Author: Bradley Peak, CoinTelegraph; Compiled by: Tao Zhu, Bitchain Vision

1. China-US trade war in 2025

On April 2, 2025, President Donald Trump declared a national economic emergency and announced a full imposition of new import tariffs.

The policy, known as the “Liberation Day”, sets a 10% benchmark tariff on all foreign goods, with tariffs of up to 145% on Chinese products.This move aims to solve the long-standing trade imbalance and protect national industries.

China responded almost immediately.Tariffs on U.S. imports soared to 125%, and imposed restrictions on exports of rare earth elements that are crucial to global manufacturing.Within days, trade between the world’s two major economies slowed sharply.

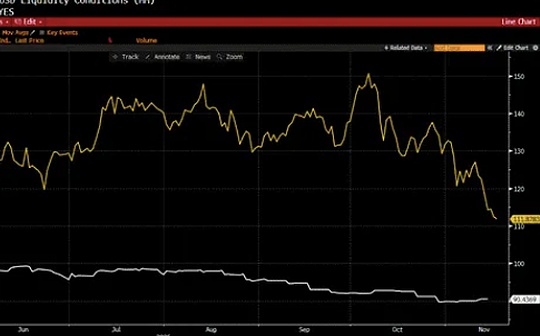

The market responded poorly to this.The S&P 500 index fell 15% in less than a week.As of April 7, the Nasdaq index has fallen nearly 20% so far this year.Investors are upset by the escalation of trade tensions and its potential ripple effect on global economic growth.

The cryptocurrency market has not calmed down because of this.As stock markets fall and uncertainty spread, Bitcoin trading volume surged, and many turned to digital assets for hedging.

Next, we will dive into how these trade tensions affect financial markets, first with traditional stocks and then with cryptocurrencies.

2. The impact of trade war on stock markets

The market doesn’t like surprises – especially trade wars.

In April 2025, the United States announced a 145% tariff on Chinese imported products, and Wall Street responded quickly and fiercely.The S&P 500 plunged more than 10% in just two days.Technology stocks have made it even worse, with the Nasdaq index falling by nearly 20% since the beginning of this year.

However, if you have followed the market trends of previous trade wars, you will find that all this is not unfamiliar with it.During the first round of tariff war between China and the United States, every tweet about negotiations or new tariffs triggered violent fluctuations in the stock market.And if you look far, the Smut-Holly Tariff Act of 1930 is one of the earliest and most notorious examples, when tariffs continued to rise, global trade shrank, and the Great Depression intensified.

So, why is the stock market hitting such a severe impact?The reasons are as follows.Tariffs raise the cost of imported goods and squeeze profit margins for companies relying on international supply chains.When automakers or electronic brands have to pay higher parts costs, these costs either erode profits or pass on to consumers.In either case, this is bad news for profit, which is the factor that determines the valuation of a stock.

There is also a fear factor.The trade war injects huge uncertainty into the economy.Will more tariffs be imposed next?Will other countries take retaliation?This unpredictability can cause businesses to delay investment and recruitment, while consumers may start to reduce spending.This manifests itself as increased market volatility, usually tracked by what Wall Street calls the “panic index” VIX, which tends to soar during this period.

Central banks sometimes try to ease the shock by adjusting interest rates or injecting liquidity.But when the root of the problem lies in politics, they can do only a limited amount of it.

3. When tariffs hit, cryptocurrencies will be hit and then rebound

Tariffs also had a shock to cryptocurrencies, but the market recovered a few days later, reflecting the cryptocurrency’s volatile and responsive nature during a period of global uncertainty.

Bitcoin fell to around $76,000 after Trump announced new tariffs.Ethereum and other major tokens have also followed, causing the cryptocurrency market value to evaporate by about $200 billion in a few days.

Again, this kind of sell-off is not uncommon.When uncertainty intensifies—such as the sudden escalation of global trade tensions—investors tend to choose to act safely.This means investors will withdraw from more volatile assets, including cryptocurrencies, and instead hold cash or bonds, etc., which are considered safer.This is a typical “hazard-haven” strategy.

But as you have seen before, cryptocurrencies won’t be long-term downturn.By mid-April, Bitcoin had rebounded and traded slightly below $85,000.Ethereum, Ripple and other major altcoins have also recovered some of the lost ground.For many investors, the rebound is a reminder that despite the high volatility of cryptocurrency, it is also increasingly seen as a valuable hedging tool, unaffected by any government or policy decisions.

In 2018-19, in the early stages of tension in Sino-US relations, Bitcoin also showed a similar pattern: it rebounded rapidly after a short-term decline.In early 2025, the United States imposed new tariffs on imported products from Canada and Mexico, causing the price of Bitcoin to fall, but then quickly rebounded.

At the same time, the road to recovery of the stock market is often more difficult.As of April, the S&P 500 has fallen nearly 9% so far in 2025, while the Nasdaq has fallen more than 13%.Stock markets briefly rebounded after 90 days of suspension of some tariffs by the United States, but overall, stock market sentiment remains volatile.

4. What does the trade war mean to supply chains and consumers

The chain reaction of the trade war in 2025 is impacting global supply chains, spreading from industry to industry.

From electronics to automobiles to medicines, global cargo transportation costs are rising.Let’s talk about several industries in detail.

The impact of the trade war on electronics and semiconductors

Electronics are the core of it.In 2024, the United States imported $146 billion worth of electronic products from China.As tariffs on these goods rise, if these tariffs continue, the annual costs of businesses could increase by $182 billion.

This is also a problem for consumers.Take Apple as an example.The iPhone 16 Pro Max price could surge from $1,199 to over $1,800 as the phone doesn’t have a long-term waiver.Coupled with the uncertainty about future tariffs on laptops, chips and smart devices, the entire industry is in a state of tension.

The impact of the trade war on the automotive industry

Automakers are facing similar dilemmas.The United States has raised tariffs on Chinese-made cars from 25% to more than 100%.Not only the entire vehicle was affected, but batteries, chips and other components from China were also affected.

This is especially a heavy blow to electric car manufacturers.Chinese battery components are crucial to many American and European electric vehicle brands.Some automakers are suspending production or changing suppliers as supply chains suddenly fall into cumbersome formalities and rising costs.

The impact of the trade war on the pharmaceutical industry

Even the health care system feels the impact.The United States relies heavily on China in terms of key medical supplies and pharmaceutical ingredients.New tariffs have led to higher prices and existing shortages are getting worse.

Industry experts warn that this will have a major impact.From commonly used drugs to hospital-grade equipment, all products can become more expensive.Even a small bottleneck can cause serious problems in a healthcare system that is already under tremendous pressure.

5. Tariffs rise and market turmoil. What will happen next?

The overall outlook for the 2025 Sino-US trade war is still unclear, and its actual impact on global investors, business leaders and policy makers is still unclear.

Let’s analyze the short-term, medium-term and long-term prospects.

short term

The market was relieved for a while.The market was relieved when the U.S. announced the harshest tariffs on some tech products, such as smartphones and laptops.The S&P 500 index rose, and global stock markets followed.Asian stock indexes, dominated by technology stocks, rose, and European stock markets including the German DAX index and the UK FTSE 100 index also rose.Even Bank of America’s performance further boosted optimism.

However, this may only be temporary.These exemptions are still under review, while more macro trade policies appear to be slow.

Medium term

Looking ahead, risks begin to increase.If the trade conflict continues, it may seriously drag down global economic growth.JPMorgan Chase recently raised its global recession risk to 60%, which is no small matter.Central banks are already weighing the next move; interest rate adjustments, coordinated actions and contingency plans are all put on the agenda.

Some, such as former British Prime Minister Gordon Brown, have called for global responses similar to those during the 2008 financial crisis.Meanwhile, businesses are rethinking their supply chains and rushing to find alternatives, but this is easier said than done.

In the long run

You will see countries exploring new trade agreements and trying to reduce their dependence on traditional powers.For example, China is increasing its efforts to internationalize the RMB and accelerating the promotion of the “Belt and Road” initiative.Instead, the United States tends toward domestic manufacturing and tries to reduce its reliance on imports.

The consequences can be huge.The World Trade Organization warns that the U.S. and China’s trade volume may shrink by as much as 80%.This is a huge shift considering that these two countries account for about 3% of global trade.If this decline becomes a reality, it could have an impact on the global economy.