Author: Decentralised.Co

A brief game

Earlier this week, friend.tech withdrew its ability to change product fees or features.In layman’s terms – there is no possibility of any change in the product in the future.If the token holder network can make changes to the product, there may still be hope.But as of now, this is no longer the case.

One of the attractions of friend.tech is that it benefits users.A wise man once said that the best way to grow the crypto community quickly is to make your token holders rich.The friend.tech model allows everyone to “become” a token and earn some income.As of now, the platform’s expenses have incurred nearly $98 million, half of which are owned by users.It sounds promising, doesn’t it?

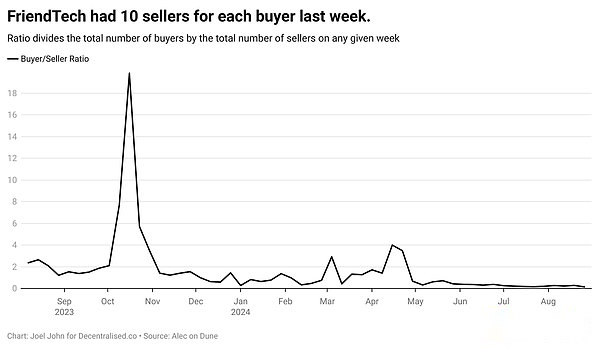

Actually, it is not. The problems in the friend.tech model have already laid the groundwork.Prior to the token release, data from DanielW_Kiwi at DuneAnalytics provided some clues to why.

In October 2023, when friend.tech entered the mainstream market, the buying and selling ratio for the product was 18:1.When there were 18 people when buying and only 1 seller, economics rule indicates that prices would rise.By the time the token was released in May, this ratio dropped to 0.32, which means that each buyer corresponds to 3 sellers.By last week, that ratio dropped to 0.14.

friend.tech can be classified as a short game that lacks durability.For those who hear the term for the first time – short-term games refer to short-term games with financial incentives.Some products have formed a complete category.There is no doubt that hashed_official is an example you will think of.

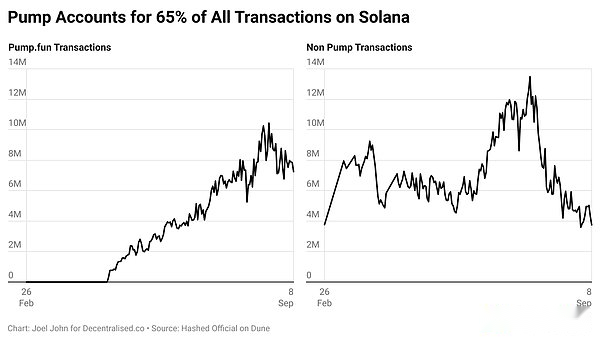

Pumpdotfun can be regarded as Costco (Costco) for token issuance, providing cheap, fast access and convenient services.The product was launched in May this year, accounting for 65% of all decentralized exchanges (DEX) transactions on Solana, according to hashed_official.Additionally, the product’s revenue is close to $100 million.As of now, nearly 2 million tokens have been issued through pumpdotfun.

Pump democratizes token issuance.In the past, users had to go through the listing process of centralized exchanges, but now Pump has determined that using DeFi infrastructure and on-chain liquidity can also be achieved.

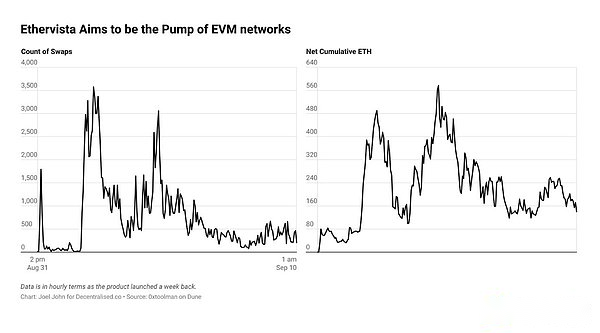

Obviously, this comes with risks.Token issuance is often troubled by “rug pulls”, a situation where developers simply withdraw liquidity and sell tokens held by users.Ethervista takes a different approach, which allows token issuers to obtain a portion of ETH from transaction fees, while liquidity providers (LPs) can obtain ETH.

In 2023, LooksRare adopted this approach in its platform fees, and the token’s stakeholders received LOOKS tokens.However, the ending of this story is not good, as the wash trading on the platform suddenly stopped.Ethervista also requires token issuers to lock their tokens for at least five days.

As of now, the platform’s activity has weakened.According to Dune data provided by 0xToolman, transaction volume has dropped from 3300 transactions per hour to just over 160 transactions.Total ETH on the platform dropped from 540 to 160, a change that occurred within a week.

All of this makes people wonder what the rules of a short game are?Are they just those short-lived and highly financialized Ponzi schemes that quickly emerge and die?Is a sustainable approach really possible?

Basically, these platforms have three characteristics:

The transaction frequency is very high, which is particularly evident in Pump.

The “reason” of trading is often based on emotions.For example, you can’t quantify why someone would buy a meme coin on Pump.Volatility is its product.

Their half-life is short.By the time the token was released, the community on friend.tech had been greatly reduced.

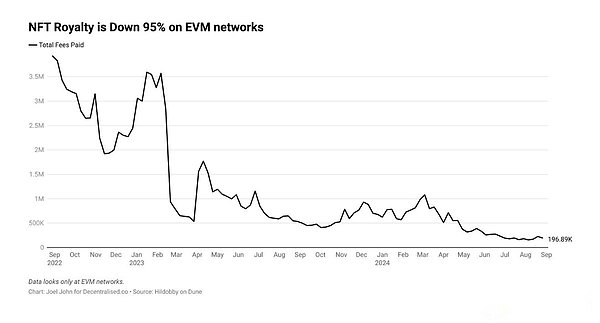

All of this reminds me of the glorious era of NFT.According to hildobby_’s Dune dashboard, the average expense incurred by NFT (on the EVM network) dropped from over $3.2 million a day to $200,000 a day, down nearly 95%.

This model is interesting because it provides creators with ways to continue to get royalties from their work and build meaningful communities.By contrast, the meme coin season in the second quarter of 2024 was driven by celebrities who often talked about their tokens that plummeted 90% in a few weeks.

Products like Pump and Ethervista directly remove the appearance of traditional communities and build hyper-trade products.In return, they pay the creators.

Can such a model be scaled?We are still uncertain about its sustainability.But if Pump and Ethervista point to a certain trend, it is the market demand for volatility.As long as the market is willing to pay for these tokens and accept the risks associated, we will continue to see their existence.Or, as ICOs and NFTs in previous cycles, they may fade away as markets recognize the risks associated with them.Only time can reveal how short these games are.