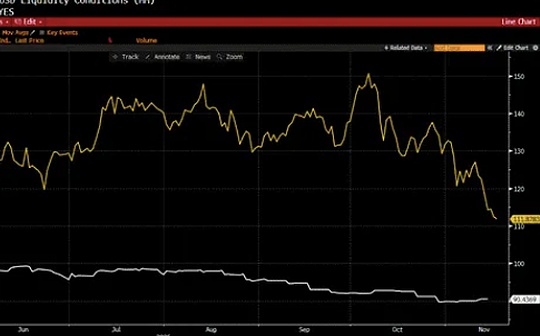

The current field of artificial intelligence, especially generative AI, is experiencing an unprecedented prosperity.Financing amounts have hit new highs repeatedly, product iterations are changing with each passing day, giants and upstarts are competing on the same stage, and everyone is thriving.However, the fluctuating market sentiment seems to be telling us that beneath this prosperity, a ghost is lingering – the ghost of the AI bubble.History has never lacked lessons from technology bubbles. From the “.com bubble” in the early days of the Internet to the “Metaverse fever” in recent years, when the tide recedes, what is often left is a pile of chicken feathers.

So, how should we cut through the noise and rationally judge whether there is a bubble in the current AI wave?We believe that a crucial criterion isExamine the degree and distance of integration between AI and trusted digital assets.The value of AI should not only be reflected in its cool model parameters and huge computing power consumption, but also in its ability to generate value carriers with real demand, tradability, and trustworthiness in the real world, especially at the asset level, the core of the digital economy.

1.AIEmpowerment is the “value engine” and “intelligent core” of trusted digital assets

The “credibility” of traditional digital assets is mostly independently supported by blockchain technology, which ensures the uniqueness, non-tamperability and traceability of transactions through distributed ledgers, cryptography and consensus mechanisms.However, this trust is more static and rule-driven.The integration of AI injects a dynamic, cognitive-driven new dimension into trusted digital assets.

Incorporate dynamic credibility and transcend static authority confirmation:Blockchain can prove “who a certain digital item belongs to at a certain point in time,” but it is difficult to judge the item’s intrinsic value, authenticity, or its status in a complex environment.AI, especially its branches such as IoT AI and predictive analytics, can continuously monitor the status of assets, assess their wear and tear, predict their future earnings, and even identify potential fraud.For example, the combination of AI and IoT sensors can enable dynamic traceability and quality control throughout the entire life cycle of physical commodities mapped as digital assets (such as high-end artworks and rare collectibles), upgrading “credibility” from static ownership records to dynamic value and status guarantees.

Release the value of data and catalyze asset derivation:Data is the oil of the new age, but unrefined crude has limited value.AI is the top data “refinery”.It can extract insights, generate knowledge, and create content from massive and messy data.This process itself is giving rise to new asset classes: AI models can be traded and licensed as assets; AI-generated content (AIGC), such as high-quality text, images, videos, and codes, can become digital assets with unique value.More importantly, AI can transform data resources that are traditionally difficult to capitalize (such as user behavior data and industrial operation data) into priceable and tradable data assets through analysis and modeling, greatly expanding the boundaries and depth of digital assets.

Realize intelligent governance and ensure ecological health:In the complex decentralized finance (DeFi) or DAO (decentralized autonomous organization) ecosystem, governance activities such as risk management, compliance review, and protocol upgrades are increasingly burdensome.AI can be embedded in the governance process to achieve intelligent risk control (real-time monitoring and early warning of liquidity risks and contract loopholes), automated compliance (ensuring that transactions comply with local regulatory requirements), and data-based proposal analysis and decision support.This enables the ecosystem with trusted digital assets as its core to operate more securely, efficiently and sustainably.

The path for AI to empower trusted digital assets is already clear:

Smart DeFi (DeAI), i.e.Introducing AI into decentralized finance will give birth to smarter liquidity management, personalized investment strategies, dynamically adjusted lending rates, and anti-fraud credit scores, making the DeFi protocol move from “code is law” to “smart code is better law”. It itself and the rights and interests it generates are the core trusted digital assets.

AINative capitalization, that isIncluding the AI model itself (representing its usage rights or ownership through specific tokens), AI-generated content (NFT to ensure its uniqueness and origin), and AI computing resources (tokenization of computing power), these constitute a new asset type native to AI technology in the digital economy era.

AIDriven Compliance and Governance:Use AI to automate KYC (Know Your Customer), AML (Anti-Money Laundering) and transaction monitoring, clearing obstacles for the integration of trusted digital assets in the mainstream financial system, while improving the wisdom of decentralized governance.

2.AIIntegration with blockchain to build a trusted digital future

AI and blockchain are not replacements, but cornerstone technologies that complement and complement each other in the digital economy.Blockchain provides a credible “skeleton” and “ledger”: it ensures that data cannot be tampered with, transactions are transparent and traceable, and assets are uniquely authenticated, solving the “hard foundation” of trust.AI provides the “brain” and “engine” of intelligence: it processes complex information, makes optimal decisions, creates new forms of value, and solves the “soft core” of efficiency and value.

Only by combining the two can we build a digital economic infrastructure that is both credible and intelligent.Blockchain ensures the authenticity and auditability of data used by AI, and avoids the risk of “garbage data in, garbage data out” in AI training data; AI gives the blockchain system intelligent processing and value creation capabilities that go beyond simple accounting.It is with the joint support of these two cornerstones that trusted digital assets can move from concept to maturity and from the fringe to the mainstream.

3. Measured by the distance of trusted digital assetsAIbubble

Whether there is a bubble or not, the key lies in the authenticity and sustainability of the value.For AI, its value ultimately needs to be carried and measured through commercialization and assetization.Therefore,Whether credible digital assets with real needs and application scenarios have been developed has become the core indicator for judging AI bubbles.We can conduct a detailed review from the following levels and dimensions:

(1) Overall grasp the balance between technological prosperity and value accumulation

Signs of a bubble:The capital market is frenzied, and valuations seriously deviate from actual revenue (especially narrative valuations based only on future potential); AI projects are highly homogenized, and a large amount of resources are concentrated on the involution competition of model training rather than solving specific industry problems; there are many people talking about the vision of “general artificial intelligence (AGI)”, but few practical applications in vertical fields.

Performance of defoaming:A clear, scalable, trusted digital asset market driven or enhanced by AI will emerge.For example, the physical asset on-chain (RWA) based on AI dynamic evaluation has formed a huge scale; the AIGC digital collection market has established a stable supply and demand relationship and value evaluation system; the AI-optimized DeFi protocol lock-in value (TVL) has grown healthily and effectively served the real economy.When the value of AI is “encapsulated” into various trusted digital assets and achieves efficient circulation, the bubble will be squeezed out and a solid value highland will be established.

(2) Subdividing the track to see its capitalization capabilities

computer visionIf its value is limited to security or beauty filters, its potential is limited.But if it can enable the assetization of high-precision industrial quality inspection data, or ensure the dynamic credibility of luxury traceability digital twins, it will be more closely integrated with trusted digital assets and its value will be more firmly established.

Natural language processing and large models:If it is only used for chatbots or content generation tools, its business model may fall into red ocean competition.However, if it generates high-quality vertical industry professional models that can be used as asset transactions (such as legal and medical diagnostic models), or builds an economic ecosystem with AIGC digital asset creation and trading as its core, its value will be more unique and moat-like.

reinforcement learning andAIAgent:If its achievements in “playing games” in a virtual environment cannot be converted into actual value, it will easily be regarded as a castle in the air.But if it can be used to optimize real-world logistics and energy networks, and its cost savings or improved efficiency can be shared with participants through tokenization, or if AI agents can autonomously perform value exchanges on the blockchain, then its integration with trusted digital assets will bring about real value creation.

(3) The direction of product capitalization from “useful” to “valuable”

When evaluating an AI product, you must not only ask “Is it useful?”, but also “What kind of trusted digital assets can it generate or be integrated into?”.For example, if an AI painting tool is only a pay-per-view SaaS service, its value ceiling is obvious.But if it can generate digital artworks (NFT) that are unique, verifiable, collectible, and tradable, and form a sustainable value sharing mechanism with creators, then it will be more than just a tool, but the creator of a new asset class, and its ecological value will increase exponentially.For another example, an AI-driven prediction market is tantamount to a gambling game if its prediction results cannot be linked to on-chain assets or real-world proof of equity.But if its prediction results can directly trigger insurance claims in the DeFi protocol, or guide the pricing and trading of RWA, then it will become an indispensable value discovery tool in the world of trusted digital assets.

(4) Development roadmap from technology demonstration to asset ecology

The roadmap of a healthy AI project should clearly show the evolution path from technology verification, to product implementation, to building a digital asset economic ecosystem as its core.What investors and observers should focus on is whether the project party consciously combines AI capabilities with the assetization capabilities of the blockchain?Is its token economic model (if applicable) well designed to effectively capture the value created by its AI?Is its ecosystem attracting developers, creators and users to participate in building a prosperous market around its trusted digital assets?

4. Grasp the general direction of integration and sail towards a new blue ocean of value

AI is undoubtedly a transformative technology, but its real greatness lies not in how “intelligent” it is, but in whether it can make the entire economy and society run smarter, more efficiently, and more equitable.Trusted digital assets, as the value carrier of the digital economy, are the perfect stage for AI to exert its transformative power.

Therefore, when facing the current craze for AI, we should maintain a sober perspective.Use the “integration distance with trusted digital assets” as a key yardstick to measure the true value behind each AI story.Those projects and companies that are down-to-earth and committed to transforming AI capabilities into real, credible, and tradable digital assets are more likely to survive the cycle and become future winners.

The integration of AI and blockchain is not a simple technological superposition, but the beginning of a profound collaborative evolution of production relations and productivity.By grasping this general direction, actively promoting AI to empower digital assets in terms of dynamic trustworthiness, data value release, and intelligent governance, while consolidating the trust foundation of the blockchain, we can burst the bubble and jointly move towards the new blue ocean of a trusted digital world full of opportunities and value.