Author: lesley@footprint.network, compile: ming@footprint.network, data source: USDC token dashboard (only Ethereum data)

In the field of cryptocurrencies and digital assets, token analysis plays a vital role.Token analysis refers to the process of in -depth research on token related data and market behavior.This is a detailed process involving a thorough inspection of prices and liquidity related to these assets.

Through token analysis, we can obtain investment decisions on market trends, risk factors, transaction activities and capital flow.

USDC is a stable currency supported by US dollar credit.It was launched in 2018 by Consensys, established by Financial Technology Circle and Coinbase.Due to stability and security in the world of cryptocurrencies, USDC emerges quickly in the digital currency world.

The USDC token is supported by the US dollar and the US dollar denomination assets.This ensures 1: 1 anchor with the US dollar.USDC is one of the most transparent and trustworthy stablecoins, because the USDC token in each circulation has a corresponding number of US dollar reserves.

How to analyze USDC?

Token analysis is very important. Generally speaking, what key indicators need to be considered?

Token price analysis: Understand market value and price fluctuations

The goal of USDC is to maintain the stable value of 1: 1 anchor with the US dollar.This is achieved through the reserve system, and the USDC token in each circulation has a corresponding amount of US dollar reserves.This ensures that the price of USDC remains stable. For those who want to avoid the price fluctuations of cryptocurrencies such as Bitcoin or Ethereum, it is an attractive choice.

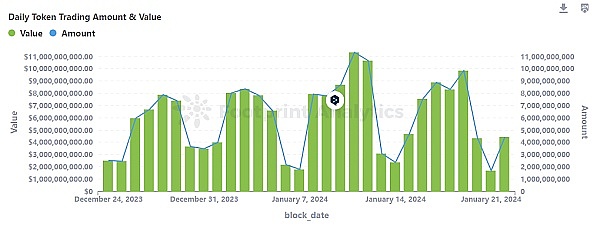

USDC daily currency transaction amount and value

Transaction value insight: diagnostic tools in encrypted analysis

Token transaction volume is the key indicator of market activities.At present, the trading volume of the token is 2.3 billion US dollars.

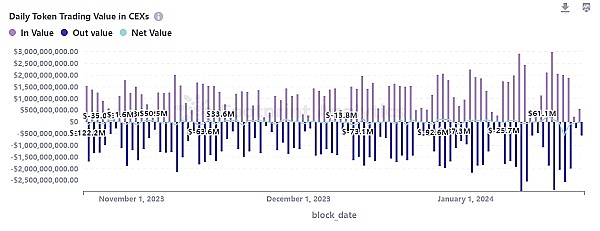

The daily currency transaction value of USDC in the centralized exchange

Analysis of net flow in CEX: Identification of investor behavior trends

In order to better understand the behavior of investor, analyze the net flow between the tokens between the centralized exchange (CEXS).As more USDC leaves the exchange instead of entering the exchange, trading activities and investors’ interest have declined.This shows that investors have preserved tokens in personal wallets, which may imply the intention of selling.This may indicate a cautious or pessimistic market emotion, and investors are waiting for better conditions or uncertainty about the market in the market.

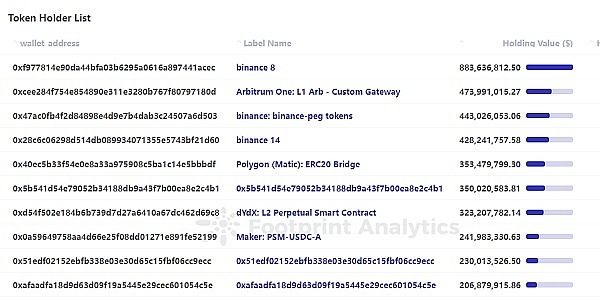

List of USDC token holder

Token concentration: descriptive analysis method

Analysis of token concentration is very important because it reveals the key insights of market integrity and easily manipulating.By analyzing the distribution of tokens among top holders, we can deeply understand the influence of whale investors and the overall health status of the token market.