Author: Vanguard_

Three years ago, GAMESTOP’s crazy retail holdings shocked the financial market, and today, this story has been ignited again.Roaring Kitty, the enthusiasm of retail investors on social platforms, once again appeared in the center of the stage, and issued a tweet with 23.5 million views.His arrival not only allowed relevant MEME currency and GameStop stocks (GME) price, but also re -ignited the enthusiasm of investors.In the financial market, the power of individuals can sometimes have surprising impact, and the re -emergence of Roaring Kitty is the reflection of this power.

This article will explore the influence of Roaring Kitty and the market changes caused by his latest tweets. At the same time, review the full picture of the Gamestop incident to explore the role of individual investors in the financial market.

Gill has no place as an ordinary person, but his successful investment in Gamestop is amazing

In the financial world, a story named Keith Patrick Gill is remarkable.Born in 1986, he was not from Wall Street, but an ordinary financial analyst and investor.However, he became famous in one fell swoop with anonymous identity named DeepFuckingValue (DFV) through the remarks on the Reddit and YouTube channels.His investment story began in September 2019, when he announced a transaction screenshot on Reddit, showing that he held a bulls of about $ 53,000 for Gamestop stocks.

Gill is not famous overnight.His views and investment strategies have gradually won people’s attention and recognition.Through fundamental and technical analysis, he firmly believes that GameStop is underestimated and worth investing.He shared his research and analysis on YouTube, attracting more and more audiences.He was nicknamed “Roar Kitten” because his enthusiasm and persistence made people think of the stubbornness of cats.

Gill’s investment story, especially his unique insights on GameStop, triggered an unprecedented stock market frenzy.In January 2021, GameStop’s stock price soared, attracting a large number of retail investors.Gill’s firm conviction and actions inspired thousands of people, and they began to find their own opportunities in the stock market.However, the violent fluctuations of the stock price also allowed people to see the cruelty and unpredictable financial markets.

The impact of the GME incident is not limited to the stock market, but even involves the film and television industry.Netflix launched a mini -series and story film based on the GME event as the background, which once again attracted public attention and discussion.

Gill is not an institutional investor, and he does not provide personalized investment proposals for fees.He is just an ordinary individual investor, and the investment and social media content of GameStop are based on his own research and analysis.However, his remarks and actions changed the pattern of the entire stock market and became a legend.Although the incident has passed, Roaring Kitty’s story will always inspire people and let them bravely chase their dreams, no matter what challenges and difficulties are facing.

Starting from GAMESTOP earlier this year, GAMESTOP entered the lowest history of history, but the appearance of Roaring Kitty turned him to safety

As of January 2024, GameStop has gone through a series of difficult moments.Before 2021, the company faced serious financial challenges.Due to the rise of digital downloads, the sales of physical stores declined sharply, and the company’s stock price once fell to a historical low, only $ 5.16.This has triggered the empty emotions of institutional investors and hedge funds. They have shorted the Stocks of GameStop and are expected to continue to fall.

However, in early 2021, retail investors in the R/WallStreetbets community on Reddit launched an unprecedented action to purchase a large number of GameStop stocks, which caused a sensational rolling market.The stock price soared to $ 492 in a short period of time, forcing many hedge funds to suffer major losses, including Melvin Capital with a loss of nearly $ 3 billion.

Subsequently, GameStop tried to transform through market attention.However, the company encountered challenges in emerging markets.In 2023, due to regulatory uncertainty, Gamestop had to close its NFT wallet business and stop its NFT market operation.

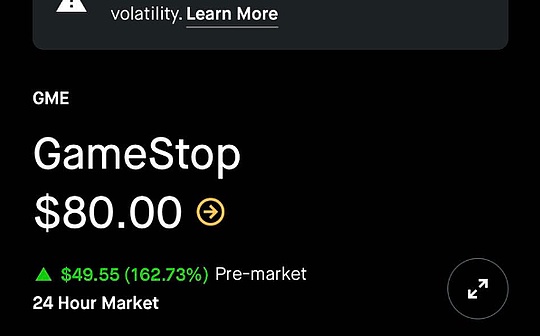

By 2024, the fate of GameStop changed again.On May 13th, the reappearance of Roaring Kitty on the social media X platform and the rapid growth of related MEME coins $ Kitty, once again pushed GameStop to the cusp of the market.The stock price skyrocketed in just a few hours, with a maximum increase of 63.29%, and multiple triggers were triggered.

The soaring stock price not only brought financial income, but also re -ignited the market’s optimistic expectations for the future of GameStop.At the same time, the company is also actively participating in more digital assets and cryptocurrency projects, such as cooperating with Pudgy Penguins to launch NFT products on its platform.In addition, GameStop’s stock was adopted by the Solana blockchain community, and the GME community coins were launched, which further enhanced its influence in the cryptocurrency market.

The story of GameStop reflects the process of studying a traditional retailer in the digital age.Despite many challenges, the company continued to seek transformation and innovation with the support of retail forces, laying a solid foundation for future development.With the rapid development of digital assets and cryptocurrency markets, GameStop is expected to continue to explore new business models to maintain its competitive advantage in the industry.

Gamestop assets rose caused a chain reaction, and a group of MEME and other projects appeared to rise.

After Keith Gill, the latest tweet of “Roaring Kitty”, the Gamestop and its related MEME currency markets have caused significant fluctuations worldwide.This time, the appearance of Gill’s influence in the digital currency market is not only amazing, but also highlights the huge potential of social media influence.In addition, the incident also caused a chain reaction, and a public asset price rose sharply:

1. The explosive growth of $ Kitty Memeco: Under the influence of Roaring Kitty, the price of $ Kitty has skyrocketed by more than 74 times within 24 hours, the market value has reached 10 million US dollars, and the transaction volume of 24 hours exceeds $ 15 million.This rapidly growing scene is not uncommon in the cryptocurrency market, but it is often closely related to significant individuals or events.

2. The significant growth of the $ GME tokens: The $ GME tokens with the same name as the stock code as Gamestop also experienced a significant increase, reaching 496.2%, and the market value instantly increased to $ 20 million.This increase is due to the market attention and the warm response of retail investors caused by Gill again.

3. The fierce fluctuations of GameStop stocks: GameStop’s stock price has experienced several disconnection after the opening of the US stock market, and eventually increased by 63.29%within a day, with a maximum increase of more than 110%.This violent market response once again proves the great influence of Roaring Kitty on retail investors.

4. Growth of other related MEME coins: other MEME coins related to Roaring Kitty and GameStop also rose to varying degrees, such as Dogecoin (Doge) and Shiba Inu (Shib), respectively 5.7%and 5.0%, respectively.

This incident not only showed the influence of Roaring KITTY in the financial market, but also highlights the cross -role role between social media and the digital asset world.The rapid response of MEME coins and the fluctuations of the stock market show that the modern financial market is becoming more and more driven by digitalization and decentralization.In addition, this phenomenon also shows that the speeches of social media platforms can be used as a potential market manipulation tool, causing the attention and possible intervention of regulatory agencies.

In summary, a tweet of Roaring Kitty not only reshaped the market position of GameStop, but also brought new vitality and investor attention to the cryptocurrency market.This reflects the complexity and variability of the dynamics of the modern financial market, and the personal influence can be comparable to any traditional financial institution.