Author: Marcel Pechman, CoinTelegraph; Compilation: Baishui, Bitchain Vision

ETH soared 15% between November 20 and 27, approaching the $3,500 mark for the first time in four months.This rally coincides with the record high of open contracts in Ethereum futures, which has raised questions from traders whether rising leverage means excessive bullish sentiment.

Total open position in Ethereum futures, ETH.Source: CoinGlass

In the 30 days ended November 27, total open interest in Ethereum futures climbed 23% to $22 billion.By comparison, on August 27, three months ago, the open interest of Bitcoin futures was $31.2 billion.Additionally, when ETH traded above $4,000 on May 13, the open interest on ETH futures was $14 billion.

Dominating the market are Binance, Bybit and OKX, which together account for 60% of ETH futures demand.However, the Chicago Mercantile Exchange (CME) is steadily expanding its footprint.It is worth noting thatCME currently holds $2.5 billion in ETH futures open contracts, which suggests an increasing institutional participation – a development that is often seen as a sign of market maturity.

Whether it is institutional investors or retail investors, the high demand for leverage does not necessarily indicate bullish sentiment.The derivatives market balances buyers and sellers, and they create opportunities for strategies that take advantage of various situations, including price drops.

For example, a cash arbitrage strategy involves buying Ethereum in the spot (or margin) market while selling the same nominal amount in Ethereum futures.Similarly, traders can take advantage of interest rate differences by selling longer-term contracts, such as contracts that expire in March 2025, while buying shorter-term contracts, such as December 2024.These strategies do not reflect bullish sentiment, but will significantly increase the demand for Ethereum leverage.

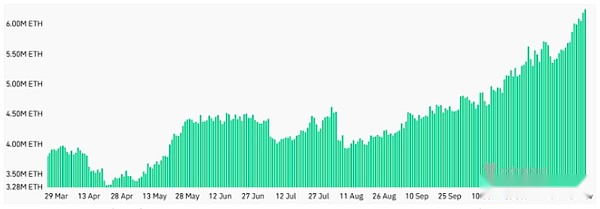

Ethereum 2-month futures annualized premium.Source: Laevitas.ch

On November 6, the two-month ETH futures annualized premium (benchmark interest rate) exceeded the 10% neutral threshold and maintained a strong level of 17% over the past week.This interest rate allows traders to earn fixed returns while fully hedging their exposure through cash arbitrage strategies.However, it is worth noting thatSome market participants accepted a 17% cost to maintain a leveraged long position, which suggests a moderate bullish sentiment in the market.

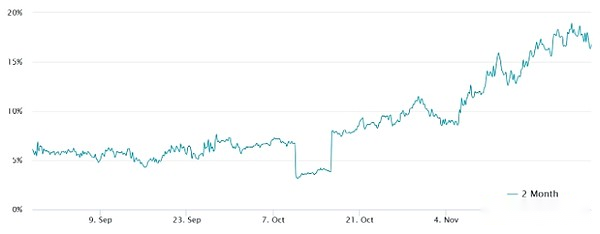

ETH liquidation may increase due to retail investors

In a high leverage environment, the biggest risk usually comes from retail traders, commonly known as “degens,” who often use up to 20 times the leverage.In this case, a standard daily price drop of 5% can erase all margin deposits, triggering closing positions.From November 23 to 26, a US$163 million leveraged long ETH futures position was forced to close.

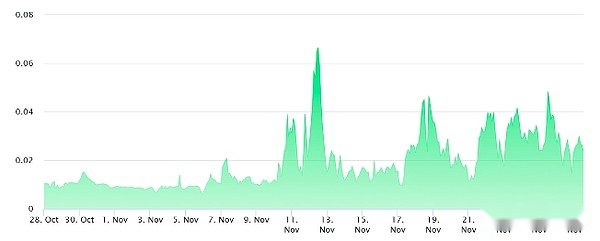

To measure the health of Ethereum retail futures positions, permanent contracts are a key indicator.Unlike monthly contracts, perpetual contracts closely reflect the spot price of ETH.They use variable financing rates—typically between 0.5% and 2.1% per month—to balance the leverage between long and short.

ETH perpetual futures 8-hour capital rate.Source: Laevitas.ch

Currently, Ethereum’s permanent futures financing rate is close to the neutral threshold, which is 2.1% per month.Although it briefly soared to more than 4% on November 25, it did not continue.This shows thatEven if Ethereum prices rise 15% per week, retail demand for leveraged bulls remains sluggish.

These dynamics reinforce the rise in open positions in Ethereum reflects institutional strategies—such as hedging or neutral positions—rather than total bullish sentiment.