Author:Anthony Pompliano, Founder and CEO of Professional Capital Management; Compiled by: Shaw Bitcoin Vision

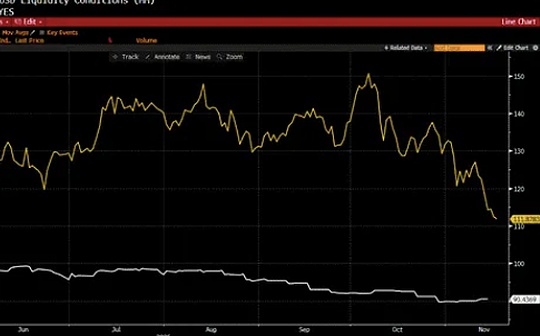

Financial markets have been bleak recently.Tech stocks, Bitcoin and many other investment assets are mired in decline.Nothing, it seems, is immune.Bloomberg’s Eric Balchunas noted that all assets were falling, including short-term Treasury bills.

The sell-off has people asking: “Is this bull market over?“

The answer is more complicated than you think.

Take stocks as an example.Carson Group’s Ryan Detrick does a good job analyzing the performance on different trading days during the week.

As you can see from the chart, Monday, Tuesday, and Wednesday performed well, while Thursday and Friday saw declines.Therefore, the recent decline is consistent with the overall trend of the market this year.

Nothing to worry about.In fact, Balciunas explains,Overall, S&P 500 volume could be a positive sign.

“If there’s any good news, it’s thatVolume in S&P 500 ETF ($SPY) is relatively muted, you can see that the transaction volume has increased, but it did not even enter the top 20 during the year.Usually this indicates that the sell-off is short-lived, while high volume indicates more severe panic, but who knows.”

Is the stock market bull market over?Maybe not yet, but anything is possible.This could have been one of the shortest bull markets in history.But that doesn’t mean it can’t happen.

Wedbush’s Dan Ives remains firmly bullish on technology stocks.Regarding the sell-off, he said: “We believe this is just a short-lived panic in technology stocks because we believe thatTechnology stocks are poised for a strong rally over the remainder of the year as investors seek to participate in the AI revolution and the second, third, and fourth wave spin-offs currently taking place in the consumer/enterprise space.“

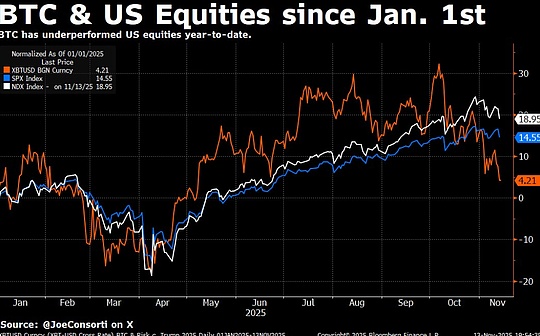

Bitcoin also fell.This asset is known for its asymmetry, butInvestors are relatively disappointed with its performance so far this year.Joe Consorti wrote: “Bitcoin is up just 4.2% so far this year, while the S&P 500 and Nasdaq are up 14.5% and 18.9% respectively.”

That’s not why many investors bought the asset.They’re looking for explosive growth, not sideways underperforming the major stock indexes.Bitcoin, on the other hand, has only gained 6% in the past year, but has gained 500% in the past five years.

Investing is hard.Different assets perform differently at different times.Coupled with uncertainties in monetary policy, geopolitics and capital flows, complex economic systems are difficult to predict.

But it reassures me that even in market downturns like the one we’re experiencing now, the really good companies will continue to perform well over the long term.Bitcoin will also thrive in the coming years.Those who worry about certain price fluctuations are more likely to make poor decisions.thoseThose who are able to buy high-quality assets and hold them for the long term will ultimately reap handsome returns..This timeless investment principle has endured for a reason.

Stay calm and trust that good weather will come.