Author:Thejaswini, source: TokenDispatch

Preface

You should know that I talk about this a lot—its philosophical underpinnings, its history, and the intricate agreements humans make to assign value to a piece of paper or a number on a screen.And every time we dig deeper, we end up coming to the same depressing conclusion: its definition keeps changing beneath our feet.

For most of human history, people used a variety of things as currency: salt, shells, livestock, precious metals, and scraps of paper with promises written on them.The question of what makes something “currency” and what makes something just an “object of value” has never been clearly answered.We usually recognize it at a glance, unless we can’t see it.

When Jack Dorsey tweeted that “Bitcoin is not a cryptocurrency,” it hit a sensitive sore point in this age-old debate.Because if Bitcoin isn’t a cryptocurrency, what is it?If cryptocurrency is not Bitcoin, then what is it?More importantly: why does this matter?

The simplest explanation is that this is just tribalism.Extremists draw clear lines, and people from all walks of life take sides.It’s the kind of frivolous argument that normal people avoid because everyone involved appears to be a little unhinged.

But I think there’s something else going on, something important that goes beyond tribal warfare.I think the market is slowly and painfully realizing that Bitcoin and cryptocurrencies were never the same thing, even though they existed in the same place for fifteen years.And what separates them is not breakup, but specialization.

This distinction matters because specialization is not about conflict but about function.The heart and lungs do not compete; they each perform different functions.If you try to make the heart also perform the function of breathing, you won’t get a more efficient organism, you’ll get a dead thing.

Bitcoin and cryptocurrencies are divided not because they are hostile to each other, but because they were designed with very different intentions.One aims to be currency, the other tries to be everything else.And they succeed precisely because they no longer try to be each other.

This sounds like a war.But war is about winning, and this is about distinction.

Dorsey’s tweet was just the trigger

Why am I bringing this up again?

Listen, when Jack Dorsey tweets that “Bitcoin is not a cryptocurrency,” you have to stop and think about what is going on here.He is the co-founder of Twitter and Square (now renamed Block). His support for Bitcoin is almost fanatical, and he even described the Bitcoin white paper as “poetry.”He is a true Bitcoin maximalist: he believes that Bitcoin is the only digital asset that matters, and that everything else is just noise at best and a scam at worst.

So when Dorsey made this statement, it felt huge, like announcing a breakup.Extremists cheered, cryptocurrency developers scoffed.Everyone falls into line.

The Czech Republic, on the other hand, just added Bitcoin to its national balance sheet.It’s not big enough to change the situation.But this comes on the heels of the establishment of a strategic Bitcoin reserve in the United States in March, prompting 45 states to introduce their own reserve bills, with Arizona, New Hampshire, and Texas already passing relevant bills.Luxembourg’s sovereign wealth fund has also fully switched to Bitcoin investments.

They looked at the entire digital asset space and finally settled on one thing.Why?

Bitcoin and “cryptocurrency” have been conflated for years.The journalists talked about the “cryptocurrency market” in their articles, referring to everything from Bitcoin to Dogecoin to whatever new coin was launched this morning.Regulators talk about “digital assets” and refer to them collectively as “digital assets.”Asset managers allocate “cryptocurrency assets” in investment portfolios.Industry insiders track “Bitcoin Market Cap Share,” which measures Bitcoin’s share of the total cryptocurrency market cap, implying that all cryptocurrencies are competing for the same piece of the pie.

But this framework is starting to unravel.This is not because of ideology or tribalism, but because of how institutions actually treat these things, how the market actually prices them, and how people actually use them.

When Fidelity released its research on Bitcoin, it didn’t call it a “crypto asset” but a “currency asset.”BlackRock describes it as “digital gold” and a “non-sovereign store of value.”This is not simple marketing talk, but a fundamental classification that distinguishes Bitcoin from all other assets.Rather than comparing Bitcoin to Ethereum like Coca-Cola and Pepsi, they view Bitcoin as an asset class in its own right.

And this all happened before Dorsey tweeted anything.Hardcore Bitcoin holders have mentally distinguished Bitcoin from cryptocurrencies for years.They just didn’t announce it via a press release.

What Bitcoin Wants

Bitcoin was designed around a few very clear priorities: security, predictability, decentralization, and monetary trustworthiness.These characteristics make it difficult to change.Bitcoin’s development culture is known for being extremely conservative, and any upgrade would require years of discussion.The entire system is designed to be difficult to modify.

You could call this a vulnerability.Many people think so.They point out that Bitcoin’s ten-minute block time is laughably slow compared to some emerging blockchains.They also point out that Bitcoin cannot run smart contracts, decentralized applications, or the advanced programmable features that Ethereum supports.These criticisms are all correct.

But look at it another way: Bitcoin isn’t trying to do it all.It strives to do one thing extremely well, and that is to be a trusted, predictable, censorship-resistant currency.

Predictability is especially important.The total number of Bitcoins is capped at 21 million, and this cap is written into the protocol.Changing the cap would require significant computing power and would likely require a hard fork.To many, the 21 million cap represents Bitcoin and is a key feature that differentiates it from fiat currencies and cryptocurrencies.Therefore, the cap remains unchanged and has been for 16 years.The same monetary policy, again and again, without any surprises.

Look at almost every other cryptocurrency.The mechanics of Ethereum have changed dramatically.It moved from Proof of Work (PoW) to Proof of Stake (PoS).It also plans to implement deflation of Ethereum through ERC 1559.These are interesting technical decisions, but they are the exact opposite of predictability.Each change is a reminder that the rules can change again at any time.

Yes, I will tell you that these changes make the system better.But you may ask, in what aspects is “better” reflected?If you want to build a neutral, long-term store of value, then changing the rules is not an advantage, but a disadvantage.But if you want to build an application platform that can iterate quickly and serve developers, then changing the rules is great.You should keep changing the rules, release quickly, and be adventurous.

The key is: the goals are different.

What cryptocurrencies want

The broader crypto ecosystem, meaning everything outside of Bitcoin, looks more like a technology sector than a monetary system.It pursues speed, programmability and innovation.New Layer 2 expansion solutions emerge every few months.There is decentralized finance, including lending protocols, derivatives, and liquidity mining.There is decentralized physical infrastructure.There are games.There are NFTs.And all kinds of things that might happen in the future.

The pace is extremely fast, the cycle is extremely short, and the ambition is extremely high.

Cryptocurrency operates much like Silicon Valley.Venture capital is pouring in.Founders raise money, launch a product, pivot if they encounter problems, and launch the product again.Some projects were huge successes, but most failed.There are hype cycles and crashes, and each quarter has a different narrative.The summer of DeFi was followed by the NFT craze, the NFT craze was followed by the Layer 2 craze, and the Layer 2 craze was followed by everything that’s happening now.

That’s not how the monetary system works.You don’t want the money supply to change based on market trends.You don’t want foundation members to vote on whether to change the issuance plan.You don’t want the unit of account to iterate frequently.

So cryptocurrencies and Bitcoin play different roles.Cryptocurrency wants to develop into a technology industry, while Bitcoin wants to become a currency.These are not competing visions, but different roles within the same economic system.

Why does this look like a breakup?

From the outside, the schism appears hostile.Bitcoin supremacists dismiss other cryptocurrencies as scams or distractions.They will tell you that all cryptocurrencies except Bitcoin are either securities, centralized databases with cumbersome operations, or solutions to a problem that does not exist.Cryptocurrency developers, meanwhile, view Bitcoin as inflexible and outdated.They point to Bitcoin’s limited functionality and argue that supremacists are still stuck in 2009.

The market’s attitude towards them is also very different.Bitcoin has its own cycle, its own trajectory, and its own institutional buyers.When MicroStrategy (sorry, “Strategy”) spends billions buying Bitcoin, they’re not going to buy some Ethereum along the way to spread their risk.When El Salvador legalized Bitcoin, they also did not include the top ten cryptocurrencies by market capitalization.

Regulators are also increasingly focusing on differentiating these tokens.Bitcoin is often viewed as a commodity.Most other tokens fall into a gray area, and whether they are securities depends on how they are issued and who controls them.This results in different regulatory frameworks, different compliance requirements and different risk profiles.

So, yes, it looks like a breakup.Different treatment, different communities, different application scenarios.

But what if this separation is not hostile?What if they are just doing different things?

asymmetric dependencies

The demand for Bitcoin from cryptocurrencies far exceeds the demand from Bitcoin for cryptocurrencies.

Bitcoin has given legitimacy to the entire field.It is the gateway for institutional investors, a reference asset for new users, and the standard for all digital assets.When people talk about “blockchain technology,” they are actually referring to the technology pioneered by Bitcoin.When regulators formulate digital asset regulatory strategies, they will first consider Bitcoin and then explore the differences between other assets.

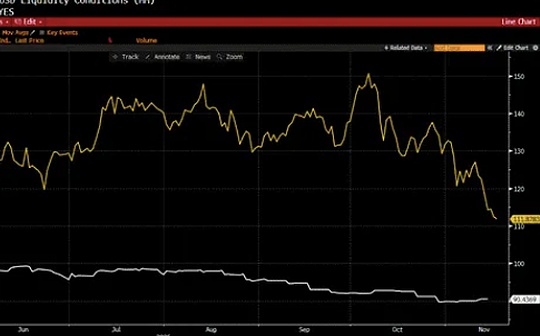

Bitcoin also determines liquidity cycles.Bull markets usually start with Bitcoin.Money first flowed into Bitcoin and then moved to riskier crypto assets.This pattern has continued for many cycles.Without Bitcoin’s liquidity and market awareness, the structural weaknesses of the entire cryptocurrency market would be even more apparent.

Bitcoin plays the role of a cryptocurrency reserve asset.Even as these ecosystems become increasingly fragmented, Bitcoin remains the dominant asset for large-scale settlement, long-term storage, and cross-border value transfer.It is the closest thing to digital gold.

The converse is not true.Bitcoin does not require innovation in the cryptocurrency space.It doesn’t require smart contracts, DeFi, NFTs, or anything else.Bitcoin could sit there quietly, processing transactions slowly, maintaining its monetary policy, and maintaining its usual essence.This is the key.

This creates an interesting dynamic.Cryptocurrencies revolve around Bitcoin.Bitcoin is like the sun.These planets can spin wildly, try new things, and collide with each other, but the center of gravity remains the same.

actual problems

If Bitcoin wants to be a currency, it faces a problem: people simply won’t spend it.

Every Bitcoin holder knows the story of Laszlo’s Pizza.This story does something to your brain.It makes you afraid to spend Bitcoin because what if it goes up in price?What if the pizza you bought became the next billion-dollar pizza?

This isn’t a quirk of early adopters, it’s basic human nature.When you hold an asset that will appreciate in value, instead of spending it, you hoard it.You spend your worst-performing assets first and save your best-performing assets last.This is called Gresham’s Law: Bad money drives out good money.If you hold currencies that are likely to appreciate 100% in value next year and some that definitely won’t, you’ll prioritize spending the ones that aren’t going to appreciate in value and saving the ones that are likely to appreciate in value.

Therefore, Bitcoin has been so successful as a store of value that it has made itself a poor medium of exchange.People think of it as digital gold because it’s exactly like gold: scarce, valuable, and you definitely don’t want to buy coffee with it.

Additionally, there is the issue of the unit of account.Money should serve three functions: a store of value, a medium of exchange, and a unit of account.Bitcoin does a great job as a store of value, but not as a unit of account.The real problem is the unit of account.

No one will use Bitcoin to set prices.Salaries are paid in US dollars, euros or rupees.Rent is paid in fiat currency.Corporate accounting is also calculated in fiat currency.Even tickets to Bitcoin conferences are often priced in U.S. dollars.You may be able to pay in Bitcoin, but the price is set in fiat currency first and then the currency is converted.

Why?Because Bitcoin is too volatile, it cannot be priced directly.You can’t walk into a coffee shop and see a sign that says “Coffee: 0.0001 BTC” because tomorrow that number could become 0.00008 BTC or 0.00015 BTC, depending on what the market does overnight.A currency that is not used to price goods cannot function as a medium of exchange.It can only be used as an asset that can be exchanged for real currency before you purchase the item.

Even if a merchant “accepts Bitcoin,” what actually happens is more telling: Bitcoin is instantly converted into fiat currency at the time of transaction.Merchants receive dollars or euros instead of Bitcoin.So, you are essentially using Bitcoin as an unnecessary middleman to convert your ever-increasing asset into currency that you could otherwise use directly.

This logic holds true in a few specific scenarios.If you’re in Türkiye, Venezuela, or Argentina and the local currency is inflating faster than Bitcoin’s volatility, then Bitcoin does become a more stable option.But that doesn’t mean Bitcoin is a good currency, it does mean that fiat currencies are bad currencies in these specific areas.

That’s why when Jack Dorsey’s Cash App announced this week that it would support stablecoins, they chose to build on Solana instead of Bitcoin.To a Bitcoin supremacist, this is like a vegetarian opening a steakhouse.But it all makes perfect sense if you understand the true purpose of each thing.

Stablecoins are currencies that people use to pay.They are pegged to the U.S. dollar, so there is no spending risk like Bitcoin.No one is worried that their USDC will increase 10x next year, so they can spend it safely.Although stablecoins are boring, they are stable and reliable, and they do facilitate the transfer of funds.

Bitcoin is a tool that people use to store value.It is scarce, difficult to inflate, and is not controlled by any government.But you wouldn’t use your 401(k) to buy coffee, and you’d better not use your Bitcoin to buy coffee.

hierarchical model

So, perhaps the digital asset economy is not fragmenting, but is organizing itself into different levels, each playing a role it is good at:

Layer 1: Bitcoin – Monetary Base Layer

A non-sovereign store of value with predictable issuance and global neutrality.It grows slowly and steadily and is designed to last for decades.Institutions view it as digital gold.People hoard it.This is normal.That’s what it’s all about.

Layer 2: Stablecoin – Medium of Exchange Layer

Digital versions of fiat currencies that people actually use.They’re quick, cheap, but also boring.They don’t appreciate in value, so you won’t feel guilty spending them.They exist on a variety of blockchains, including Bitcoin’s Lightning Network, as well as Ethereum, Solana, Tron, and others, depending on which blockchain is best suited for a specific use case.

Layer 3: Encrypted Network—Application Layer

The platform empowers financial markets, decentralized applications, tokenized assets and everything in the future.Innovation happens here.This is the technology industry.It’s fast-moving, venture-backed, sometimes downright stupid, but occasionally bursting with astonishing wisdom.

This model reflects the way traditional economies work.Gold is a store of value, fiat currency is a medium of exchange, and financial markets and technology companies develop applications on this basis.No one expects gold to be both a payment channel and a smart contract platform.Different things perform different functions.

These are not competing investments.

Bitcoin is not breaking up with cryptocurrencies, it is simply adapting to its role.Cryptocurrencies are doing the same thing.Stablecoins fill a gap that neither can solve.

It’s not a breakup, it’s a professionalization.

And this specialization is the cornerstone of the future architecture of digital currencies—Bitcoin provides the foundation for a complex, diverse, and rapidly evolving ecosystem.

The question has never been who will win, Bitcoin or cryptocurrencies.The real question is how they can coexist in a system where each has its own strengths and works together.

This system is gradually taking shape.The “breakup theory” completely misses this point.