Author: Christine Kim, Galaxy; Compilation: Baishui, Bitchain Vision

General description

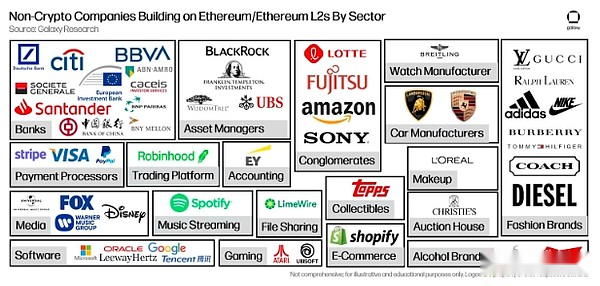

More than 50 non-crypto companies have built products and services on Ethereum or Ethereum L2.These companies include fashion brands such as Louis Vuitton and Adidas, as well as financial institutions such as Deutsche Bank and Paypal.These products and services obviously do not include products and services related to general market infrastructure such as cryptocurrency trading, custody, auditing and compliance.Instead, they are related to encryption-specific infrastructure and use cases such as NFT, RWA, Web3 developer tools, and L2.Of the 20 financial institutions that have established crypto-specific infrastructure and applications, 10 are banks, most of whom issue RWAs on Ethereum.This report is intended to highlight early and key use cases of traditional companies and institutions using Ethereum.

Preface

For this report, the main sectors of the crypto industry can be divided into three categories:

-

General Infrastructure– Companies that provide products and services related to cryptocurrencies and blockchains that are not exclusive or exclusive to the crypto industry, such as general market infrastructure (i.e. exchanges, market makers, asset management) and general business support(i.e. banking, accounting, consulting, compliance).

-

Encrypted dedicated infrastructure– Companies that offer exclusive and exclusive products and services for encryption.This includes, for example, companies involved in mining, staking, and building on-chain oracles, responsible for infrastructure that is only useful in crypto and blockchain environments.

-

Encryption use cases and applications– A company that is building consumer applications that run in all or in part on the blockchain.For example, a decentralized exchange will automatically perform cryptocurrency transactions on the blockchain without relying on third-party intermediaries.

Rather than expanding existing suites of applications and services to support cryptocurrencies, traditional companies have gone further to innovate new products and services that can only be powered by blockchain.In addition, many of these companies (at least 55) are innovating on public blockchains such as Ethereum and Ethereum L2, such as Polygon, Arbitrum, and Base.

Here is a market map of 55 non-crypto-native companies that have or are building crypto-specific infrastructure and applications on Ethereum and Ethereum L2.

Of the 55 companies, at least 23 are offering NFTs on Ethereum or Ethereum L2.

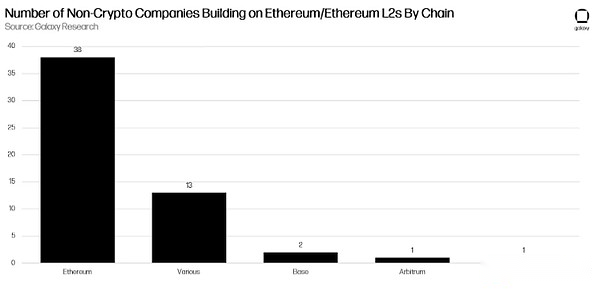

While most companies are built directly on Ethereum, at least 17 companies have or are trying to build across multiple general blockchains and Layer-2 Rollup.

RWA on Ethereum

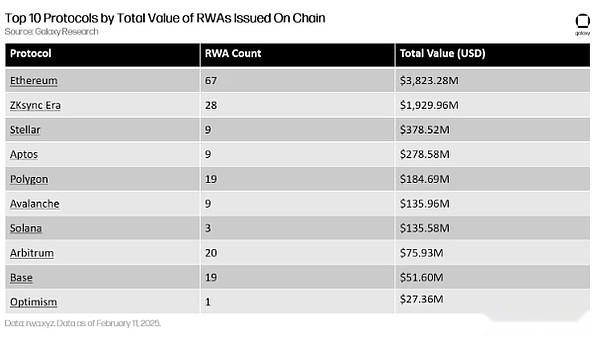

One of the most common types of non-crypto companies in the Ethereum ecosystem is financial institutions, such as banks, asset management companies, payment processors, trading platforms and accounting firms.Of the 20 financial institutions that have identified that they have built crypto-specific infrastructure and applications, 13 have issued RWAs on Ethereum and Ethereum L2.The types of RWA issued on-chain include government bonds issued by money market funds (such as Franklin OnChain U.S. Government Money Fund) and European Investment Bank.

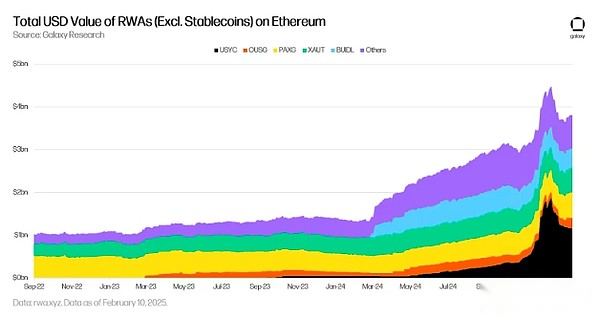

Ethereum is the preferred blockchain for issuing tokenized assets, and its total RWA value is almost ten times that of Stellar, the next most popular RWA blockchain.ZKsync is a Layer-2 summary built on Ethereum, with the number and total value of RWAs issued on-chain higher than Stellar.Six of the top 10 protocols for issuing RWA are Ethereum or Ethereum L2.

As of February 11, 2025, the third largest tokenized fund in all blockchains is BlackRock’s USD Institution Digital Liquidity Fund (BUIDL).Launched in March 2024, BUIDL provides investors with US dollar returns, with advantages of instant transparent settlement and interoperability between traditional financial markets and decentralized financial markets.“Through tokenization, we expose traditional financial investment risks to cryptocurrency native packaging,” Robert Mitchnick, head of digital assets at BlackRock, said in March.

BlackRock, the world’s largest asset management company, has partnered with tokenization platform Securities and Bank of New York Mellon, a US financial services company, to launch BUIDL for the first time on Ethereum.Since last March, BlackRock has expanded the fund to five other protocols outside Ethereum, three of which are Ethereum L2.

The value of RWA issued on Ethereum alone has tripled in the past year.According to rwa.xyz data, over 160 RWAs are issued on Ethereum and stored in 60,000 unique active wallet addresses.These numbers do not include stablecoins.

Although the number is small,A subset of financial institutions dedicated to RWA and tokenization is also developing their own stablecoins.PayPal, a payment processor, first launched its own dollar-pegged stablecoin PYUSD on Ethereum in August 2023.Since then, PayPal has expanded the distribution scope of PYUSD to Solana.Trading platform Robinhood, in partnership with many other crypto-native institutions such as Galaxy Digital, Kraken, Nuvei, Anchorage, Bullish and Paxos, also launched its own dollar-pegged stablecoin USDG on Ethereum in November 2024.

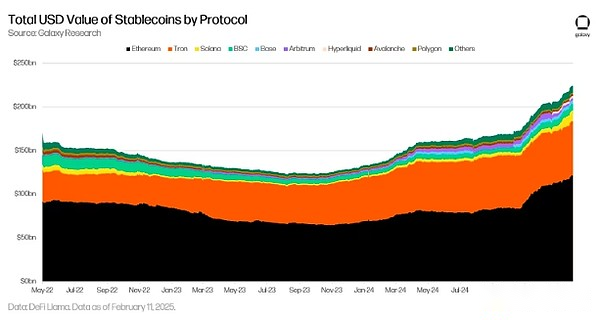

The total supply of stablecoins in circulation on Ethereum has increased by 70% over the past year.The collateral portfolio and design types of these stablecoins vary, but the vast majority are USD-pegged tools that hold high-quality current assets (HQLAs) as collateral.As of February 11, 2025, Ethereum accounted for more than 50% of the total stablecoin market.

Galaxy Research data showsBy 2025, the total supply of stablecoins will double to more than $400 billion.This year, one catalyst for accelerating the launch of a new stablecoin backed by traditional financial partners is Stripe’s acquisition of Bridge, a stablecoin payment platform for $1 billion in 2024.Regarding the acquisition, Stripe CEO Patrick Collison said:“Stablecoins are room temperature superconductors for financial services. Thanks to stablecoins, global companies will benefit from significant improvements in speed, coverage and costs in the coming years.”

In the United States,Another catalyst that drives RWA and stablecoins to adopt is the regulatory environment.The Securities and Exchange Commission (SEC) Commissioner Hester Peirce issued a statement on Tuesday, February 4, 2025 outlining specific priorities and topics related to the digital asset industry that the Commission may address, and the ninth item on her list emphasizes the passage of generationsMonetization realizes the modernization of traditional finance.“The Working Group also plans to study the intersection of cryptocurrencies with clearing agencies and transfer agency rules. “We will continue to work with market participants who are interested in tokenizing securities or otherwise using blockchain technology to modernize traditional financial markets,” said the statement.

RWA and stablecoins are cryptocurrency native use cases that are quickly finding product market fits among traditional financial institutions.As a universal blockchain with the highest degree of decentralization, the widest coverage of cryptocurrency native users and the longest network uptime, Ethereum is the portal used by many institutions to incubate and launch financial-focused cryptocurrency services and products..

Scalable blockchain infrastructure

Although Ethereum is the portal for many financial institutions and non-crypto companies to leverage cryptocurrencies and blockchain technology, it is not a protocol that new blockchain use cases can scale.Compared with blockchains such as Solana, Ethereum has poor performance, slow block production time and higher transaction fees.Ethereum protocol developers are committed to making Ethereum the center of layer 2 aggregation, rather than sacrificing the resilience and security of the network for speed (a by-product of network decentralization).The blockchain infrastructure can inherit Ethereum’s security and scale to millions of new users.

Not only are non-crypto companies pushing crypto use cases (such as tokenization) on Ethereum, they are also investing in the infrastructure needed to support these use cases, making their audiences wider than crypto-native users.Germany’s largest bank, Deutsche Bank, is working with Matter Labs, the team that sets up ZKSync aggregation to develop new aggregations on Ethereum.Codenamed Project DAMA 2, Rollup is part of a broader initiative led by the Monetary Authority of Singapore (MAS) and 24 other financial institutions around the world, aiming to explore the use cases of public blockchain in global finance.

The main motivation of Deutsche Bank L2 is to create a scalable, auditable, transparent and interoperable blockchain infrastructure that is interoperable with regulated platforms and financial services.“Organizations looking to build on the chain have chosen ZKSync to gain the ability to build in Web3 without compromise. ZKSync provides organizations with customizable architectures to build customized solutions that enable privacy, scalability and other privateand public blockchain interoperability,” said Alex Gluchowski, co-inventor of ZKSync, when talking about the motivations of Deutsche Bank L2.

Financial institutions such as Deutsche Bank are developing scalable blockchain infrastructure that can also be customized and comply with regional regulations of Ethereum.However, the appeal of scalable and customizable blockchain infrastructure is not limited to financial use cases.

Japanese conglomerate Sony recently launched its own rollup using the OP technology stack on Ethereum.Their motivation to create and operate their own universal rollup is to support a wider ecosystem of gaming, finance and entertainment applications.About Sony’s L2 Soneium, Jun Watanabe, Chairman of Sony Blockchain Solutions Lab, said: “I think it’s very important to the Sony Group that develops a comprehensive Web3 solution based on blockchain, which is in the power of creativity and technology to makeThe world is full of emotions’ and has carried out a variety of businesses.”

Since the launch of Soneium, the protocol has faced strong opposition due to Sony’s oversight of on-chain activities, especially the launch of memecoin, which has led to restrictions on token transfers and blacklist addresses.While the incident has raised questions about how much control businesses should have on rollups they build on license-free infrastructure such as Ethereum, it also highlights the unity of the world’s largest conglomeratesFind answers to these questions.Sony is investing in new digital experiences and applications on Ethereum by launching Soneium and launching a summary on Ethereum, which fully illustrates the Ethereum block space and the scalable blockchain infrastructure built on it.Potential value.

Playing games on Ethereum L2

NFT is a major use case for traditional companies, mainly luxury fashion brands such as Louis Vuitton and Coach, as well as luxury car manufacturers such as Porsche and Lamborghini.Most of the NFTs issued by these companies were cast between 2021 and 2023, when it was the peak of the NFT craze.Given the decline in NFT reserve prices in the past few years, many companies are no longer actively publishing NFTs on Ethereum and Ethereum L2 in 2025.

A few companies that are still actively publishing NFTs on Ethereum in 2025 do so in the context of game development and are almost entirely on Ethereum L2, not on Ethereum.

In July 2024, video game giant Atari deployed two classic arcade games “Asteroids” and “Breakout” on top of Ethereum optimistic summary Base operated by Coinbase.By the end of August 2024, gamers can earn rewards on Base, cast exclusive Atari NFTs and redeem physical merchandise.A few months after Atari entered the on-chain gaming industry, in October 2024, Lamborghini announced a partnership with Web3 gaming company Animoca Brands to launch a digital collectibles platform called FastForWorld.

FastForWorld enables gamers to buy, sell and drive Lamborghini cars in a range of games developed by Animoca Brands, including proprietary experiences from Torque Drift 2, REVV Racing, Motorverse Hub and FastForWorld.The collaboration was described in the press release as “Lamborghini’s first interoperability of its iconic vehicles based on blockchain in the game.”

It was later revealed that FastForWorld’s in-game assets will be minted on Base.The first version of the platform, launched on November 7, 2024, is still under active development and is expected to announce additional extensions to the FastForWorld platform in 2025.

Recently, on January 7, 2025, Lotte Group, one of the five largest conglomerates in South Korea, announced a deeper partnership with the Arbitrum Foundation and Offchain Labs to build Lotte’s meta-universe gaming platform “Caliverse” on Ethereum Summary Arbitrum.Already online Caliverse allows users to shop, attend virtual concerts and play games on their platform.“Along with the most trusted blockchain Arbitrum, we are delighted to take the first step in the blockchain world with Rakuten Caliverse, and we will leverage Rakuten’s successful history in retail to deliver outstanding products to over 40 million peopleand service,” Caliverse CEO Kim said of his collaboration with Arbitrum.During the 2025 Consumer Electronics Show (CES) in Las Vegas, USA, the Caliverse team announced plans to launch virtual reality and 3D movie features on its platform in the first half of 2025.

Most notably, non-crypto-native companies such as Atari, Lamborghini and Rakuten’s Caliverse are continuing to invest and develop NFTs that are developed in the context of larger on-chain gaming applications.Blockchain-based games may require frequent on-chain transactions, which can also lead to expensive fees and network congestion.For this reason, these companies are building their games on Ethereum L2 to take advantage of the scaling benefits of Ethereum’s aggregation-centric architecture.

“Arbitrum’s blockchain is the ideal home for Caliverse thanks to the industry-leading 250 millisecond block time that enables seamless virtual worlds and game use cases,” said Steven Goldfeder, co-founder and CEO of Offchain Labs.

in conclusion

NFT and RWA are the main use cases for Ethereum among non-crypto-native companies and institutions.Among the companies that issue NFTs in the Ethereum ecosystem, the most active company in 2025 is issuing NFTs in on-chain gaming applications built on Ethereum L2.This highlights how the scalability benefits of L2 can help support crypto-native use cases that require frequent on-chain interactions, such as games between major retail brands and companies.Ethereum strives to expand its infrastructure with Rollup, which also provides an opportunity for early adopters of the technology in traditional finance and other industries to lead crypto-non-speculative use cases by creating customizable and compliant infrastructure for these use cases.at last,Ethereum remains the preferred blockchain for traditional financial companies to issue RWA and stablecoins.The key partnerships and acquisitions established in 2024 are expected to drive new progress in stablecoin adoption in 2025.