Author: NingNing Source: X, @0x Ning

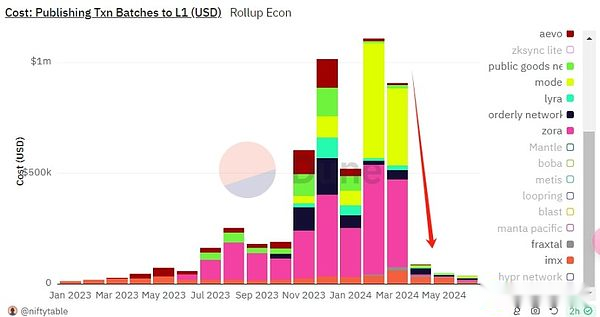

The core upgrade of Cancun upgrade is EIP 4844, which stores the state data from L2 batch to the Ethereum main network to the newly added blob space.

We know that Rollup’s design architecture is actually reselling the Ethereum main network block space to developers and consumers.

There are two core business models of Rollup:

-

Build a truly prosperous Rollup ecosystem and then make money from the interaction between developers and consumers L1<>L2 Gas spread and serializer MEV gains.Those who adopt this business model include: Arbitrum, Optimism (via superchain ecosystem), Base, etc.

-

Use airdrop expectations to continuously engage in Odyssey PUA users, and then make money from the interaction between developers and consumers. L1<>L2 Gas spread and serializer MEV returns.Those who adopt this business model include: ZkSync, Scroll, Linea, etc.

The Cancun upgrade ultimately compresses the data availability fee for L2→L1, reducing the average L2 Gas fee for deploying Cancun upgrades by an order of magnitude.

Ethereum is trying to use Cancun to upgrade and strengthen L1’s dominance over the current Rollup Centric Ethereum ecosystem, and promote the explosive growth of the number of Rollups by reducing costs and increasing efficiency.

But intentionally or unintentionally, the economic foundation of Rollup, which adopts the second core business model, was destroyed.

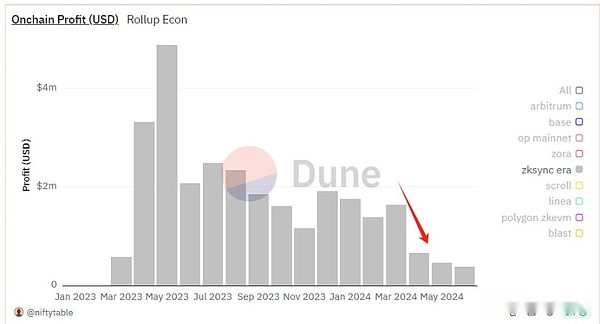

The first thing to be affected is ZkSync.After the Cancun upgrade, ZkSync supported this new feature as soon as possible, but the effect was poor.The geometric reduction in Gas fees did not bring about the expected user growth and ecological prosperity, but instead led to a halving of the price difference of Rollup L1-L2 Gas.

As ZkSync has been ecologically maldeveloped, MEV revenue growth cannot make up for the sharp drop in L1-L2 Gas spread income.With no choice, ZkSync had to choose the time window of rebound in June to achieve partial exit in the form of selling tokens in the secondary market.

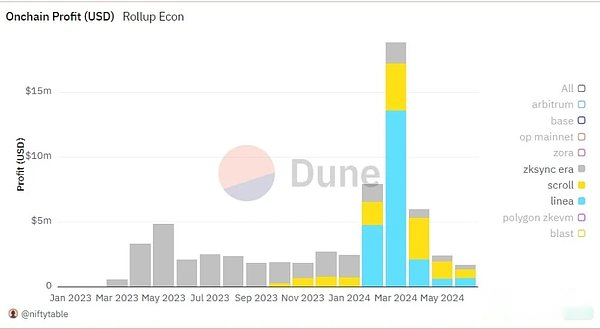

Its competitors Scroll and Linea have resisted the pressure of the community and the market, and, as long as possible, delayed the deployment of Cancun upgrades, and continued to maintain the profit margin of L2 high gas fees; second, keep the bottom line of not airdropping or issuing coins, and continue to interact with PUA users.

Judging from the on-chain data, after February, Scroll and Linea’s Rollup revenue far surpassed ZkSync.

I think that until the next time the Ethereum main network Pectra upgrade changes the rules of the game, Scroll and Linea’s team will not have any idea of airdropping and issuing coins, and the “electronic beggars” are mentally prepared and expected to manage.

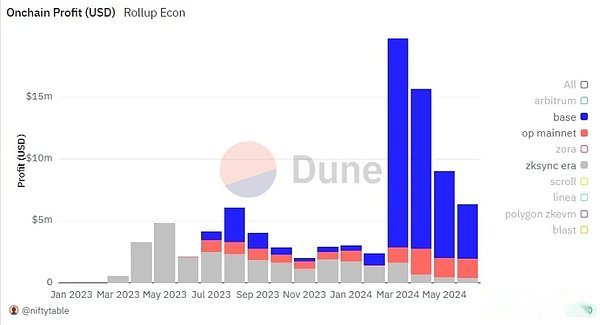

Rollup, which adopts the first business model, encountered different challenges, mainly the siphon effect of the Solana MeMe boom on the funds and users of the Ethereum ecosystem.

Fortunately, the SocialFi and MeMe sectors of the Base Chain have emerged and become the shield of Ethereum ecosystem to resist the impact of Solana barbarians. Rollup’s revenue has also risen, maintaining the first place for four consecutive months.

Since Base is built with OP Stack and is a member of Optimism’s super chain, Optimism’s Rollup revenue also gains the dividends of Base’s positive externalities, achieving growth after the upgrade of Cancun.

Arbitrum, the former leader, overbearing Web3 games and slowing its strategy on Rollup Stack, saw its revenue decline in April and May, but recovered rapidly in July.

Finally, the Cancun upgrade greatly reduces the operating costs of Dapp Rollup, and promotes more Dapp choices to adopt Rollup paradigm reconstruction (such as Frax, Uniswap, AAVE, etc.).