Author: Kyle Ellicott, YAN MA, Darius Tan, Melody He, Spartan Group; Translation: 0xjs@作 作 作 作 作 作 作 作 作 作

“Bitcoin Layer: Trunk blankets that do not need to trust the financial era” are a research report on the development of the entire Bitcoin ecosystem.The report was written by the Spartan Group team Kyle Ellicott and a number of experts. These experts provided feedback and insights, and took time to review the final version of this article.This part is the third in the four articles of this series.

The concept of “Bitcoin Layers” introduced in 2018 represents a key change in the development of Bitcoin and solves its scalability challenges.From a historical point of view, the aim to strengthen the various efforts of the Bitcoin L1 have a common goal: promoting the under -chain transactions to improve the scalability of the network.These efforts are based on the security settlement layer provided by L1.The Bitcoin layer has become a solution that covers L2, L3, data and application layers, and draws insights from the layered architecture of Ethereum.These innovations reflect the adaptive response to its inherent limitations of its network, and show the method of moving towards a stronger and more common blockchain infrastructure.

The newly emerged Bitcoin layer introduces a variety of functions and changes the ability of the network.These layers are provided:

-

Smart contract programming:Realize complex financial and contract transactions directly on the Bitcoin network.

-

Improve throughput speed:A significant reduction of transaction processing time, the speed of some layers can reach less than 30 seconds.

-

BTC’s trust to minimize to L2:Promote the safe and efficient movement between BTCs between layers and provide solutions for the centralized problems of federal methods.

-

Reduce cost:Reduce transaction costs and make it easier for Bitcoin transactions to be more widely used.

-

Asset issuance and rollup:Provide new ways for asset creation and transaction bundles to improve efficiency.

-

Mutuality and privacy measures:Enhance the ability to interact with other blockchain systems and protect user privacy.

-

Virtual machine (VM) and specific functions:Support various applications, including games, finance, media and decentralized science (DESCI).

These layers are strategically based on the L1 of Bitcoin, using L1 as the basic platform, similar to the “cold storage” of BTC assets.This layered structure not only allows seamless assets to move across different layers, but also releases a Bitcoin $ 850 billion in idle capital.Therefore, the use of these layers of applications benefit from Bitcoin’s famous security and stability.

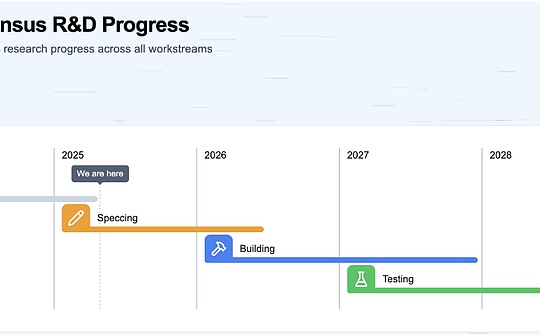

Bitcoin viewing (March 2024)

As of the fourth quarter of 2023, major progress has been made in the development of the Bitcoin layer, and the L2 solution has made significant progress.The ecosystem has expanded to including side chain, DriveChain, combined mining chain and POS chain.This period also marks the emergence of various protocols, tokens, cross -chain bridges, ROLLUP, and other innovative solutions.

These development is not only technological improvement, but also technical progress.They represent the paradigm of Bitcoin’s practicality, which has opened up new ways for users to deploy and applied.This layered method emphasizes the development and adaptability of Bitcoin and consolidates its position in the rapidly developing digital world.The following sections introduce the key innovations in these categories in detail, which illustrates the dynamic and forward -looking nature of the Bitcoin layered ecosystem.

Four Bitcoin L2

The existing major Bitcoin layers are dominated by the “four major” -Stacks, Lightning, RSK, and Liquid.These four entities have jointly conducted L2 transactions, shaping the pattern of Bitcoin scalable solutions.Each of these L2 solutions has unique characteristics and functions, making unique contributions to the growth and scalability of the Bitcoin ecosystem.

1. Stacks

The Bitcoin L2 project was launched by Princeton computer scientists Ryan Shea and Muneeb Ali in 2017 to provide smart contracts for Bitcoin.The initial version of the Stacks network was launched in January 2021, allowing smart contracts and decentralized applications to use Bitcoin as a safe L1.Stacks Bitcoin L2 with its transmission certificate(POX)The consensus mechanism activates the Bitcoin economy.(POW)consensusRun parallel and reuse its computing capabilitiesEssence

-

The network is further protected through “Stacking”, where the Stacks token holder submits a transaction, protecting the STACKS network and earning BTC rewards.

-

The smart contracts on Stacks are coded in Clarity. Clarity is a native language that can be readable, which can respond to Bitcoin transactions and assets and BTC atom exchange.

-

STX tokens are used as GAS on L2, which is 2019The first tokens that meet the SEC qualificationLater, before the launch of the main network in 2021, a decentralized filing update was made to the SEC as a non -securities.

-

STX is the top 50 project, and alsoThe only bitcoin l2 with native tokenIt was also listed in the top 100 of Coinmarketcap when writing this article.In the 2022 Electric Capital Developer Report, the company ranked 38th in the developer activities of the entire industry. Since 2015, the number of active developers has continued to increase. As of October 2023, the number of active developers is the number of active developers is175.

Monthly developers on Stacks.Source: Electric Capital

Monthly developers on Stacks.Source: Electric Capital

The upcoming catalyst:

-

NakamotoNetwork upgrade (second quarter of 2024) will enable Stacks to achieve fast and cheap BTC transmission on L2, and has 100% Bitcoin security (anti -reorganization).In addition, the transaction speed on the network will be shortened from the current settlement of Bitcoin more than 10-30 minutes to about 5 seconds, which will increase by 1,000 times.As of December 2023, the two main milestones in upgrading and development have been realized. V0.1 (called “Mockamoto”) and NEON (V0.2) “Controlled” test network, with a single miner, a single Stacker and Stacker signature signatureEssence

-

SBTCIt is a decentralized 1: 1 Bitcoin that supports assets. It can deploy and mobile BTC between Bitcoin and Stacks (L2), and is used as a GAS in the transaction without additional assets.SBTC transmission 100% is guaranteed by Bitcoin computing power.To reverse the transaction, Bitcoin itself must be attacked.

SBTC releases roadmap.Source: SBTC

The resulting Stacks layer makes Bitcoin a completely programmable asset in a decentralized way.If it is successful, it will promote more demand for Stacks and Bitcoin.This can provide a accelerated development environment for the Bitcoin economy, release hundreds of billions of dollars of passive Bitcoin capital, and make Bitcoin a safer network pillar.

2. Lightning Network

Released in 2018 (White Paper in 2016), the Lightning Network supports Bitcoin small payment, which can be sent immediately anywhere without any cost.The strong transaction processing capabilities of Lightning Networks and its increasing popularity highlights its role in enhancing the scalability and transaction efficiency of Bitcoin.

-

The protocol uses a smart contract to create a payment channel that combines the settlement and the process under the chain.

-

When the channel is closed, the transaction will be merged and sent to the Bitcoin network.The native assets of Lightning Network are Lightning Bitcoin (BTC).

-

In August 2023, the network was dealing with about 6.6 million routing transactions, that is, about 213,000 pens per day, accounting for about 52% of the network public capacity.Compared with the 503,000 lightning payment estimated in K33 in August 2021, these similar numbers increased by 1,212%.

-

In addition, on average, the Lightning Network handles at least 47% of the Bitcoin chain per day.

Lightning network is increasing the daily transaction volume of Bitcoin.Source: River

Lightning network is increasing the daily transaction volume of Bitcoin.Source: River

3. rootstock (RSK)

Founded by RSK LABS in 2015, the network passes through itThe RSK virtual machine (RVM) introduces EVM compatible smart contracts into Bitcoin.With the help of RVM, developers can transplant the Ethereum contract to Bitcoin.RSK’s native assets are Smart Bitcoin (RBTC).RBTC keeps 1: 1 hook with BTC, but does not need to trust.Because its block security is based on “merging mining”, it continues to rely on centralized custodians, which highlights the balance between security and decentralization in the L2 solution.

4. Liquid Network

Published by Blockstream in 2018, the LIquid Network side chain enables users to perform fast, safe and confidential transactions on Bitcoin.Liquid is independent of Bitcoin, has its own ledger, and abandons the POW POW consensus mechanism of Bitcoin. Instead, it adopts the LIQUID alliance composed of about 60 members. They are founders of new blocks.LIquid’s native assets are liquid Bitcoin (L-BTC), which is the “packaging” version of BTC.This independent operation of Liquid Network shows the diversity of methods in the Bitcoin L2 ecosystem.

Today, although there is no Bitcoin L2 holding more than 10,000 BTCs or millions of user bases, the potential of index growth is still huge, which highlights the key role of these solutions in Bitcoin’s future scalability and functions.With the advancement of Bitcoin L2 technology, they have begun to open up a variety of ways to achieve fast experiments around BTC while maintaining the stability of the core network.The success of the future L2 solution depends on their ability to provide a complete execution environment similar to EVM, solve current restrictions and cultivate a more inclusive development environment.

Copy L2 difficulties

In the process of pursuing the scalability of the Bitcoin layer, a new problem occurred: L2 cannot triangle.The impossible triangle of the blockchain was re -examined and it was applied to the Bitcoin L2. We found that it was still the same, but the balance was slightly different.For L2 cannot triangle, the choice is limited to:

A. Become an open network or alliance.

B. Whether to introduce a new Token.

C. Have a complete/global virtual machine (VM) or a limited chain contract.

The industry has witnessed the attempt to turn this triangle into a square to re -use the existing Bitcoin mining machine to tap L2.RSK (previously called rootstock) and DriveChains are examples of these attempts.In this method, the incentive of miners has become an unreasonable problem, similar to GAS fees (especially in the early days) may not be enough to deal with the incentive problem.

-

Lightning chose A and B, but there was no full VM global state.

-

STACKS chose A and C using the new token (STX).

-

Liquid chose B and C as the alliance operation.

Early discussions between developers focusing on the new operating code of Bitcoin (L1). Theoretically, this may help eliminate today’s triangle.The new operating code, such as OP-SNARK-VERIFY, can be used for Bitcoin (L1) to verify the calculation of L2.However, the historical challenges facing soft forks or hard forks in Bitcoin show that this solution may not be feasible in the short term.

Looking forward to the future, the Bitcoin ecosystem may be extended to the current minority L2 solution, and hundreds of solutions are required to fully explore and develop the potential of the network.At present, developers are considering these options to balance the balance in L2 dilemma.The trend of the open network is rising. Anyone can dig and enter/exit freely, provide a complete virtual machine (VM) environment for smart contracts, and use the global state as the basic attribute.This method reflects the successful structure of other blockchain ecosystems such as Ethereum and Solana, and is expected to shape the future trajectory of Bitcoin L2 progress.

Emerging innovation

In addition to the four major L2 that has been established, fast experiments are continuing, involving many projects involving infrastructure tools, standards and agreements.With the formation of technology stacks, the existing technology gaps in the application requirements are actively introducing new classification definitions.

ARKIt is an experimental L2 agreement launched in May 2023.ARK allows users to provide liquidity to the network through their always online, no trust intermediary ARK service provider (ASP), and conduct chain and scalable Bitcoin payment in low cost and anonymous manner.Since the transaction is performed on the agreement, the receiver can receive payment without obtaining flow of flow, and at the same time protect the privacy of the receiver at a lower cost than the lightning network.

BabylonDuring the COSMOVERSE 2023, Babylon is a POS network, consisting of two security sharing agreements, Bitcoin timestamps and bridge pledge of Bitcoin and other POS networks.

Botanix (SpiderChain L2) is a kind ofPOS Bitcoin EVM, it uses multiple signature distributed networks to promote two -way hooks with Bitcoin and enhance its interoperability.

InternetIt is a modular programming network between Bitcoin and multi -chain ecosystems, running as a Polkadot parallel chain.Interlay has created a decentralized Bitcoin Bridge that can cast IBTC or “valuable BTC”, which is the asset supported by its multi -chain 1: 1 Bitcoin.

MintlayerIt is a POS network, which aims to act as the side chain of Bitcoin, and optimizes DEFI -related activities (including atomic exchange).Use Mintlayer to create tokens without using a Bitcoin or smart contract language (that is, Solidity, etc.), because the network is based on UTXO and needs to create a transaction with embedded additional data.The goal of the network is to generate a block every 120 seconds with verified random functions and finally determine after 1,000 blocks.

Ordinals.The innovative Ordinals theory framework was released in June 2022, which triggered a cultural revolution based on Bitcoin.In December 2023, only a few months after the release of Ordinals (ORD), developers began to use Ordinals. It does not need a separate side chain, token or Bitcoin core update, and supports Bitcoin inscriptions.The inscription is a Bitcoin NFT that cannot be tampered with, including the original file data (video, audio, image, executable software, etc.) address, wallet, etc. that can be transferred or sent to Bitcoin on Bitcoin and can be transferred or sent to Bitcoin.

Number of inscriptions.Source: dune

With the emergence of new experiments, infrastructure tools and standards, the rapid growth of Ordinals will only show index level growth.In the year since the first inscription on December 14, 2022, the total number of inscriptions in the first 90 days exceeded 460,000. This year, it has exceeded 46.2 million. During this period, about 3,365 BTC (approximately $ 148.8 million) was incurred.

RGBnetwork(Really Good Bitcoin) is a Bitcoin -based protocol using the Lightning Network, not a token protocol.

Threshold NetworkIt is a fusion network centered on Keep and NycyPher. It allows users to use Keep Network to protect the ability of private data through the linked container and NucyPher’s privacy tools for key management and dynamic access control.Threshold is the founder of the TBTC Bitcoin Bridge. This is a decentralized and no license bridge between Bitcoin and Ethereum.

These agreement experiments only represent a small part of the developers per week.The continuous introduction of new agreements and standards indicates that the Bitcoin technology stack is full of vitality and continuous development.The momentum of these development, especially in the context of the upcoming Bitcoin halving incident in the second quarter of 2024, shows that the Bitcoin ecosystem has further innovated and adopted in the Bitcoin ecosystem.

The rise of tokens

Following several emerging agreements, the community has also begun to try new token standards to provide early previews that can be designed to be designed by Bitcoin’s unique structure.In its infancy, it is important to emphasize the content introduced to developers and pay attention to the similarities of peers in the Ethereum ecosystem.

BRC-20It is the experimental token standard created by DOMO. It was released in early March 2023, which aims to create alternative tokens on Bitcoin.This standard uses the ORDinals inscription and JSON data to reflect Ethereum’s ERC-20 standard, but it is tailor-made for the limited Bitcoin ecosystem.Several platforms followed up quickly to develop tools and start -up tools for experimental token standards (Alex, Bitget, Leather, Ordinalsbot, Unisat Wallet, XV Erse, etc.).It is worth noting that the ORDI tokens are the first tokens deployed according to the standard. By May 2023, its market value has exceeded $ 1 billion. It ranks 52nd in CoinMarketcap.Dollar.

Brc-721eIt is an experimental token standard, similar to the extensive ERC-721, which is implemented by Bitcoin Miladys, Ordinals Market and XVERSE.In the initial state, the experimental standard allows users to connect NFT from Ethereum to Bitcoin, to record the unruly version of NFT, and it has a link to return the original Ethereum version and the airdrop function.Once the NFT is bridged, it will automatically appear in the Ordinals market.The experiment has opened up many possibilities for cross -chain interaction between the two networks.

ORC-20It is an experimental open token standard, which aims to improve the BRC-20 experiment to achieve backward compatibility, flexible naming space between the BRC-20 and the introduction of UTXO to prevent the dual expenditure in future development.

ORC-CASHThe experimental token standard based on the ORDINALS protocol is designed to the most suitable UTXO security model, and it is a simplified version of the ORC-20 standard.

RunesIt is an experimental homogeneous token agreement proposed by the Ordinals founder Casey Rodarmor in September 2023 as an alternative to the BRC-20 standard.Runes does not intend to rely on the data under the chain or request the native currency. Instead, it holds the balance through UTXO and uses specific script conditions to identify the transaction.

SRC-20It is a token standard created by Mike in Space, known as the Bitcoin Stamps (Bitcoin Secure Tradeable Art Maintenanceed Securely).Unloaded transactions).

STX-20The experimental inscription protocol standard released in December 2023 is used to create and share digital workpieces on the Stacks blockchain by embedding the protocol information (only 34 symbol restrictions) transmitted in the STX token.The release of the STX-20 leads to one of the largest blocks on the Stacks network, with a transaction volume of more than 10,000.

Privacy and security solutions

In addition to expansion, developers have also made great efforts to introduce Rollup into Bitcoin and add important security layers.In the early development phase, some of the famous experiments in this category include Urbit, Rollkit, Zerosync, Alpen Labs, Bison Labs, Chainway, Kasar Labs, and so on.

Other experiments in the ecosystem include specially designed protocols, such as 1BTC, BNSX, and ROOCH Network, as well as new classification definitions, such as DriveChains, SpiderChains, Fedes, SpaceChains, and SoftChains.Contribute to the extensive technology stack.

These innovations enhance the intrinsic value of the network and position Bitcoin as a more common and secure platform.They are critical to expanding the network and improving their ability to support various applications.With the continuous development of these technologies, they are expected to greatly improve the capacity of continuously increasing network processing and the ability to diversify applications while maintaining the basic principles of privacy and security.The ultimate goal is to create a sufficiently smooth user experience without worrying about supporting infrastructure.

The future of Bitcoin Finance

The Bitcoin layer marked by the improvement of Layer 2 solutions and privacy enhancement technology is shaping a financial ecosystem without trust.These development represents a major change in Bitcoin functions and potential impact on the financial sector.With its enhanced privacy, security, and scalability, Bitcoin is expected to support extensive financial applications such as traded transactions to innovative DEFI solutions.This transformation highlights the increasing role of Bitcoin. It is not only a kind of asset, but also the basic element of a safer, more efficient and more inclusive financial pattern.With the popularization of these technologies, the contribution of Bitcoin to trusting the financial system has become increasingly important, consolidating its position as a key pillar of finance in the future.

Attachment: The latest bitcoin L2

Since their initial reports, the Bitcoin ecosystem has made significant development.It is worth noting that the value of Bitcoin has soared to more than $ 63,000 since November 2021, marking a significant rebound in the market.At the same time, the territory of the Bitcoin L2 is rapidly expanding, and the DWF tracker highlights this. The tracker now lists 28 new Bitcoin L2 projects.How do we accurately evaluate the potential of these L2?

“Bitcoin Magazine” formulates a editing policy to define the real Bitcoin L2 according to three standards: use Bitcoin as native assets, use Bitcoin for transaction settlement execution, and functional dependence on bitcoin, which triggers discussion.

This definition has classified many emerging platforms, especially those with its own tokens for decentralized expansion. It is classified as the “meta protocol” or “parasitic chain” instead of the real L2 solution.

Despite these categories, the wider goal is to enhance the entire ecosystem.The significant innovation that aroused our interest includes:

Merlin Chain:Leed by the team behind the BRC-4 20 and Bitmap. This asset-centric L2 aims to associate the famous L1 assets with its user base with L2. As of the end of February, the total value (TVL) has exceeded $ 2 billionEssence

B-Squared Network:The platform introduces a modular method to combine ZK-Rollup as the execution layer and B² Hub to integrate decentralized storage with the bitcoin network, thereby forming a comprehensive ecosystem that includes consensus, data usability and settlement layer.

BOUNCEBIT:This is a Bitcoin re -mortgage chain. Users can use LSD to perform BTC mortgage and the chain agriculture while earning the original CEFI income, which is basically “re -mortgage” on Bitcoin.With the success of financing, TVL has also soared to more than $ 500 million this month.

Bob:The project uses Ethereum virtual machine (EVM) to create and execute smart contracts.

Bevm:Through the combination of POS consensus of the Bitcoin light node and the Taproot threshold contract to achieve decentralized interaction between Bitcoin and Bevm.

Citrea:This is ZKEVM on Bitcoin, which proves that it is engraved in Bitcoin and passes Bitvm for optimistic verification.

It is worth noting that the rise of the new Bitcoin L2 is mainly promoted by the Chinese team and has been supported by the large -scale Chinese community, bringing a large number of TVL, which indicates that the Bitcoin ecosystem is changing to the east.

These projects have successfully improved the cross -chain function of Bitcoin and used their previous construction experience to achieve great growth.However, this surge has also aroused concerns about the possibility of decentralization of liquidity in L2 solutions, as Ethereum saw.

Instead, there is a chance to expand the scope of Bitcoin assets and allow more Bitcoin users to participate in these new platforms.Although many of them have similarities, the future of the Bitcoin L2 is still uncertain and vibrant, and needs to be further developed.