source:Grayscale Research;Compiled: bitchain vision

Key points of this article:

-

Three years after the cryptocurrency market bottomed out, the debate over the “cycle” state reappeared.But the factors that drive the application of cryptocurrencies—the macro demand for scarce digital assets and the increased regulatory transparency—still exist.

-

In September, cryptocurrencies lagged behind other asset classes; clearing of futures accelerated mid-month declines.Leveraged traders’ positions seem to be more balanced at the moment.

-

The U.S. SEC approved the general listing standard for encrypted ETP, the Senate made progress in market structure legislation, and the number of encrypted IPOs increased.

-

From a return perspective, the AI Crypto sector dominates other segments.

During the last cryptocurrency market cycle, prices peaked in November 2021 and then bottomed out in November 2022.Now, nearly three years have passed.Some cryptocurrency market participants warned that the current cycle is about to end and valuations are about to “peak”.

Cycles are a feature of the financial market and an important factor that investors need to consider in the risk management process.butThere is no reason to think that valuations will start to decline just because the bull market lasts for three years.Economist Rudy Donbush once said that economic expansion did not end because of its long duration, but was strangled by the Federal Reserve.In other words, changes in fundamentals—usually a tightening of monetary policies designed to control inflation—are what could lead to the economy falling into a recession.

Like all bull markets, the latest expansion momentum for cryptocurrency valuations will eventually end.ButAt present, fundamentals are still pointing in a positive direction: macroeconomic imbalances are creating demand for scarce digital assets, and regulatory clarity is driving institutions’ investment in blockchain technology.We believe that before these factors change,The market pullback in September may be only temporary,The cryptocurrency market may be heading to new highs.Bitcoin’s supply always follows a four-year cycle, but cryptocurrencies may not be valuation.

Leveraged longs have been cleared

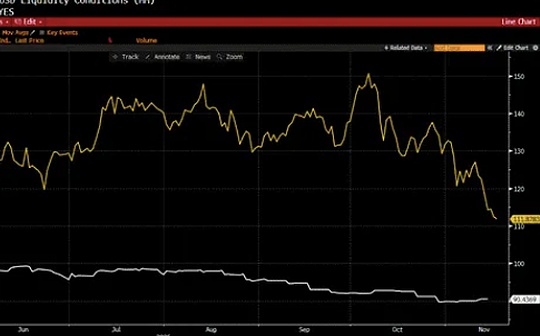

In September, Bitcoin and other digital assets did not perform as well as other segments, especially precious metals and stocks closely related to AI (Figure 1).Both categories, as well as the traditional capital market as a whole, may benefit from the Federal Reserve’s rate cuts and strong inflows of exchange-traded products (ETPs).

Figure 1: Cryptocurrencies lag behind other asset classes in September

Crypto assets appreciated in early September, but fell sharply in late that month.This sudden decline may be related to the clearing of long positions in perpetual futures contracts – a unique feature of the cryptocurrency market structure.For example, according to Glassnode, the total liquidation of ETH perpetual futures contracts reached US$277 million on September 25, marking the largest single-day clearance since April 2021 (Figure 2).After liquidation, financing rates (i.e. the cost of holding leveraged long positions) fall and prices stabilize, which may indicate that speculative traders have more balanced positions.

Chart 2: Perpetual futures leverage positions are liquidated

Simplified encryption ETP approval

Aside from price performance, the most important development in September is arguably the Securities and Exchange Commission approved the universal listing standard for crypto ETP.This decision provides a simplified approval process for the exchange to launch crypto ETP, provided that the underlying token meets certain technical standards for trading in qualified venues.Grayscale expects more crypto assets to meet these standards, and investors can expect a significant increase in the amount of single-asset crypto ETP provided by U.S. exchanges.In addition to approving the general listing standards, the SEC also approved the listing and trading of certain Bitcoin option products.

The U.S. Senate has also made further progress in legislation on crypto market structures – the next big move for Congress after the Genius Act, which covers stablecoins.The Senate Banking Committee has released a new draft of the Market Structure Act.It includes better protections for decentralized finance (DeFi) applications and developers, which is widely welcomed by the crypto industry.Additionally, a panel of 12 Senate Democrats released a legislative framework for crypto market structure.The framework also received positive responses from key stakeholders, indicating that there is still room for the bipartisan cooperation process to continue.The House version of the Market Structure Act, the CLARITY Act, was passed in the House in July by a bipartisan vote.

The clarity of regulation in the digital asset industry continued to promote institutional activities in September.More cryptocurrency companies are listed, including Figure Technologies (FIGR) that utilizes blockchain technology to improve the efficiency of home equity loans and exchange Gemini (GEMI).In addition, several traditional financial institutions, including BlackRock and Nasdaq, have announced plans related to tokenized assets.In addition, institutions are committed to launching new regulated financial products, including “continuous” (i.e., perpetual) futures and stablecoins that comply with the GENIUS Act.

AI Crypto sector stands out

From a cryptocurrency industry perspective, artificial intelligence (AI) is the best performing segment, driven by several outstanding projects (Figure 3).The strong returns are mainly attributed to Near (NEAR), Worldcoin (WLD) and Aethir (ATH).Founded by a leading figure in the artificial intelligence industry, NEAR is a blockchain platform tailored for artificial intelligence use cases, and its NEAR intents products is increasing.Worldcoin was founded by Sam Altman to provide digital identity solutions.The rise in WLD token prices may be partly related to the new Digital Asset Library (DAT) Eightco Holdings (ORBS).GPU market Aethir benefits from a new collaboration with Chainlink and a new DAT.

Figure 3: AI Crypto sector performs well

Story Protocol (IP) is a blockchain focused on intellectual property rights. Despite its huge fluctuations in the month, it is another leader in the field of artificial intelligence encryption.The focus is mainly on announcements at the project’s Origin summit during South Korea’s blockchain week.Story partnered with award-winning Korean web comic brand Solo Levelling.The collaboration will enable Solo Levelling to explore on-chain intellectual property models and potentially launch memecoin.Story has also partnered with gaming company Verse8 to bring web3 brands Moonbirds and Azuki into AI-generated games, enabling creators to recombinate and monetize these brands by enforcing licenses and royalties on-chain.

In addition to applications related to artificial intelligence, the most popular category in the industry is arguably the decentralized exchange (DEX) of perpetual futures.Among them, Hyperliquid is in a leading position and has become one of the three major revenue-generating applications in the cryptocurrency field.However, Hyperliquid faces new competition from Aster, a perpetual futures DEX supported by Binance founder Changpeng Zhao (Figure 4).Regardless of the outcome, it is encouraging to see DEX seize transaction volume from centralized alternatives – decentralization is the core premise of blockchain technology and DeFi.

Figure 4: New Perpetual Futures DEX Appears

Finally, the stablecoin field continues to develop.For example, Layer 1 ecosystem Plasma, which focuses on stablecoins, launched the mainnet and XPL tokens in late September.Within a week, its stablecoin supply grew rapidly to $6 billion, becoming the fifth largest blockchain in stablecoin supply and leading Coinbase’s Layer 2 Eco-BASE (Figure 5).Meanwhile, Tether, the largest stablecoin issuer, announced plans to raise between $15 billion and $20 billion, with a valuation of around $500 billion, which will make it among the world’s most valuable private companies along with OpenAI and SpaceX.

Figure 5: Plasma, a new payment blockchain, currently ranked fifth in stablecoin supply

Future Outlook

As mentioned above,The cryptocurrency bull market is driven by the macro demand for scarce digital assets and the regulatory clarity that supports adoption.These two factors are likely to be the focus of investors again in the fourth quarter of 2025.

The Fed restarted interest rate cuts in September and suggested another one to two cuts before the end of the year.Other conditions are equal, lower interest rates should be considered favorable to crypto asset classes (as it reduces the opportunity cost of holding interest-free goods such as Bitcoin and may support investors’ risk appetite).

Meanwhile, various macro factors may put pressure on cryptocurrency valuations, including possible slowdown in GDP growth and/or geopolitical tail risks.Of course, the unexpected shift from interest rate cuts to rate hikes should also be seen as a risk factor for cryptocurrency valuation.

From a regulatory perspective,Positive market catalysts may include: the possible introduction of crypto ETP to staking functionality, more altcoin ETP listings, and the passage of the market structure bill in the Senate.Having said that, these development trends have been reflected at least in part in the price, so any obstacles may be considered as a downside risk to valuation.