Author: David Pan, Olga Kharif, Isabelle Lee; Compilation: Wuzhu, Bitchain Vision

-

Traders turn to bets SEC approve spot Ethereum ETFs;

-

Current regulation signs suggest regulators may give the green light.

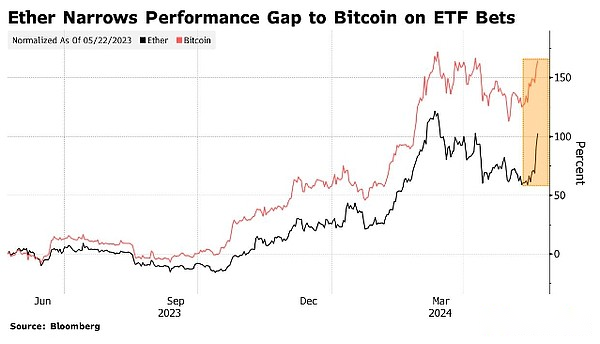

Cryptocurrency prices soared as signs that the U.S. approved exchange-traded funds to invest directly in Ethereum, the second largest token, which is very different from last week’s more pessimistic outlook.

Market speculation about spot Ethereum ETFs is partly due to the rebound in investor enthusiasm for US Bitcoin funds, the listing of Bitcoin Fund in January stimulated the rise of the largest digital asset to an all-time high.

Ethereum rose nearly 14% in the U.S. session, its biggest gain since November 2022, before further gaining in the Asian session, with the turnover price rising to $3,666 as of Tuesday at 9:33 am Singapore time.Bitcoin once climbed to $72,000, approaching its historical peak of nearly $74,000 in mid-March.

According to people familiar with the matter, the SEC contacted at least one exchange and at least one potential Ethereum ETF spot issuer to update the relevant 19b-4 filings.Since the matter was not disclosed, an insider requested not to be named.This suggests the possibility of SEC approval may be rising, a person familiar with the matter said.The person added that the conversation was an unexpected turnaround, but there is no guarantee of approval.

ETF file deadline

19b-4 Files are only part of the required files.Issuers also need regulators to sign an S-1 registration statement before launching the product.At least one decision to apply for Ethereum spot ETF will be made by May 23.

A SEC spokesman said the agency would not comment on individual filings.

Social media is full of speculation:“The SEC is more likely to be inclined to potential approvals, and traders are now scrambling to build positions because many have completely ruled out the possibility of approval,” he said.Analyst Chris Newhouse said.

Ethereum is the native token of the Ethereum blockchain, the most important commercial highway in cryptocurrencies.The network is very popular in decentralized financial services, where investors trade and borrow through automated software protocols rather than traditional intermediaries.

Pass rate increases

On Monday, Bloomberg Information ETF analyst Eric Balchunas said he and colleague James Seyffart had alreadyThe estimated probability of spot Ethereum ETF being approved has increased from 25% to 75%.

Bloomberg News reported on Friday, citing two people familiar with the matter, that some fund companies were expected to be rejected because their private negotiations with the SEC were not going well compared to the preparation phase before the launch of the Bitcoin spot ETF.

The caution of some investors remains obvious.Ravi Doshi, head of market at FalconX, said the company’s “derivatives division has seen that most of our counterparties downplay the move and that the SEC is expected to move slower than market expectations.”

The skeptical SEC had been cracking down on cryptocurrencies, but after a reversal in 2023, the SEC reluctantly acquiesced the U.S. spot bitcoin ETF earlier this year.Products from companies such as BlackRock and Fidelity Investment have accumulated $58 billion in assets, making it one of the most successful debuts in the fund category ever.

BlackRock and Fidelity are also seeking to launch the Ethereum fund.The digital asset industry sees U.S. ETFs as a way to expand the cryptocurrency investor base.Retail investors, hedge funds, pension funds and banks have all invested money into Bitcoin funds – Millennium Management, Steven Cohen’s Point72 Asset Management and Elliott Investment Management are all well-known buyers.