introduction

In September 2025, the scale of US federal debt has soared to a record $37.4 trillion, a figure like a towering iceberg, with a calm surface but a surging global risks.The debt problem is not unique to the United States, but is the core challenge of the contemporary economic system, which is intertwined with fiscal policy imbalances, weak productivity growth, and the inherent fragility of the monetary system.From the relative stability after World War II to the exponential expansion today, the evolution of US public debt not only tests the resilience of the domestic economy, but also profoundly affects the international trade pattern, monetary hegemony status and geopolitical game.Understanding the causes, manifestations and their ripple effects of this crisis is crucial for investors, economists and policy makers.This article will start with the historical evolution of US debt, analyze current data and indicators, examine recent crisis events, explore the mechanisms of linkage between the bond market and the global, reveal the intertwined impact of geopolitics, analyze the dilemma of solutions, and look forward to global trends.Through an objective perspective, we will reveal how the U.S. debt crisis evolved into a global debt crisis and explore its potential structural reset.

The debt crisis is like a silent financial crisis. It originated from policy choices but affects the stability of the real economy and society.Historically, the Roman Empire’s debt expansion led to currency depreciation and empire collapse; Britain in the 19th century resolved the threat of debt peak through the industrial revolution.The current path of the United States is more similar to the former – the debt/GDP ratio has exceeded 120%, far higher than the 60%-80% threshold recommended by the International Monetary Fund (IMF).This ratio not only curbs economic growth, but also amplifies inflationary pressure and financial instability.What’s even more serious is that with the shift in policies of major creditor countries such as Japan, global bond market yields have risen simultaneously, indicating a reshaping of capital flows and a potential reset of the monetary system.In September 2025, the yield on the 10-year U.S. Treasury bonds was about 4.05%, Japan’s 30-year government bonds yielded 3.26%, and the euro zone’s 10-year bonds yielded about 3.16%.These data are not isolated, but a microcosm of the total global debt exceeding $324 trillion.This article aims to reveal the multidimensional face of this crisis through systematic analysis and provide insights into response.

Historical evolution of U.S. debt

The history of public debt in the United States can be traced back to the early days of the founding of the People’s Republic of China in 1789, when the debt was only $54 million, mainly due to financing needs of the War of Independence.However, the root causes of the modern debt crisis were mainly formed in the mid-20th century.During World War II, the United States issued huge war bonds to support Allied forces and local production, resulting in the total public debt reaching US$258.9 billion in 1945, accounting for as much as 120% of GDP.Although this peak was astonishing, the miraculous post-war economic recovery—benefited by Keynesian stimulus and the stability of the Bretton Woods system—had rapidly reduced the debt burden.By 1960, the debt level had stabilized at around $300 billion, and the debt-to-GDP ratio dropped below 35%, reflecting the vitality of the United States as the global economic engine.

Since the 1970s, debt growth has entered an accelerated channel.This transformation is closely related to the protracted war in Vietnam, the out-of-control inflation and the expansion of the social welfare system.In 1970, public debt was US$370 billion; by 1980, it had expanded to US$907 billion, and the debt-to-GDP ratio rebounded to 32%.Although the “supply-side” reform of the Reagan administration stimulated economic growth, the surge in military spending and tax cuts further pushed up the deficit.Entering the 1990s, the fiscal surplus during the Clinton era briefly reversed the trend – from 1998 to 2001, the United States achieved a budget surplus for four consecutive years, with a total amount of more than $500 billion – but this “honeymoon period” was quickly broken.

At the beginning of the 21st century, the “9/11” terrorist attacks marked a new stage of debt inflation.Spending on the war on terrorism and the conflict in Afghanistan and Iraq has soared, driving debt to jump from $5.7 trillion in 2000 to $10 trillion in 2008.The global financial crisis in 2008 became a turning point: the subprime mortgage crash triggered a credit freeze, and the Federal Reserve and Congress launched trillion-dollar stimulus plans, including quantitative easing (QE) and the U.S. Recovery and Reinvestment Act.During the Obama administration, debt continued to rise, reaching $19.5 trillion in 2016.During Trump’s tenure, the 2017 tax reform (Tax Cuts and Employment Act) reduced federal revenue by about $1.5 trillion, while the burden of COVID-19 response further increased, and debt exceeded $27 trillion by the end of 2020.The Biden administration continues to be loose fiscal , infrastructure bills and “Rebuild Better” plan push up spending , with debt exceeding $31 trillion in 2023 .

As 2025 begins, the debt growth momentum remains unabated.According to U.S. Treasury Department data, as of September 2025, the total public debt was approximately $37.4 trillion, of which the publicly held debt was $30.1 trillion and the government’s internal debt was $7.3 trillion.This figure is about $1.9 trillion higher than the $35.5 trillion at the end of 2024, with an average monthly increase of about $160 billion.The huge scale of debt can be compared through the time scale: 100 million seconds is equivalent to 3.17 years, which is traced back to 2022; but one trillion seconds takes 31,700 years, far exceeding the history of human civilization.This exponential leap stems from the superposition of war, economic recession and social change.Historically, debt traps often led to currency devaluation and social unrest, such as the devaluation of silver coins in the Roman Empire or the fiscal collapse before the French Revolution.The current path of the United States is similar, and it needs to be vigilant about its sustainability threshold.

Debt growth is not linear, but a product of policy cycles.Keynesian-led post-war period emphasized deficit spending stimulated demand, but ignored long-term supply-side constraints.The dividends of globalization in the Reagan-Clinton era temporarily relieved pressure, but exposed the vulnerability of financialization after 2008.The epidemic has accelerated this process: from 2020 to 2022, the debt/GDP ratio once reached 132.8%.Today, with the aging of the population and slowing productivity (the average annual growth rate from 2020 to 2025 is only 1.2%), debt has become a structural shackle, restricting fiscal space.

Current debt data and indicators

The latest data from September 2025 shows that the U.S. debt crisis has changed from potential risks to real threats.The total public debt is $37.4 trillion, of which foreign investors hold about 30% (about $11.2 trillion), mainly including Japan (1.147 trillion US dollars) and China (about $756 billion).The debt/GDP ratio reached 124%, further up from 123% in 2024, far exceeding the IMF threshold.The historical warning of this ratio is profound: when it exceeds 100%, the average economic growth rate drops by 1/3. As David Hume said, crossing the “Rubicon River” will curb productivity and innovation.

Household debts are also alarm bells.According to data from the Federal Reserve, the total household debt in the second quarter of 2025 reached $20.1 trillion, with a debt-to-income ratio of about 97%.Mortgage accounts for more than 60% (about $12 trillion), student loans are $1.6 trillion, and credit card debts are $1.1 trillion.These indicators reflect the vulnerability of the middle class: high housing prices and education costs drive up leverage, and any interest rate rise could trigger a wave of defaults.The total corporate debt was approximately US$19 trillion, with a record leverage ratio, and the debt-to-GDP ratio of non-financial enterprises reached 95%, higher than the peak in 2008.

The interest burden on government debt has become a “time bomb”.In fiscal 2025, interest payments are expected to reach US$1.2 trillion, accounting for more than 15% of the federal budget, doubling from US$300 billion in 2020.The surge was due to the Fed’s benchmark interest rate remaining at around 4.5% and the 10-year Treasury yield rose to 4.05%.Combined with rigid expenditures such as social security (about $1.4 trillion), health insurance ($1.2 trillion) and defense ($900 billion), these projects have accounted for 75% of the budget, a significant increase from 65% in 2016.Tax revenue is difficult to match: federal tax revenue in 2024 is $4.9 trillion, with a deficit of $1.8 trillion; the deficit in 2025 is expected to be $1.9 trillion.

The IMF predicts that without reform, debt/GDP will reach 140% in 2030 and interest expenses will account for 20% of the budget.These data reveal structural imbalances: weak productivity growth (only 62.5% of labor force participation), aging (20% of the population over 65 years old) and global competition (such as Sino-US trade frictions) jointly amplify risks.The debts of households, businesses and governments are mirrored by each other, forming a “debt trio”. Any breakage of any link may trigger a systematic collapse.

Recent debt-related crisis events

The debt crisis changes from abstract to reality through concrete events.The repurchase market crisis in September 2019 was a precursor: overnight repurchase rates soared to 10%, due to insufficient bank reserves and oversupply of Treasury bonds. The Federal Reserve injected hundreds of billions of dollars of liquidity before it subsided.This exposes the vulnerability of shadow banking and the Fed’s role as “lender of last resort”.

In March 2020, the new crown epidemic triggered a panic of “cash is king” around the world, with U.S. Treasury bonds and stock markets plummeting simultaneously, the Dow Jones Index fell 20% in one week, and the 10-year yield fell to 0.3%.The Fed launched unlimited QE and purchased $3 trillion in assets, stabilizing the market.But this “helicopter money” has exacerbated asset bubbles and inequality.

The 2022 UK pension crisis has spread to the world: Leeds Trass government’s tax cut plan pushes up British bond yields, triggering a chain reaction of pension funds selling US bonds.Inflation in the United States reached 9%, and the Federal Reserve’s interest rate hike caused bond prices to fall by 20%.In 2023, five banks including Silicon Valley Bank (SVB) went bankrupt, with a total loss of more than US$500 billion, mainly due to book losses in holding long-term Treasury bonds.

The “Trump Two-Step Dance” incident in April 2025 is more warning: the Trump administration announced the escalation of tariffs on “Liberation Day” and imposed a 60% tariff on China, but the next day the Treasury bond auction was cold, the subscription multiple dropped to 2.41, and the yield soared to 5%.The policy shifted rapidly, highlighting the “barometer” role of the bond market.The debt ceiling crisis in January 2025 further escalated: the ceiling was set to $36.1 trillion, and the Treasury Department exhausted “extraordinary measures” on January 23, forcing Congress to enact urgent legislation.These events are not isolated, but debt-dominated credit market signals: oversupply, weak demand and policy uncertainty intertwined, indicating a greater storm.

The repeated game of debt ceiling has been adjusted 78 times since 1960, each creating market fluctuations.In August 2025, the upper limit is expected to peak again. If Congress delays, it may trigger a first default and a credit rating downgrade (Moody’s has dropped from Aaa to Aa1).These crises reveal that debt problems appear before the stock market, and the bond market is the “nerve center” of the economy.

The mechanism for linking bond market with global

The bond market is an amplifier of the debt crisis, with a scale of over 50 trillion US dollars and is the world’s largest credit system.As a “risk-free” benchmark, U.S. Treasury bonds directly transmit to the world.In September 2025, global bond yields rose against the trend: Although the Federal Reserve’s September 17 meeting expected a 25 basis point cut rate to 4.25%, the 10-year yield still reached 4.05%.This phenomenon covers many countries: France’s 10-year 3.2%, Canada’s 3.1%, and the UK’s 3.4%, reflecting the inflation of fiscal deficit and stubborn inflation.

The principle of bonds is concise: Bonds are government IOUs, and the yield is determined by supply and demand.As demand drops, rising yields push up borrowing costs.Currently, global debt reaches US$324 trillion and public debt exceeds US$100 trillion.Japan’s policy shift is the key driver.Bank of Japan exited the yield curve control, causing the 30-year yield to rise to 3.26%, a high in the 1990s.Due to aging (pension pressure) and rebound in inflation, Japanese investors turned to the country and reduced their holdings of US bonds (holding $1.147 trillion).The yield gap between Japan and the United States narrowed (4.05% vs 3.26%), hedging costs increased, and capital return accelerated.

This linkage poses a challenge to the US “exorbitant privilege”.The dollar reserve status depends on US Treasury demand, but sanctions against Russia accelerate de-dollarization in 2022: BRICS expands to 10 countries, and non-USD trade accounts for 30%.In 2025, trillions of dollars in debt matured, Japan’s reduction in holdings will trigger a funding crisis, and yields will further rise.The transmission effect is obvious: mortgage interest rates rise to 7%, real estate cools down; corporate credit tightens, investment declines; consumption slows down, and the unemployment rate reaches 4.3% in August.Inflation accelerated to 2.9% in August.The Federal Reserve’s dilemma: interest rate cuts stimulate employment, but risks inflation; stability intensifies recession.

The disintegration of the yen arbitrage trading in August 2024 is a lesson from the past: the low-interest yen leverage invested in US bonds, the BOJ turned to cause the yen to appreciate, the trillions of dollars of positions closed, the yield on US bonds surged, and the stock market fell 10%.Risks amplified in 2025, and the rise in global yields against the trend indicates a “disillusion” – the central bank’s credibility is shaken and the debt phantom collapses.

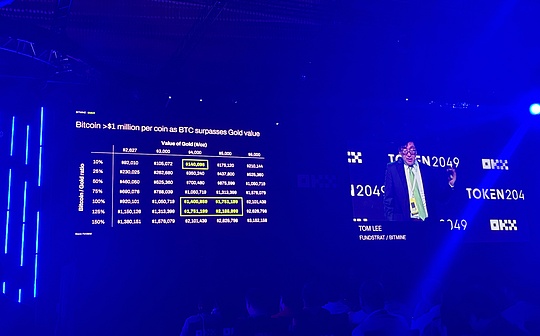

Gold stands out: September’s price is $3,689 per ounce, up 10.72% month-on-month and 43.35% year-on-year.The central bank’s net purchase of gold exceeded 1,000 tons, hedging and depreciation.In the 1970s, gold prices rose by 2,300%; today’s scale is even larger, and it is predicted to be $3,800 by the end of 2025.

The bond market linkage highlights global nature: the US debt crisis is like a domino, destroying capital flows and currency stability.

The interweaving of geopolitics and debt

High debt erodes diplomatic flexibility.When debt/GDP exceeds 120%, the policy is restrained by creditor countries.China holds US$756 billion in debt, and the Sino-US trade war has intensified fiscal pressure.Trump’s “Liberation Day” tariffs aim to revive manufacturing, but push up the deficit.The 2025 event shows that the bond market can reverse its geopolitical ambitions.

De-dollarization progressive: After the collapse of Bretton Woods, the US dollar was maintained by the petrodollar, but in the 2020s, Saudi Arabia accepted the RMB, and BRICS promoted non-dollar settlement.In 2024, the central bank’s gold reserves increased from 30,000 tons to 40,000 tons, and China exceeded 2,000 tons.Debt affects national defense: 2025 budget is $900 billion, interest squeezes space.High debt empires often resorted to wars, such as Rome plundering resources.Hemingway warned that the debt crisis is accompanied by “war dividends” and the burden is transferred through inflation.

Geographic tensions amplify debt risks: The Russian-Ukrainian conflict pushes up energy prices, and inflation is stubborn; turmoil in the Middle East disrupts supply chains.Debt has become a “weakness”, restricting the US’s “money printing” privileges and giving birth to a multipolar monetary system.

The dilemma of the solution

Resolving debt requires multiple measures, but there are limited options.First, growth drivers: revitalize manufacturing and increase GDP.Trump DOGE plans to cut bureaucracy and expects to save $250 billion, but the bottleneck of productivity is difficult to break.Cut interest rates by 25 basis points to save $25 billion in interest, with limited effect.

Secondly, expenditure control: rigid expenditure accounts for 75%, and the political cost of austerity is high.The Austrian school advocates “creative destruction”, but politicians are afraid of votes.Inflation strategy: Debt dilutes with negative real interest rates, inflation is 5%-7% from 2022 to 2025, but the real one is higher, and the Fed model ignores tail risks.

Third, default reset is rare, and the Argentine Mile reform (inflation fell 20% from 200%) provides reference, but the G7 is difficult to replicate.Tariff revenue increases may increase debt instead of military expansion.Grantham said that investors lack courage in short-term thinking.

Economist limitations: Model optimization ignores complexity, Hayek’s “knowledge limitations” warning.Politicians prioritize power, former Federal Reserve Henig criticizes naivety.”Honest brokers” like Milei are needed to promote reform.

Global Trends and Future Outlook

The debt crisis accelerates changes: de-dollarization is gradual, and the BRICS currency basket and gold standard are revived.Global public debt accounts for 100% of GDP.Social impact: Wealth is uneven, the stock market is concentrated in the top 10%, the middle class feels frustration and the risk of turmoil increases.Civil liberties decline, such as the Patriot Act.

Market collapse or state intervention, but history, as shown in the 1929 New Deal, is stronger after rebirth.Investor diversification: gold, physical assets.

Outlook: CBO forecasts debt/GDP 118% in 2035 and interest rate 15.6%.Through reform, the United States can be reversed, but bipartisan consensus is required.Global coordination is needed to promote sustainable debt management.

in conclusion

From the U.S. debt crisis to the global debt crisis, it is the product of policy mistakes and system imbalance.The debt of US$37.4 trillion, the 124% ratio and the 4.05% yield were interlaced with 2.9% inflation and 4.3% unemployment, indicating stagflation.Japan turns to amplify its vulnerability, and the bond market warns of currency reset.Change takes courage, and investors are wary of gray swans.Long-term, constructively undermine or reshape sustainable systems to avoid empire dusk.