Author: Chetanya, Researcher The Spartan Group; Translation: Bit Chain Vision Xiaozou Xiaozou

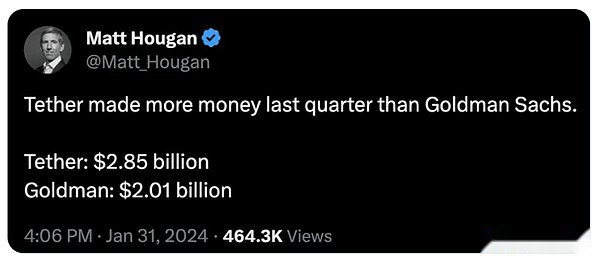

Ethena Labs is the fastest growing participant in the high profit field of stabilization -from the skyrocketing income of Tether and Maker.

I am a loyal supporter of the stable currency supported by illegal currency, and it can solve the projects that can solve the dilemma of stable coins.

>

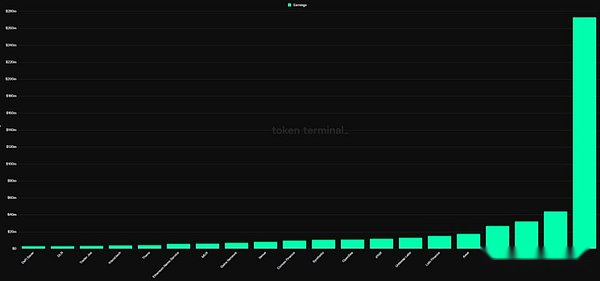

USDE’s TVL soared to $ 2.3 billion.Ethena quickly became the most profitable DEFI protocol, second only to ETH and MKR.

>

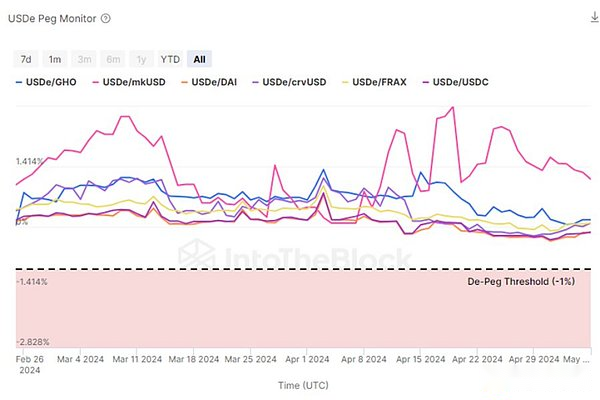

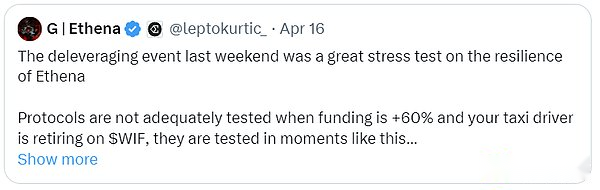

Interestingly, after the recent leveraged boom, its TVL elasticity and the perfect management of the agreement on the perfect management of redemption and USEE hook me.This will boost the market’s confidence in the product and attract a large number of USDE holders when the market rebounds.

>

>

1, OptimisticUSDE

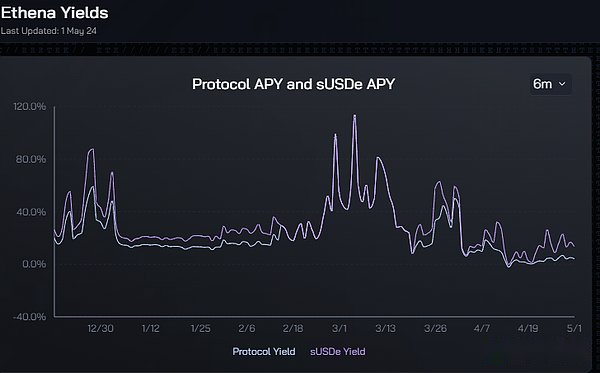

SUSDE provides a scalable way that can obtain a two -digit market neutral return, making it an effective alternative option for USDT/USDC.As the Anchor protocol showed a large demand for stable returns in the previous round (ATH TVL: 18 billion US dollars).I hope that when traders, exchanges, funds, etc., are gradually deploying funds, they will keep some USDE stablecoins.

>

Seraphim and his team quickly integrated USDE into large DEFI protocols, including Frax Finance, Pendle, Morpho Labs, etc., and USDE showed early signs of DEFI expansion.With the upcoming CEFI integration (bybit is the first), USDE is likely to become one of the largest stablecoins.

>

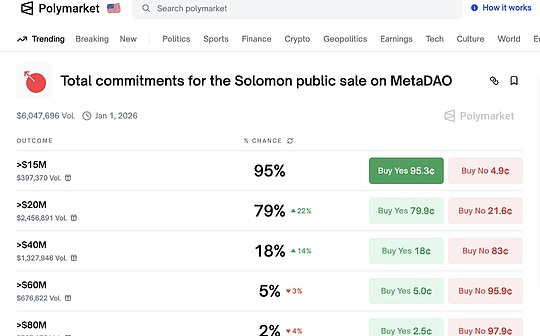

The growth of BTC and SOL mortgages may not be considered.This may greatly expand TAM and make USDE’s TVL more than $ 10 billion in this cycle.

2Valuation

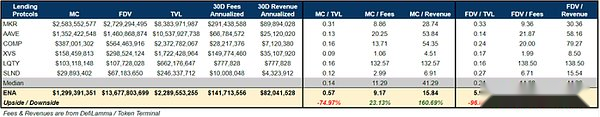

When comparing ENA with the lending agreement and the stabilized currency protocol for TVL, cost and income index, ENA seems to be overestimated under complete dilution.However, in MC (market value) dimension, valuation seems to be reasonable.

I think MC is at least a more suitable indicator in the short term, because the first major unlocking will be opened in early 2025.Before that, the floating range will remain around 10-20%.

>

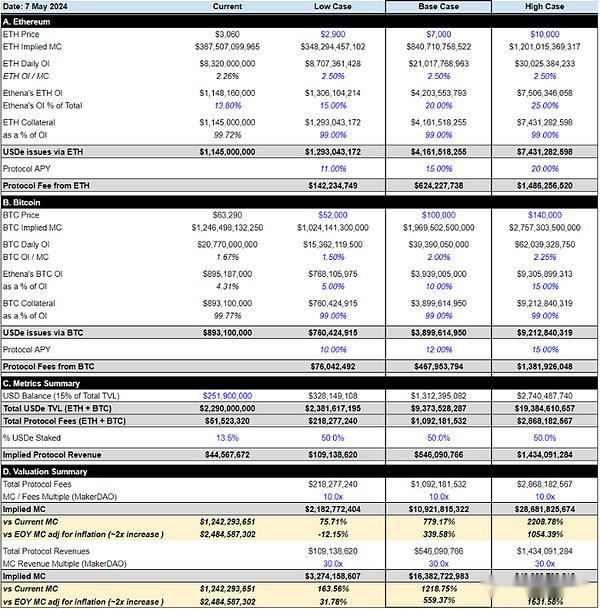

3Data forecast

In basic cases, I expect ENA TVL to increase to about $ 10 billion.This will enable it to earn more than $ 1 billion in costs and generate more than $ 500 million in revenue according to the situation of USDE’s utilization (or SUSDE exchange rate).ENA’s rising space may be 5-10 times, which means that the market value will reach $ 50-10 billion.

The prerequisite for these predictions is that the prosperity of this round of this cycle is no less than that of the previous round.

>

4,risk

Ethena’s design risk was basically handled well.However, a more urgent problem is how they will manage TVL once the points/Shards plan ends.They can generate high agreement revenue and provide SUSDE holders with abnormal high exchange rates, which is largely due to the low pledge rate of USDE (currently about 13.5%).In essence, currently USDE holders are encouraged to earn more “points/sHARDS” with pledge.

After the integration plan is over, the USDE holder will not accumulate any value, which means that there is no natural demand for USDE.I expect some income to share with USDE holders, or Susde/USDE exchange rate will approach 100%, and the agreement revenue will be reduced, thereby reducing ENA’s effectiveness.

But I believe that Ethena’s founders and teams will have some strategies to deal with this problem in the future.